Exciting news for altcoin enthusiasts! Leading crypto exchange Coinbase has just announced support for Stader (SD), a dynamic liquid staking platform that’s been making waves in the DeFi space. If you’ve been keeping an eye on promising low-cap tokens, or are deep into the world of staking, this listing is definitely something to pay attention to. Let’s dive into what this means for Stader, Coinbase users, and the broader crypto ecosystem.

Stader (SD) Arrives on Coinbase: A New Chapter Begins

Coinbase officially announced the listing of Stader (SD), making it accessible on Coinbase.com and their mobile apps for both iOS and Android. This move opens up SD to Coinbase’s massive user base, potentially boosting its visibility and liquidity. For those unfamiliar, Stader is not just another crypto project; it’s a noncustodial, multi-chain liquid staking solution that’s been building momentum.

Coinbase will add support for @staderlabs ($SD) on Coinbase.com and in the Coinbase iOS & Android apps. Coinbase customers can now buy, sell, send, and receive SD with near global access (exceptions apply). https://t.co/bZ3zFhYj46 pic.twitter.com/qg9tWwrq2K

— Coinbase Assets 🛡️ (@CoinbaseAssets) July 16, 2024

Why is this Listing Significant?

Coinbase listings are often seen as a major milestone for crypto projects. Here’s why this particular listing could be a game-changer for Stader:

- Increased Accessibility: Coinbase’s platform provides a user-friendly gateway for millions of retail investors to access SD tokens. This wider availability can lead to increased trading volume and community growth.

- Enhanced Credibility: Being listed on a reputable exchange like Coinbase lends significant credibility to Stader. It signals a level of vetting and trust, potentially attracting more users and investors.

- Price Catalyst: Historically, tokens listed on Coinbase have often experienced price rallies. While past performance isn’t indicative of future results, the “Coinbase Effect” is a well-documented phenomenon in the crypto market.

From Roadmap to Reality: The Anticipation Builds

Adding to the excitement, Coinbase had previously included SD on its listing roadmap last month. This roadmap serves as a public signal of potential future listings, and for SD, it acted as a strong positive indicator. The inclusion on the roadmap itself can generate buzz and speculative buying, as traders anticipate the actual listing and its potential impact.

Stader’s Journey: Resilience and Reinvention

Stader’s story is one of adaptation and growth. Initially conceived as a liquid staking solution for the Terra blockchain, the project demonstrated remarkable resilience after the dramatic Terra ecosystem collapse in 2022. Instead of faltering, Stader pivoted and expanded its focus to support multiple blockchain networks. This adaptability speaks volumes about the team’s commitment and the project’s underlying technology.

Tokenomics Reboot: A Fresh Start for SD

The Stader community has been actively shaping the token’s future. Recently, a significant vote took place to implement a “tokenomics reboot.” This involved reducing the total supply of SD from 150 million to 120 million tokens. Tokenomics adjustments can be crucial for a project’s long-term health and value proposition. Let’s break down why this reboot matters:

- Reduced Supply: Decreasing the total supply can create scarcity, potentially leading to upward pressure on the token price if demand remains constant or increases.

- Enhanced Scarcity: A lower supply can make each token more valuable in the long run, appealing to investors who believe in the project’s future growth.

- Community Governance: The fact that this change was driven by a community vote highlights the decentralized and community-focused nature of Stader.

📢SD Tokenomics Reboot Vote is LIVE!📢

This is a pivotal moment for the SD token. Your participation will shape the future of SD tokenomics and its utility within the Stader ecosystem.

🗳️Vote Now: https://t.co/xY7h674y9t

🗓️Voting Period: June 25th – June 28th #Stader #SDTokenomics #Governance #DeFi #Crypto pic.twitter.com/a7l1Yq5n8V

— Stader Labs (@staderlabs) June 25, 2024

Expanding Utility: Insurance for Node Operators

Stader isn’t stopping at tokenomics adjustments. The community is currently voting on proposals to further expand the token’s utility. One notable initiative involves using the SD Utility Pool to provide insurance coverage for permissioned node operators. This innovative approach aims to mitigate risks associated with slashing penalties in Ethereum staking. Essentially, it could work like this:

- Risk Mitigation: Node operators would only be responsible for covering up to 4 ETH in slashing penalties.

- Insurance Pool: Any penalties exceeding 4 ETH would be covered by the SD Utility Pool.

- Increased Security & Confidence: This insurance mechanism could attract more node operators to the Stader ecosystem, enhancing the network’s security and resilience.

Pantera Capital’s Backing: A Vote of Confidence

It’s worth noting that Stader Labs, the team behind the project, secured $4 million in seed funding back in 2023. This funding round was led by prominent investors, including Pantera Capital. Pantera Capital’s involvement is a significant vote of confidence in Stader’s vision and potential. Such backing from established venture capital firms can provide projects with not only capital but also valuable expertise and network connections.

SD Price Check: Where Does it Stand?

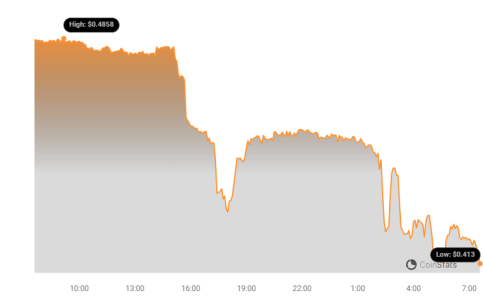

As of the time of writing, SD is trading at around $0.48. While this is a significant 98.4% drop from its all-time high of $30.17 reached in March 2022, it’s important to remember the broader market context and the specific challenges faced by projects initially built on Terra. The Coinbase listing and the ongoing developments in tokenomics and utility could potentially signal a turning point for SD.

What’s Next for Stader and SD?

The Coinbase listing is undoubtedly a major step forward for Stader. Keep an eye on these key areas to gauge the project’s continued progress:

- Coinbase Trading Volume: Monitor the trading volume of SD on Coinbase to assess the initial market response to the listing.

- Utility Pool Development: Track the progress of the SD Utility Pool and its impact on attracting node operators and enhancing network security.

- Community Governance: Stay informed about future community votes and proposals that shape the direction of Stader and SD.

- Broader Market Sentiment: Like all cryptocurrencies, SD’s price action will be influenced by overall market trends and investor sentiment towards altcoins and DeFi projects.

In Conclusion: A Promising Development for Stader

Coinbase’s decision to list Stader (SD) marks an exciting chapter for this resilient and innovative liquid staking platform. From its origins on Terra to its multi-chain expansion and tokenomics reboot, Stader has demonstrated a commitment to growth and adaptation. With the added visibility and accessibility of Coinbase, coupled with ongoing utility enhancements and strong investor backing, Stader (SD) is definitely a project to watch in the evolving DeFi landscape. Whether you’re a seasoned crypto trader or new to the world of altcoins, the Stader story offers valuable insights into the dynamism and potential of the crypto market.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.