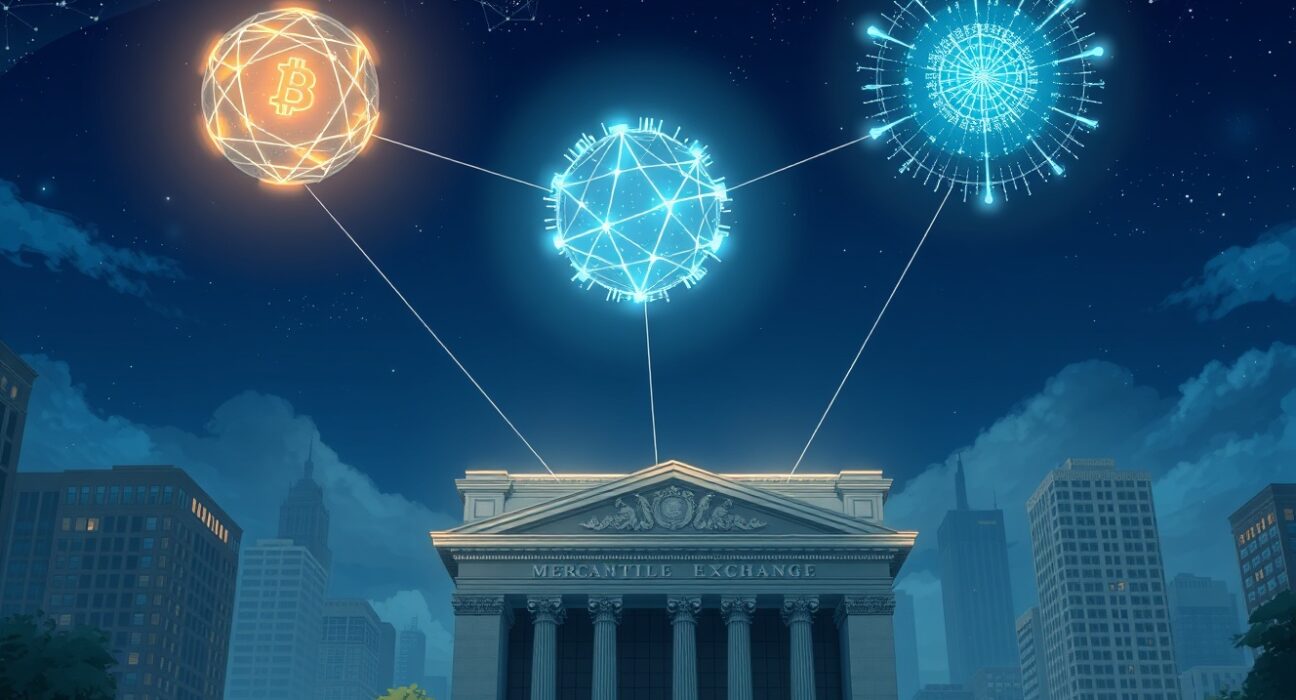

CHICAGO, Feb. 5, 2025 – In a landmark move for digital asset markets, CME Group, the world’s leading derivatives marketplace, will launch regulated futures contracts for Cardano (ADA), Chainlink (LINK), and Stellar (XLM) on February 9. This strategic expansion directly responds to growing institutional demand for diversified crypto exposure beyond Bitcoin and Ethereum. Consequently, it marks a significant step toward mainstream financial integration for these three prominent blockchain networks.

CME Group Futures Launch: A Deep Dive into the New Offerings

The Chicago Mercantile Exchange (CME) will introduce cash-settled futures for ADA, LINK, and XLM. These contracts will settle against the CME CF Cryptocurrency Real-Time Indices. This methodology ensures pricing integrity and aligns with existing Bitcoin and Ether futures. Each contract will represent a specific quantity of the underlying digital asset, providing a standardized, regulated tool for hedging and speculation.

CME Group first entered the crypto space with Bitcoin futures in 2017. Subsequently, it added Ether futures in 2021. The exchange has consistently cited client demand and market maturity as key drivers for new product launches. The selection of ADA, LINK, and XLM follows a rigorous evaluation of liquidity, market capitalization, and institutional interest. This move effectively brings the total number of crypto futures offered by CME to five.

The three new futures contracts share several critical features:

- Cash Settlement: Contracts settle in U.S. dollars, eliminating the need for physical delivery of tokens.

- Regulated Environment: Trading occurs under the oversight of the Commodity Futures Trading Commission (CFTC).

- Transparent Pricing: Prices derive from aggregated data across major spot exchanges.

- Risk Management: Provides institutions with tools to hedge portfolio exposure.

Analyzing the Impact on Cardano, Chainlink, and Stellar

The launch confers immediate legitimacy and visibility. CME’s rigorous listing standards act as a de facto vetting process for institutional investors. Therefore, ADA, LINK, and XLM gain a powerful stamp of approval. Historically, the announcement of CME futures has preceded increased trading volume and price discovery for an asset. However, the long-term price impact remains a function of broader market dynamics.

More importantly, these futures create new avenues for capital flow. Institutional players, such as hedge funds and asset managers, who are restricted from direct spot market purchases, can now gain regulated exposure. This potential influx of institutional capital could enhance overall market depth and stability for these assets. Moreover, the availability of hedging tools may encourage larger enterprises to build on these blockchains, knowing they can manage treasury risk.

| Asset | Primary Use Case | Notable Differentiator |

|---|---|---|

| Cardano (ADA) | Proof-of-stake smart contract platform | Peer-reviewed, research-driven development |

| Chainlink (LINK) | Decentralized oracle network | Bridges smart contracts to real-world data |

| Stellar (XLM) | Cross-border payments and asset issuance | Focus on financial inclusion and low-cost transfers |

Expert Perspective on Market Structure Evolution

Financial analysts view this expansion as a natural progression. “CME’s move signals that the crypto market is maturing beyond a two-asset ecosystem,” notes a report from Bloomberg Intelligence. It reflects a growing recognition of the unique utility provided by alternative layer-1 platforms and critical infrastructure protocols like oracles. Furthermore, this development pressures other traditional finance (TradFi) institutions to evaluate their own crypto product roadmaps. The competitive landscape for crypto derivatives is intensifying rapidly.

Regulatory clarity remains a pivotal backdrop. The CFTC’s oversight of these futures contrasts with the ongoing SEC deliberations over spot crypto ETFs. This regulatory dichotomy highlights the complex environment for digital assets in the United States. Nevertheless, CME’s established compliance framework provides a trusted conduit for cautious institutional capital. The launch also arrives as global financial hubs like the EU implement comprehensive crypto regulations, fostering a more structured global market.

Conclusion

The CME Group’s launch of ADA, LINK, and XLM futures on February 9 represents a pivotal moment for cryptocurrency adoption. It extends the reach of regulated financial instruments to three major altcoins, validating their market role and utility. This development provides institutional investors with essential risk management tools. Ultimately, it strengthens the bridge between decentralized blockchain networks and the traditional global financial system, fostering greater integration, liquidity, and maturity for the entire digital asset class.

FAQs

Q1: What are CME Group’s new cryptocurrency futures?

CME Group is launching cash-settled futures contracts for Cardano (ADA), Chainlink (LINK), and Stellar (XLM), allowing regulated trading and hedging based on their prices.

Q2: Why is the launch of ADA, LINK, and XLM futures significant?

It signals institutional validation, provides regulated exposure tools for major funds, and expands the crypto derivatives market beyond just Bitcoin and Ethereum.

Q3: How will these futures contracts be settled?

They are cash-settled in U.S. dollars, using the CME CF Cryptocurrency Real-Time Indices as the official reference price, with no physical delivery of tokens.

Q4: What impact could this have on the prices of ADA, LINK, and XLM?

While futures can improve liquidity and price discovery, direct price impact is uncertain and depends on broader market sentiment, adoption, and capital flows.

Q5: Can retail investors trade these CME futures contracts?

Yes, but typically through a futures brokerage account that meets CME’s requirements; they are not traded on standard crypto exchanges.

Q6: Does this mean ADA, LINK, and XLM are more likely to get a spot ETF?

Not directly. A futures launch is separate from an ETF approval process, which involves different regulators and criteria, though it may support the case for their maturity.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.