The cryptocurrency market in India is witnessing exponential growth, with increasing adoption and awareness among investors. CoinDCX, India’s largest and safest cryptocurrency exchange, has played a pivotal role in educating users and driving this transformation.

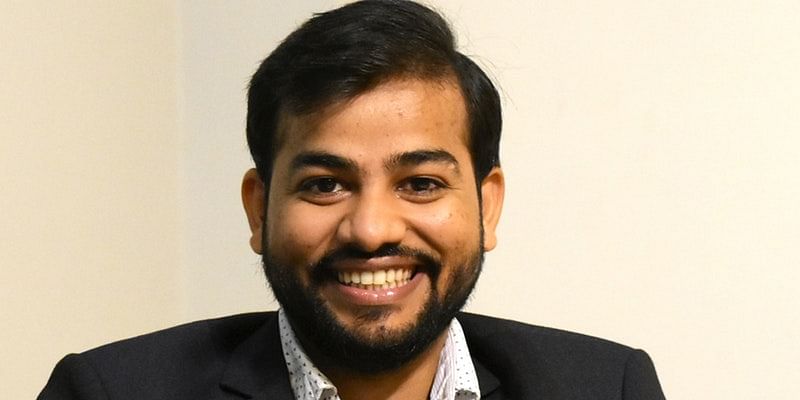

In an exclusive interview with Bitcoinworld.co.in, CoinDCX CEO and Co-Founder Sumit Gupta shared his journey, the challenges faced, and his assessment of the Indian cryptocurrency market.

The Journey of CoinDCX

1. The Beginning

Sumit Gupta and Neeraj Khandelwal, co-founders of CoinDCX, entered the cryptocurrency space as traders in 2017.

-

Early Challenges:

They identified significant issues such as:- Lack of liquidity.

- Wide spreads.

- Slow order execution on both Indian and global exchanges.

-

Vision for Change:

Determined to solve these problems, the duo established CoinDCX with the mission of providing high liquidity by aggregating order books from global exchanges like Binance and Huobi Global.

2. The Launch

CoinDCX was launched to:

- Enable global financial inclusion through cryptocurrency.

- Deliver a seamless trading experience with innovative products tailored for all types of traders.

3. Key Products Offered

CoinDCX has created a comprehensive ecosystem of crypto-based financial services, including:

- Spot Trading: Access to over 500 markets for cryptocurrency trading.

- Insta: Fiat onboarding from INR to crypto.

- Lend: Earn 12.78% APR on cryptocurrencies.

- Margin: Trade with up to 6x leverage across 250+ markets.

- Stake: Earn passive income by holding cryptocurrencies.

Entering the Cryptocurrency Market

1. Early Fascination with Bitcoin

Sumit Gupta’s interest in cryptocurrency began in 2016 when Bitcoin started gaining traction. His trading journey coincided with meeting Neeraj, who shared similar interests in crypto.

2. Academic and Personal Connection

- Sumit and Neeraj met during their preparation for IIT entrance exams in Kota and later attended IIT Bombay.

- Their shared passion for technology and investments laid the foundation for CoinDCX.

The Current State of India’s Cryptocurrency Market

1. Overcoming Regulatory Challenges

India’s crypto market faced a major setback in April 2018 when the Reserve Bank of India (RBI) banned cryptocurrency banking and settlements.

-

CoinDCX’s Resilience: Despite the ban, CoinDCX launched just two days after the announcement, innovating to provide users with a safe and compliant trading platform.

-

Supreme Court Victory: The RBI ban was overturned in March 2020, leading to a revitalization of India’s cryptocurrency space.

2. Factors Driving Growth

The lifting of the banking ban has unlocked significant growth:

- Return of Traders: Many traders who exited the market in 2018 are now returning.

- Foreign Investment: International investors are entering the Indian crypto market.

- Tech-Savvy Population: High mobile penetration and a skilled tech workforce position India as a global crypto hub.

3. Regulatory Uncertainty

While trading has resumed, there’s a need for clear crypto trading regulations to:

- Protect traders and ensure their safety.

- Provide a framework for businesses and investors to operate confidently.

Future Prospects of the Indian Crypto Market

India holds immense potential to become a global leader in cryptocurrency. Sumit Gupta highlights key factors fueling this optimism:

- A young, tech-savvy population eager to explore new asset classes.

- Growing awareness and education about cryptocurrency benefits.

- Increasing integration of blockchain technology into mainstream industries.

FAQs About CoinDCX and the Indian Crypto Market

1. What is CoinDCX?

CoinDCX is India’s largest cryptocurrency exchange, offering diverse crypto-based financial products and services.

2. What challenges did CoinDCX face during its launch?

CoinDCX launched amid the RBI’s banking ban in 2018, requiring innovative approaches to ensure safe and compliant trading for users.

3. How has the Indian crypto market evolved since 2020?

The Supreme Court’s decision to lift the RBI banking ban has reignited interest, attracting traders and foreign investors back into the market.

4. What are CoinDCX’s key offerings?

CoinDCX provides products like Spot Trading, Margin Trading, Lending, Staking, and Fiat Onboarding for a comprehensive trading experience.

5. What is the potential of the Indian crypto market?

India’s young population, high mobile penetration, and growing tech talent position the country as a potential global hub for cryptocurrency.

6. What regulatory challenges remain?

India’s crypto industry awaits clear rules and regulations to safeguard traders and provide a framework for businesses.

Conclusion: A Bright Future for Indian Crypto

CoinDCX’s journey reflects the resilience and innovation driving the growth of India’s cryptocurrency market. With increasing adoption, supportive regulatory developments, and an enthusiastic population, India is poised to emerge as a major player in the global crypto space.

As CoinDCX continues to lead this transformation, the company’s commitment to education, innovation, and inclusivity ensures it remains at the forefront of this dynamic industry.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.