Hold onto your crypto keys! The digital asset world has been shaken again as reports surface about a significant security breach at crypto exchange Four Dragons. Based in Kyrgyzstan, this exchange has announced it was targeted in a cyberattack on February 22nd, resulting in a substantial amount of cryptocurrency being siphoned away. While the exact figure remains officially undisclosed by Four Dragons, whispers in the crypto community suggest a staggering loss of around $100 million. Let’s dive into what we know about this developing situation.

What Exactly Happened to Four Dragons Exchange?

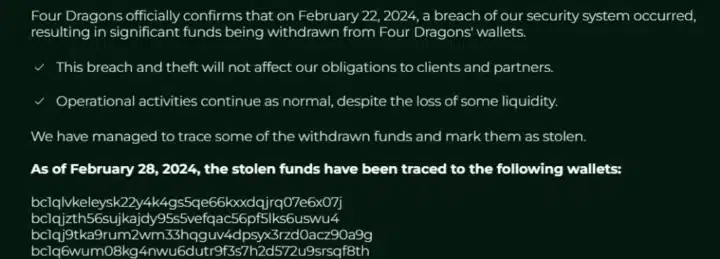

According to a statement posted on their website, Four Dragons confirmed they experienced a ‘breach of its security system.’ This breach led to ‘significant funds being withdrawn.’ While details are still emerging, the exchange has acknowledged the incident and is attempting to reassure users.

Headquartered in Bishkek, the capital of Kyrgyzstan, Four Dragons has not explicitly stated the precise amount stolen. However, they conceded the loss is “significant,” indicating it’s a substantial blow. Despite this, the exchange maintains a business-as-usual stance, stating that operational activities “continue as normal, despite the loss of some liquidity.” This raises questions about the extent of the ‘liquidity loss’ and how it might impact users in the long run.

How Did the Hackers Breach Four Dragons’ Security?

This is the million-dollar question, or rather, the $100 million question! Four Dragons has remained tight-lipped about the specifics of the attack. It’s currently unclear how the perpetrators managed to infiltrate their security measures and gain access to what is suspected to be the exchange’s hot wallets. Hot wallets, while facilitating faster transactions, are generally considered more vulnerable to online attacks compared to cold wallets, which are stored offline.

See Also: Serenity Shield Token (SERSH) Collapsed By 95% After $5.6m Breach

Will User Funds Be Affected?

Four Dragons is adamant that this security incident “will not affect our obligations to clients and partners.” This is a crucial statement for users who have funds held on the exchange. However, the term ‘liquidity loss’ mentioned by the exchange might hint at potential limitations in the short term. It remains to be seen how the exchange will manage withdrawals and deposits in the aftermath of such a significant financial hit.

Tracking the Stolen Crypto: Bitcoin Addresses Revealed

In a move towards transparency, Four Dragons has publicly disclosed 16 Bitcoin addresses where the stolen funds were transferred. This action is a common practice in crypto hacks, aiming to track the movement of the stolen assets and potentially recover them. As of now, reports indicate that a considerable portion of the pilfered cryptocurrency remains within these identified addresses. Here’s what Four Dragons is doing to mitigate further damage:

- Freezing Funds: Four Dragons states, “We are taking maximum measures to ensure these funds cannot be used.” This likely involves working with blockchain analytics firms and potentially other exchanges to flag these addresses and prevent the hackers from moving or cashing out the stolen crypto.

- Community Alert: By sharing these addresses, they are alerting the wider crypto community, including other exchanges and security firms, to be vigilant and block any attempts to transfer funds from these addresses.

- Offering a Reward: In a bid to incentivize community help, Four Dragons is offering a reward of 10% of the returned amount “to anyone who helps in the recovery of the stolen funds.” They are also promising anonymity and further information to anyone who can assist. This is a common tactic to leverage the decentralized and interconnected nature of the crypto world for asset recovery.

Kyrgyzstan’s Crypto Regulation: A Factor?

The regulatory environment in Kyrgyzstan concerning cryptocurrencies is still in its nascent stages. While the nation has taken initial steps to regulate virtual assets, the landscape is marked by “considerable uncertainty and ambiguity.”

Notably, Kyrgyzstan’s legislation, passed in 2022, primarily outlines the parameters for virtual assets themselves but lacks specific, direct regulations for crypto exchanges. This regulatory gap could potentially create vulnerabilities and challenges for exchanges operating within the country, particularly in terms of security and accountability in the event of incidents like this hack. Whether this regulatory ambiguity played a role in the Four Dragons breach is currently unknown, but it highlights the importance of robust and clear regulatory frameworks for the crypto industry.

What Does This Mean for the Crypto Space?

The Four Dragons hack serves as another stark reminder of the ever-present security risks within the cryptocurrency ecosystem. Despite advancements in security protocols, exchanges remain lucrative targets for cybercriminals. This incident underscores the critical need for:

- Enhanced Security Measures: Crypto exchanges must continuously invest in and upgrade their security infrastructure, including robust hot and cold wallet strategies, multi-factor authentication, and regular security audits.

- Proactive Risk Management: Exchanges need to have comprehensive incident response plans in place to effectively manage and mitigate the impact of security breaches.

- Regulatory Clarity: Clear and comprehensive regulations are essential to protect users, ensure exchange accountability, and foster a safer crypto environment.

- User Awareness: Crypto users should also remain vigilant and practice good security habits, such as using strong passwords, enabling two-factor authentication, and being cautious of phishing attempts.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.