Buckle up, crypto enthusiasts! If you thought 2020 was a wild ride for the cryptocurrency market, 2021 blew it out of the water. As digital currencies continue their march into mainstream acceptance, with individuals, businesses, and even governments embracing them, the investment returns have been nothing short of phenomenal. Want to know just how impressive? Let’s dive into some eye-opening data.

A groundbreaking study by Chainalysis, a leading on-chain analytics platform, reveals just how lucrative crypto investments became in 2021. Released on April 20th, the research shows a staggering over 400% increase in crypto investor returns worldwide compared to the previous year. Yes, you read that right – over 400%!

Globally, crypto investors pocketed a whopping $162.7 billion in gains in 2021. To put that into perspective, this is a monumental leap from the $32.5 billion in gains seen in 2020. It’s clear evidence that crypto is not just a fleeting trend, but a rapidly maturing asset class with the potential for significant financial rewards.

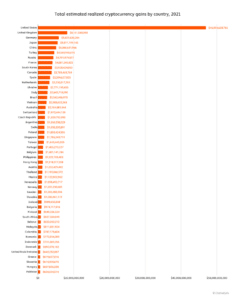

Which Countries Reaped the Biggest Crypto Rewards?

So, where in the world were crypto investors seeing the most significant gains? Let’s break down the top countries that led the charge in crypto investment profits during 2021:

- United States: Topping the list by a considerable margin, the United States saw a massive $46.96 billion in crypto gains. This represents a staggering 28.86% of the total global gains. It seems America is truly embracing the digital gold rush!

- United Kingdom: Coming in second place is the UK, with crypto investors there realizing $8.16 billion in profits, accounting for 5% of global gains.

- Germany: Germany takes the third spot, with $5.83 billion in gains, or 3.58% of the global total. This indicates strong crypto adoption and investment within the German economy.

- Japan: Following closely behind is Japan, with $5.51 billion in gains, representing 3.39% of global profits. Japan has long been a forward-thinking nation when it comes to technology and finance, so their strong crypto showing is not entirely surprising.

- China: Rounding out the top five is China, with $5.06 billion in crypto investment gains, making up 3.11% of the worldwide total. Despite regulatory uncertainties at times, China’s crypto investor base still managed to secure substantial profits.

It’s quite remarkable to consider that American crypto investors alone made more money in 2021 than the entire world did in crypto in 2020! This truly highlights the exponential growth and increasing mainstream acceptance of cryptocurrencies.

Furthermore, in some nations, crypto investment returns were actually higher than their Gross Domestic Product (GDP) growth – a traditional measure of a country’s economic health. This underscores the significant economic impact cryptocurrencies are beginning to have on a global scale.

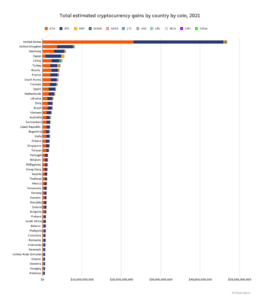

Bitcoin vs. Ethereum: Which Crypto Dominated Returns?

Now, let’s talk about the cryptocurrencies themselves. Which digital assets were the primary drivers of these impressive investment returns? According to the Chainalysis report, Ethereum (ETH) gains slightly edged out Bitcoin (BTC) gains in 2021.

Globally, Ethereum investors saw a total of $76.3 billion in gains, which is approximately 2.12% higher than the $74.7 billion in gains realized by Bitcoin investors. While Bitcoin remains the king of crypto in terms of market capitalization and name recognition, Ethereum’s network saw even greater profitability for investors in 2021.

Chainalysis points out that Ethereum’s dominance in gains likely reflects the explosive growth of Decentralized Finance (DeFi) in 2021. The vast majority of DeFi protocols are built on the Ethereum network and utilize ETH as their primary currency. As DeFi took off, so did the demand and value of Ethereum, leading to significant investor profits.

Interestingly, there’s a notable exception to this trend: Japan. In Japan, Bitcoin investors saw significantly larger profits (nearly $4 billion) compared to Ethereum investors ($790 million). This suggests regional differences in crypto preferences and adoption patterns.

Key Takeaways:

- Crypto investment returns in 2021 experienced unprecedented growth, exceeding 400% globally.

- The United States led the world in total gains, followed by the UK, Germany, Japan, and China.

- Ethereum slightly outperformed Bitcoin in terms of overall investor gains, likely driven by the DeFi boom.

- Japan is an exception, with Bitcoin gains significantly higher than Ethereum gains.

- These findings highlight the increasing mainstream adoption and financial potential of cryptocurrencies.

The data is clear: 2021 was a landmark year for crypto investment. As adoption continues to rise and the crypto ecosystem matures, it will be fascinating to see if these trends continue and how the landscape evolves in the years to come. One thing is certain – cryptocurrency is no longer a niche market, but a significant force in the global financial world.

Related Posts – XRP Price Goes Up After Unexpected Reappearance On Coinbase

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.