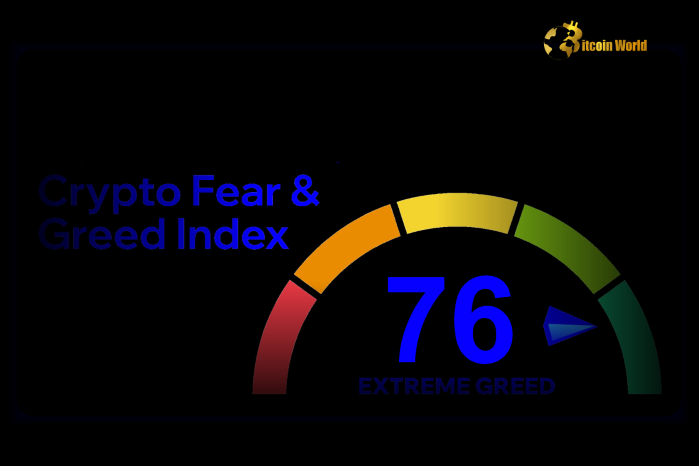

Crypto Fear & Greed Index Declines Slightly to 76

On December 3, 2024, the Crypto Fear & Greed Index, a key metric reflecting market sentiment, registered 76, down four points from the previous day’s score of 80. Despite the dip, the index remains firmly in the “Extreme Greed” zone, signaling heightened enthusiasm among cryptocurrency investors.

The index, developed by Alternative.me, ranges from 0 to 100, where lower scores indicate fear and higher scores represent greed. A score above 75 signifies “Extreme Greed,” while a score below 25 denotes “Extreme Fear.”

Understanding the Crypto Fear & Greed Index

1. How It Works

The index aggregates data from six factors to quantify overall market sentiment:

- Volatility (25%): High price swings indicate fear, while stability suggests greed.

- Market Momentum/Volume (25%): Increased buying volumes contribute to greed.

- Social Media (15%): Positive mentions and activity on platforms like Twitter drive greed.

- Surveys (15%): Investor sentiment surveys (when available) influence the score.

- Bitcoin Dominance (10%): Higher Bitcoin dominance signals fear, as altcoins typically thrive during greed phases.

- Google Trends (10%): Increased searches for terms like “Bitcoin price” reflect heightened interest and greed.

2. Zones of Sentiment

- Extreme Fear (0–25): Signals market panic, often presenting buying opportunities.

- Fear (26–49): Indicates caution among investors.

- Neutral (50): Balanced sentiment with no clear directional bias.

- Greed (51–75): Reflects optimism and potential overvaluation.

- Extreme Greed (76–100): Suggests euphoria, often preceding corrections.

Why the Index Fell by Four Points

1. Market Consolidation

The slight decline in the index may reflect profit-taking or consolidation after recent rallies in major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

2. Cooling Social Media Sentiment

Lower engagement levels on platforms like X (formerly Twitter) and Reddit could have contributed to the dip in the sentiment score.

3. Volatility Adjustments

A stabilization in Bitcoin and Ethereum prices, following weeks of upward momentum, may have tempered market exuberance.

Implications of Staying in ‘Extreme Greed’

1. Cautious Optimism

While remaining in the “Extreme Greed” zone signals continued bullish sentiment, it also raises concerns about potential overvaluation and market corrections.

2. Investor Behavior

Historically, “Extreme Greed” phases are associated with:

- Increased speculative trading.

- Elevated risk appetite among retail investors.

3. Market Opportunities and Risks

- Opportunities: Altcoins may see additional gains as investors diversify during greedy phases.

- Risks: Sudden corrections are more likely, especially if sentiment turns negative or external shocks occur.

Historical Performance During ‘Extreme Greed’ Phases

2021 Bull Run

During Bitcoin’s rally to $69,000 in late 2021, the index consistently stayed above 75, reflecting euphoria. However, this was followed by a sharp correction as profit-taking set in.

2023 Recovery

In early 2023, the index fluctuated between greed and extreme greed during Bitcoin’s recovery from bear market lows, signaling sustained investor optimism.

2024 Context

The current score of 76 aligns with ongoing bullish trends in Bitcoin and Ethereum, suggesting strong market sentiment despite minor pullbacks.

What This Means for Investors

1. Opportunities

- Altcoin Rally Potential: Strong sentiment often benefits altcoins, as investors seek higher returns beyond Bitcoin and Ethereum.

- Short-Term Gains: Greedy phases are typically favorable for momentum traders looking to capitalize on price surges.

2. Risks

- Corrections: Extreme greed often precedes market pullbacks, as overly optimistic sentiment can lead to overvaluation.

- FOMO Investing: Retail investors may succumb to fear of missing out (FOMO), leading to poorly timed investments.

3. Strategy Recommendations

- Diversify Holdings: Spread investments across multiple assets to mitigate risks.

- Take Partial Profits: Lock in gains during greedy phases to reduce exposure to sudden downturns.

- Monitor Sentiment Trends: Keep an eye on daily sentiment changes to anticipate market shifts.

Future Outlook for the Crypto Market

1. Sustained Optimism

If the index remains in the “Extreme Greed” zone, it could signal continued bullish momentum for Bitcoin and altcoins.

2. Potential Market Cooling

A further decline in sentiment could lead to consolidation or corrections, offering buying opportunities for long-term investors.

3. Macro and Regulatory Factors

Broader economic conditions and cryptocurrency regulations will play a pivotal role in shaping sentiment and price movements in the coming weeks.

Conclusion: Navigating the ‘Extreme Greed’ Zone

The Crypto Fear & Greed Index’s dip to 76 reflects a slight cooling of sentiment, but the market remains firmly in “Extreme Greed.” This phase indicates continued bullishness, albeit with heightened risks of corrections. For investors, this is a time to balance optimism with caution, leveraging short-term opportunities while safeguarding against potential downturns.

Stay informed on market sentiment and cryptocurrency trends by exploring our article on latest news, where we analyze key developments shaping the digital asset landscape.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.