Heads up, crypto enthusiasts! Get ready for a major shake-up in the digital finance world. Two giants, Coinbase and Stripe, are teaming up in a groundbreaking partnership that’s set to make crypto more accessible and user-friendly for millions across the globe. Imagine a world where crypto transactions are faster, cheaper, and seamlessly integrated into the financial systems you use every day. That future is closer than you think, thanks to this powerful collaboration. Let’s dive into the three key integrations that are making waves:

- USDC on Base for Lightning-Fast, Low-Cost Transfers: Stripe is now leveraging USDC on the Base network to power crypto payouts. This means significantly faster and more affordable money transfers for businesses and individuals in over 150 countries. Think global reach without the hefty fees!

- Turbocharged Fiat-to-Crypto Onramps in the US: Converting your traditional currency into crypto just got a whole lot quicker in the United States. Stripe has supercharged its fiat-to-crypto onramp, making it easier than ever for customers to dive into the crypto world.

- Coinbase Wallet Gets a Stripe Boost: Coinbase is integrating Stripe’s streamlined onramp directly into its Coinbase Wallet. This means you can now effortlessly buy crypto using credit cards and even Apple Pay, directly within your wallet. Talk about convenience!

This isn’t just another partnership; it’s a strategic move to bridge the gap between traditional finance and the burgeoning world of cryptocurrency. By leveraging the strengths of each platform, Coinbase and Stripe are paving the way for a more inclusive and efficient global financial ecosystem.

Why Base Network is the Game Changer?

At the heart of this collaboration lies the Base network. But what exactly makes Base so special? It’s rapidly becoming the preferred Ethereum Layer 2 (L2) solution, and here’s why:

- Scalability and Speed: Base is engineered for speed and efficiency. It’s designed to handle a high volume of transactions, making crypto interactions feel as smooth as your everyday online experiences.

- Cost-Effectiveness: Say goodbye to exorbitant transaction fees! Base significantly reduces gas costs, making crypto transactions more accessible for everyone, from casual users to large enterprises.

- Developer-Friendly Environment: Base provides a robust and intuitive platform for developers, fostering innovation and the creation of new and exciting crypto applications.

- Security: Built with security in mind, Base offers a reliable and safe environment for users and developers alike.

The numbers speak for themselves. Base isn’t just promising potential; it’s delivering real results. Let’s take a look at its impressive growth:

Base Network: By the Numbers

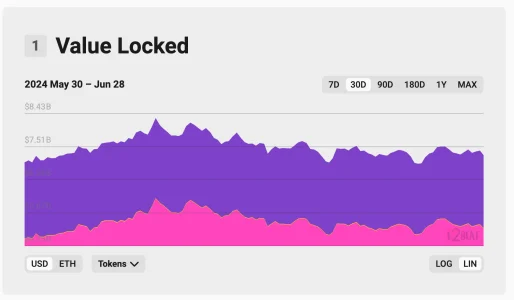

Base has experienced explosive growth since its launch in August 2023. Its Total Value Locked (TVL) – a key metric for measuring the value of assets deposited in a DeFi protocol – has skyrocketed.

Here’s a snapshot of Base’s remarkable journey:

- TVL Surpasses $8 Billion: Base has blown past the $8 billion mark in TVL, firmly establishing itself as a major player in the Layer 2 space.

- Second Largest Ethereum Scaler: Base now holds the position of the second-largest Ethereum Layer 2 in terms of TVL, trailing only behind Arbitrum One. It has even overtaken Optimism’s OP Mainnet!

- Rapid Growth Trajectory: Reaching its first billion in TVL by February 2024, Base has maintained an incredible upward momentum.

- Transaction Leader: Base leads all Ethereum L2s with a staggering transaction rate of 30.36 transactions per second (TPS) over the past month.

- Millions of Transactions Processed: In the same period, Base processed nearly 65 million transactions, demonstrating its capacity and user adoption.

What’s Fueling Base’s On-Chain Activity?

To understand the driving force behind Base’s success, we turn to insights from the community itself. Speaking with Cryptopolitan, Radar Bear, co-founder of Jojo, a perpetual futures exchange built on Base, shared his perspective.

Radar Bear highlights several key factors contributing to Base’s impressive on-chain activity:

- Active and Supportive Team: He praised the Base team for being exceptionally active and helpful, fostering a positive and collaborative ecosystem for developers.

- Sophisticated User Base: Base users are becoming increasingly sophisticated, engaging in advanced DeFi activities like borrowing, lending, and yield farming, indicating a maturing ecosystem.

- Focus on High-Quality Projects: Projects launching on Base prioritize building robust products with excellent user interfaces (UI), user experiences (UX), and solid codebases, leading to greater user satisfaction and engagement.

- Early Arbitrum/BSC Vibe: Radar Bear draws a comparison to the early days of Arbitrum and Binance Smart Chain, suggesting Base is following a similar trajectory of rapid growth and innovation.

“The Base team is always active and helpful. So we think they perform like the early stage of Arbitrum or Binance Smart Chain. That’s pretty good,” Radar stated, emphasizing the supportive environment.

He also pointed to the vibrant community on Forecaster, a leading social platform on Base, as a key driver for Jojo’s growth. Interestingly, Radar noted a preference for higher-risk trading among Base users, which contributes to the platform’s substantial trading volume.

“Base users, they like high-risk trading, so they bring us a lot of trading volume,” he explained.

Furthermore, Radar lauded the technical stability of Base, mentioning, “There are very few bugs. We found some very tiny problems but they can fix it very quickly. We always have a channel to talk with the official developers so that’s pretty helpful.” This responsiveness and commitment to quality are crucial for building trust and attracting developers and users.

Base: A Launchpad for DeFi Innovation

Radar Bear’s insights paint a clear picture: Base is not just a network; it’s a thriving ecosystem ripe with opportunity. He recommends Base as an ideal platform for new DeFi developers, citing its active user base and the potential to introduce DeFi products to a wave of new users.

“Many Base users had never used DeFi before but found Jojo to be a better trading tool,” Radar observed, highlighting Base’s ability to onboard newcomers to the world of decentralized finance.

The Future is Bright for Crypto and Global Finance

The partnership between Coinbase and Stripe, powered by the robust Base network, marks a significant leap forward for the crypto industry. By streamlining crypto transactions, enhancing fiat-to-crypto accessibility, and fostering a thriving developer ecosystem, these collaborations are accelerating the journey towards mainstream crypto adoption. With Base leading the charge in Layer 2 innovation and companies like Coinbase and Stripe pushing the boundaries of accessibility, the future of global finance is looking increasingly decentralized, efficient, and inclusive. Keep an eye on Base – it’s a network to watch as it continues to redefine the landscape of crypto and beyond!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.