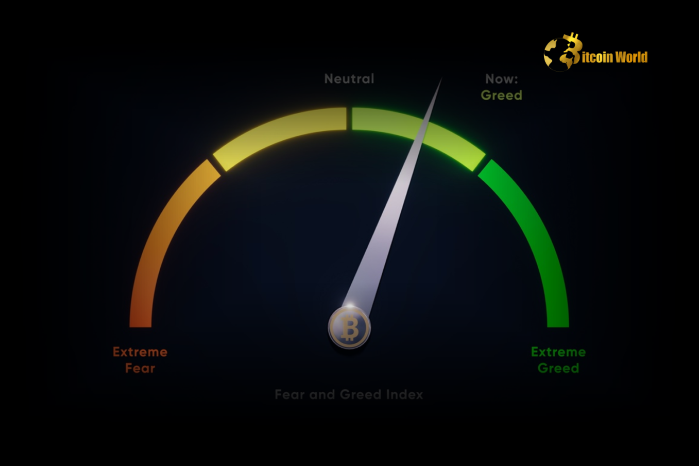

The crypto market is known for its wild swings, and keeping a pulse on its emotional state is crucial for any investor. Right now, the needle is moving! The widely-followed Crypto Fear and Greed Index has just flashed a significant signal, climbing 4 points to reach 47. This leap propels the index into ‘Neutral’ territory, shaking off the ‘Fear’ that gripped the market just yesterday. But what does this shift in crypto sentiment really mean, and how should you interpret it for your crypto strategy? Let’s dive deep.

Decoding the Crypto Fear & Greed Index: What’s Behind the ‘Neutral’ Shift?

The Crypto Fear and Greed Index, a creation of Alternative.me, serves as a valuable barometer of market emotions. It’s not just guesswork; this index is built on a data-driven approach, analyzing various factors to gauge whether the crypto market is leaning towards excessive fear or overwhelming greed. A reading of 47 indicates a balanced, ‘Neutral’ stance, suggesting neither extreme fear-driven selling nor rampant greed-fueled buying is dominating the market right now.

But how does this index actually work? Let’s break down the six key components that power its readings:

- Volatility (25%): Measuring the current and maximum drawdowns of Bitcoin, it compares them with the corresponding average values over the last 30 and 90 days. Unusually high volatility can often signal fear in the market.

- Market Momentum/Volume (25%): This factor assesses the current market momentum and trading volume in relation to the past 30 and 90-day averages. High buying volumes and strong momentum can indicate greed.

- Social Media (15%): By analyzing social media sentiment, primarily on platforms like Twitter and Reddit, the index gauges the overall mood surrounding cryptocurrencies. A surge in positive sentiment can point towards greed, while negative sentiment can indicate fear.

- Surveys (15%): While currently paused, the index previously incorporated weekly crypto polls to directly measure investor sentiment. This provided a direct pulse check on how market participants were feeling.

- Bitcoin Dominance (10%): Bitcoin dominance tracks Bitcoin’s market capitalization relative to the rest of the cryptocurrency market. Increased Bitcoin dominance can sometimes suggest a ‘flight to safety’ during fearful times, while a decrease might indicate higher risk appetite and greed towards altcoins.

- Google Trends (10%): Analyzing Google Trends for Bitcoin-related search queries provides insights into general public interest and curiosity in the crypto market. Spikes in searches can sometimes correlate with market excitement or fear.

Why Does Market Sentiment Matter in Crypto?

Understanding market sentiment is arguably even more vital in the crypto world than in traditional finance. Here’s why:

- High Volatility: The crypto market is notorious for its volatility. Sentiment can amplify these swings, leading to rapid price increases during greed phases and dramatic crashes during fear phases.

- 24/7 Trading: Unlike traditional markets with set trading hours, crypto markets operate 24/7. This constant trading environment means sentiment can shift rapidly and have immediate price impacts at any time.

- Retail-Driven Market: While institutional investment is growing, the crypto market is still largely driven by retail investors, who are often more susceptible to emotional trading and herd behavior influenced by sentiment.

- News and Social Media Influence: Crypto markets are highly sensitive to news headlines and social media trends. Positive news can quickly fuel greed, while negative news can trigger widespread fear, irrespective of underlying fundamentals.

Navigating the ‘Neutral’ Zone: What’s Next for Crypto?

The shift to ‘Neutral’ from ‘Fear’ on the Bitcoin Fear and Greed Index suggests a cooling off period in market anxiety. It doesn’t necessarily signal a bull market is imminent, but it does indicate a potential stabilization and a possible opportunity for strategic moves. Here’s what to consider during this ‘Neutral’ phase:

- Reduced Volatility (Potentially): ‘Neutral’ sentiment can sometimes precede a period of lower volatility compared to extreme fear or greed phases. This could be a good time for traders who prefer less turbulent market conditions.

- Opportunity for Accumulation: For long-term investors, a ‘Neutral’ zone might present a window to accumulate favored cryptocurrencies without the intense upward price pressure of a greed-driven market.

- Careful Analysis Required: ‘Neutral’ doesn’t mean autopilot. It’s crucial to conduct thorough fundamental and technical analysis to identify potential opportunities and risks. Don’t rely solely on sentiment; look at project fundamentals, on-chain metrics, and broader market trends.

- Monitor for Sentiment Shifts: The market is dynamic. Keep a close eye on the Crypto Fear and Greed Index and other sentiment indicators for any signs of a return to ‘Fear’ or a surge into ‘Greed’. These shifts can provide early warnings of potential market movements.

How to Use the Crypto Fear & Greed Index in Your Strategy: Actionable Insights

The Crypto Fear and Greed Index is a valuable tool, but it should be used as one piece of the puzzle, not the sole determinant of your investment decisions. Here are some actionable ways to incorporate it into your crypto strategy:

| Index Reading | Market Sentiment | Potential Strategy |

|---|---|---|

| Extreme Fear (0-25) | Maximum Fear, Potential Panic Selling | Consider Dollar-Cost Averaging (DCA) into fundamentally strong cryptos. ‘Be fearful when others are greedy.’ |

| Fear (26-49) | Anxious, Cautious Market | Exercise caution, but continue research and identify potential undervalued assets. |

| Neutral (50) | Balanced, Uncertain Direction | Conduct thorough analysis, look for specific opportunities, and manage risk carefully. |

| Greed (51-74) | Increasing Optimism, Potential FOMO | Be cautious of overextended valuations. Consider taking profits or tightening stop-loss orders. |

| Extreme Greed (75-100) | Euphoria, Bubble Territory | High risk of correction. Reduce exposure, take profits aggressively. ‘Be greedy when others are fearful.’ |

Important Note: The Fear and Greed Index is a sentiment indicator, not a crystal ball. It’s most effective when used in conjunction with other forms of analysis and risk management strategies. Don’t make impulsive decisions based solely on the index reading.

Conclusion: Riding the Waves of Crypto Sentiment

The Crypto Fear and Greed Index shifting to ‘Neutral’ is a notable development, signaling a potential breather after a period dominated by fear. Understanding and monitoring crypto sentiment is crucial for navigating the volatile crypto market. By incorporating tools like the Fear & Greed Index into your analysis, and combining it with fundamental research and risk management, you can make more informed decisions and potentially capitalize on market opportunities, regardless of whether the sentiment leans towards fear, greed, or a balanced ‘Neutral’ stance. Stay informed, stay adaptable, and ride the waves of crypto sentiment wisely.

To learn more about the latest crypto market trends, explore our article on key developments shaping Bitcoin price action.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.