The volatile world of cryptocurrency mining has seen another twist. Core Scientific, a major player in Bitcoin mining, experienced a significant stock drop following its announcement of offering $400 million in convertible senior notes. Is this a strategic move to stabilize the company, or a sign of deeper financial challenges? Let’s dive into the details.

Core Scientific Stock Takes a Hit

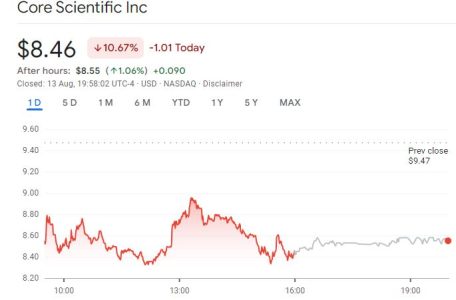

- Core Scientific stock dipped to $8.46 per share on the Nasdaq.

- This drop followed the announcement of offering convertible senior notes to settle debts.

- The offering was upsized from an initial $350 million to $400 million.

The stock initially dropped just over 10% before a slight recovery after hours. This kind of volatility is common in the crypto market, but what’s driving this particular downturn?

Understanding Convertible Senior Notes

What exactly are convertible senior notes, and why are they significant? Here’s a breakdown:

- Definition: A debt security that can be converted into equity at a later date.

- Benefit for Investors: Accrues interest payments over time.

- Benefit for Company: A form of debt financing.

In Core Scientific’s case, these notes will mature on Sept. 1, 2029, unless converted, redeemed, or repurchased earlier. The company is offering these notes in a private offering to qualified institutional buyers only.

The Purpose of the Offering

According to Core Scientific, the net proceeds from this offering will be used to:

- Repay outstanding loans under its credit and guaranty agreement.

- Redeem all of its outstanding senior secured notes due 2028.

- Fund general corporate purposes, including working capital, operating expenses, capital expenditures, acquisitions, or repurchases of securities.

The company expects to raise $386.6 million, or $445 million if investors purchase additional notes. This move is aimed at restructuring its debt and providing more financial flexibility.

Navigating Through Financial Turbulence

Core Scientific’s recent history includes a Chapter 11 bankruptcy filing in December 2022, from which it emerged in January. The bankruptcy was triggered by a combination of factors:

- The crypto winter.

- Rising energy prices.

- Increased mining difficulty.

- Bad debt lent to Celsius.

The reorganization plan allowed Core Scientific to scrap $400 million in debt and continue operations. However, the company reported a net loss of $804.9 million for the second quarter of 2024.

Silver Linings and Future Prospects

Despite the challenges, there are positive signs. Year-to-date, Core Scientific has mined 5,052 Bitcoin (BTC), worth over $300 million at current prices. This demonstrates the company’s continued operational capacity and potential for future profitability.

Final Thoughts

Core Scientific’s journey is a testament to the volatile nature of the cryptocurrency industry. The offering of convertible senior notes represents a strategic effort to manage debt and secure financial stability. While the stock drop is concerning, the company’s ability to mine substantial amounts of Bitcoin and its emergence from bankruptcy offer a glimmer of hope. Whether this move will ultimately lead to long-term success remains to be seen, but it’s a crucial step in Core Scientific’s ongoing evolution.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.