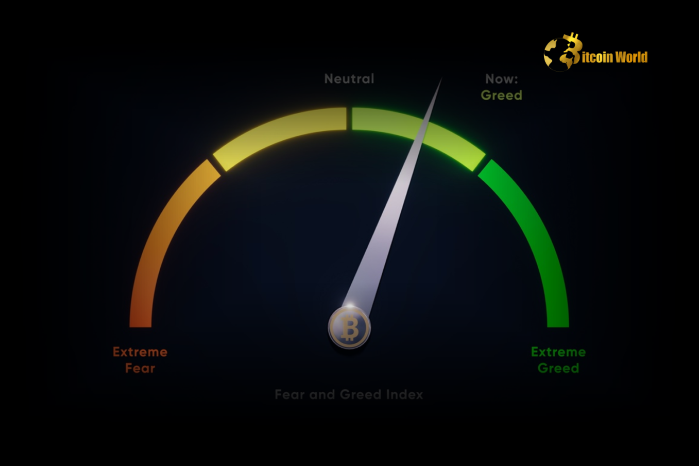

Are you feeling the chills of fear gripping the crypto market? Or perhaps sensing a glimmer of greed on the horizon? Understanding the emotional pulse of the cryptocurrency market is crucial for making informed investment decisions. The Crypto Fear & Greed Index is a vital tool that attempts to quantify these very emotions. Let’s dive into the latest reading and decipher what it signals for your crypto strategy.

Decoding the Crypto Fear & Greed Index: Fear Persists

As of March 31st, the Crypto Fear & Greed Index, a widely recognized gauge of market sentiment provided by Alternative, registered a score of 34. This marks a slight uptick of two points from the previous day. While any increase might seem encouraging, it’s crucial to note that the index remains firmly entrenched in the “Fear” zone. This persistent fear, despite the marginal improvement, paints a picture of cautious, if not anxious, investor behavior within the cryptocurrency space.

But what exactly does this index measure, and why should you care? Let’s break it down:

- Range: The index operates on a scale from 0 to 100.

- 0-24: Represents “Extreme Fear,” indicating investors are excessively worried, often signaling potential buying opportunities.

- 25-49: “Fear” zone, suggesting caution and uncertainty prevail in the market.

- 50-74: “Greed” zone, indicating growing optimism and potential market exuberance.

- 75-100: “Extreme Greed,” signaling excessive market optimism, which can sometimes precede market corrections.

Currently sitting at 34, we are still in the “Fear” zone. This implies that while there might be a slight easing of negative sentiment compared to the previous day, overall, the crypto market participants are still exhibiting more fear than greed.

What Drives the Fear and Greed Index? Unpacking the Metrics

The Crypto Fear & Greed Index isn’t just a random number pulled from thin air. It’s a composite index, meticulously calculated by weighing six distinct market factors. Each factor provides a different perspective on market sentiment, contributing to the overall index score. Let’s explore these components in detail:

- Volatility (25% Weight): Volatility measures the rapid and unpredictable price swings in the crypto market, particularly Bitcoin. High volatility often triggers fear as investors become wary of potential losses. The index analyzes the current and maximum drawdowns of Bitcoin to gauge this fear factor.

- Market Momentum/Volume (25% Weight): This factor examines market momentum by comparing the current market momentum and volume against the past 30 and 90-day averages. Strong buying momentum and high trading volumes can suggest growing greed, while weak momentum and low volume might indicate fear or uncertainty.

- Social Media (15% Weight): Social media sentiment plays a significant role in shaping market perceptions. The index analyzes social media platforms, primarily Twitter and Reddit, for crypto-related hashtags and engagement rates. An increase in positive crypto mentions and engagement can signal growing greed, whereas negative sentiment can contribute to fear.

- Surveys (15% Weight): While currently paused, surveys were previously used to directly gauge investor sentiment. These polls asked participants about their current market views, providing a direct measure of fear or greed. When active, survey results were a valuable input to the index.

- Bitcoin Dominance (10% Weight): Bitcoin dominance refers to Bitcoin’s market capitalization relative to the rest of the cryptocurrency market. Increased Bitcoin dominance can sometimes signal a “flight to safety” during periods of fear, as investors move away from riskier altcoins and towards the perceived stability of Bitcoin. Conversely, decreasing Bitcoin dominance might suggest growing greed as investors become more comfortable with altcoins.

- Google Trends (10% Weight): Google Trends data analyzes the search volume for various Bitcoin-related search queries. Increased search interest in terms like “Bitcoin price manipulation” often indicates fear, while rising searches for “Bitcoin buy” can suggest growing greed and investment interest.

By combining these six diverse data points, the Crypto Fear & Greed Index aims to provide a holistic view of the prevailing market sentiment in the crypto space.

Navigating Market Volatility: Why Does the ‘Fear’ Zone Matter?

Understanding that the Crypto Fear & Greed Index is currently in the “Fear” zone is more than just an interesting data point; it has practical implications for your crypto investment strategy. Here’s why it matters:

- Investor Psychology: The index reflects the collective emotional state of the crypto market. Fear can lead to impulsive selling and missed buying opportunities, while excessive greed can result in irrational exuberance and market bubbles. Recognizing these emotional biases is crucial for making rational decisions.

- Potential Buying Opportunities: Historically, periods of extreme fear (index values below 25) have often presented compelling buying opportunities. When fear is rampant, asset prices can be driven down to undervalued levels, offering patient investors a chance to accumulate crypto at a discount.

- Risk Management: Conversely, periods of extreme greed (index values above 75) can signal increased market risk. High greed can indicate that the market is overextended and potentially due for a correction. In such times, it might be prudent to take profits or reduce exposure to riskier assets.

- Confirmation Tool: The index should not be used in isolation but rather as a confirmation tool alongside other technical and fundamental analysis. It can help validate your own market assessment and provide additional context to your investment decisions.

It’s essential to remember that the crypto fear and greed index is a sentiment indicator, not a crystal ball. It doesn’t predict future price movements with certainty. However, it provides valuable insights into the prevailing market psychology, which can be a powerful tool in your investment toolkit.

Actionable Insights: Leveraging the Fear & Greed Index for Smarter Crypto Decisions

So, how can you practically use the Crypto Fear & Greed Index to enhance your crypto investment strategy? Here are some actionable insights:

- Long-Term Investors: Consider periods of “Extreme Fear” as potential accumulation phases. When the market is fearful, it often presents opportunities to buy quality crypto assets at lower prices. Think of it as “buying when others are fearful.”

- Short-Term Traders: Use the index in conjunction with technical analysis. A sudden spike in fear during a downtrend might signal potential capitulation and a possible short-term bounce. Conversely, extreme greed during an uptrend could indicate an overheated market and a potential pullback.

- Risk Management: Monitor the index to gauge overall market risk. As the index moves towards “Extreme Greed,” consider tightening your stop-loss orders or taking some profits off the table to protect your portfolio.

- Diversification: The index can also indirectly inform your diversification strategy. During periods of fear, Bitcoin dominance might increase, suggesting a preference for Bitcoin over altcoins. Adjust your portfolio allocation accordingly based on your risk tolerance and market assessment.

- Stay Informed: Regularly check the Crypto Fear & Greed Index and understand the factors driving its movements. This will help you stay attuned to market sentiment shifts and make more informed decisions.

Remember, the key is to use the index as one piece of the puzzle in your overall crypto investment strategy. Combine it with your own research, analysis, and risk management framework for a more robust and informed approach.

Conclusion: Embracing Market Sentiment for Informed Crypto Investing

The Crypto Fear & Greed Index, currently at 34 and lingering in the “Fear” zone, serves as a crucial reminder of the emotional rollercoaster that is the cryptocurrency market. While the slight increase from the previous day offers a glimmer of potential improvement, the prevailing sentiment remains cautious. By understanding the factors that influence this index – from volatility and market momentum to social media buzz and Bitcoin dominance – you gain a powerful tool to interpret market psychology.

Don’t let fear paralyze you or greed cloud your judgment. Use the Crypto Fear & Greed Index as a compass to navigate market sentiment, identify potential opportunities, and manage risk effectively. In the volatile world of crypto, emotional intelligence, guided by data-driven insights like the Fear & Greed Index, can be your greatest asset.

To learn more about the latest crypto market trends, explore our article on key developments shaping Bitcoin price action.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.