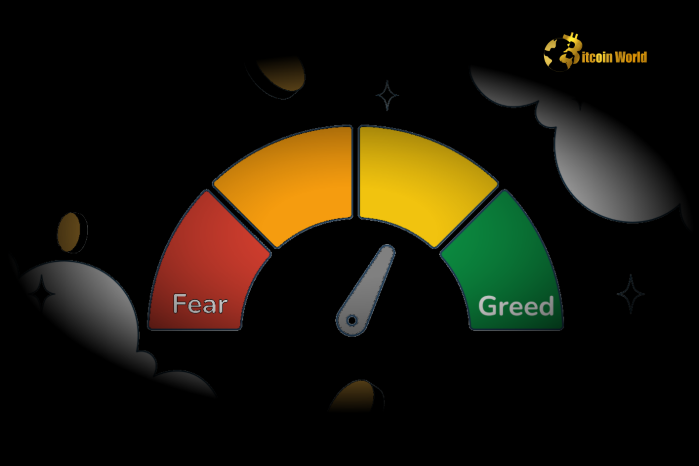

Crypto Fear & Greed Index Remains in ‘Greed’ Zone at 65

The Crypto Fear & Greed Index, a barometer for market sentiment in the cryptocurrency space, stands at 65 as of December 30, indicating a continued presence in the “Greed” zone. Although the index dropped by eight points compared to the previous day, it still reflects a predominantly positive market sentiment.

Understanding the Crypto Fear & Greed Index

The Crypto Fear & Greed Index, provided by Alternative.me, measures market emotions on a scale from 0 to 100:

- 0-24: Extreme Fear

- 25-49: Fear

- 50-74: Greed

- 75-100: Extreme Greed

What Contributes to the Index?

The index aggregates data from six key factors, each contributing a specific percentage:

- Volatility (25%): Tracks sudden price swings in the crypto market.

- Market Momentum/Volume (25%): Reflects trading activity and interest.

- Social Media (15%): Monitors discussions and sentiment across platforms.

- Surveys (15%): Incorporates public opinion from polls (when available).

- Bitcoin Dominance (10%): Measures BTC’s share of the overall crypto market.

- Google Trends (10%): Analyzes search interest in crypto-related topics.

Why the Drop from 73 to 65?

The eight-point decline in the index may be attributed to several factors:

- Weakened Market Momentum: A slight decrease in trading activity has dampened market enthusiasm.

- Price Consolidation: After recent rallies, key cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) have experienced minor price corrections.

Despite the drop, the sentiment remains in the “Greed” zone, indicating a bullish undertone.

What Does This Mean for Investors?

Greed Zone Implications

- Potential for Overvaluation: High greed levels may suggest that the market is overheated, leading to overvalued assets.

- FOMO Risk: Fear of missing out can drive irrational buying behavior, increasing market volatility.

Caution Amid Greed

While greed signals optimism, investors should exercise caution:

- Evaluate Fundamentals: Assess the intrinsic value of assets before buying.

- Diversify Investments: Avoid putting all funds into a single asset, especially during periods of heightened greed.

Recent Trends in Fear & Greed

Historical Perspective

- Extreme Fear to Greed Transitions: Periods of extreme fear often precede market rebounds, while sustained greed can lead to corrections.

- Current Sentiment: The index’s position at 65 suggests a maturing rally but calls for vigilance as greed persists.

Market Outlook

With the index fluctuating within the “Greed” zone, the crypto market could see continued bullish activity, albeit with increased risk of short-term pullbacks.

Conclusion

The Crypto Fear & Greed Index’s current position at 65 highlights a prevailing optimistic sentiment in the market. However, the slight dip from 73 reflects caution among some investors. As the market remains in the “Greed” zone, traders should balance opportunities with risk management to navigate potential volatility effectively.

For more insights on market sentiment and crypto trends, explore our latest updates, where we provide comprehensive analysis and actionable strategies for the digital asset space.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.