Navigating the ever-shifting tides of the cryptocurrency market can feel like charting a course through uncharted waters. This week, we’re diving deep into the currents affecting some key players: TRON (TRX), USD Coin (USDC), Internet Computer (ICP), and Ethereum Classic (ETC). Let’s break down the latest market movements and what they could mean for you.

TRON (TRX): Can It Break Through the Resistance Barrier?

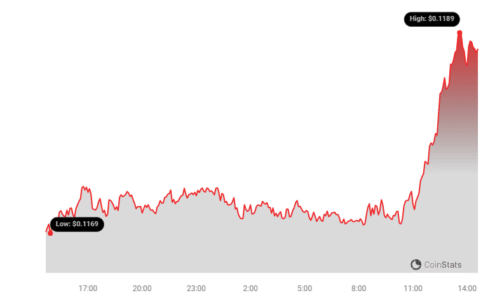

TRON (TRX) has been locked in a battle with the $0.1190 resistance level, like a digital tug-of-war. For weeks now, since January 13, 2024, buyers have been striving to gain solid ground above this point, but the market seems to be pushing back. Currently priced at $0.1187, the TRX price chart paints a picture of ongoing fluctuation and uncertainty in the near term.

Despite the overall uptrend, indicated by TRX consistently trading above moving averages, the $0.1150 mark has acted as a persistent resistance zone. Keep an eye out for doji candlesticks and consolidation patterns, as these often signal periods of indecision and potentially limited price swings. For traders watching TRX, it’s crucial to note the key zones:

- Supply Zones (Potential Sell Points): $0.09, $0.10, $0.11

- Demand Zones (Potential Buy Points): $0.06, $0.05, $0.04

See Also: Don’t Miss The Kelexo (KLXO) Presale

USD Coin (USDC): What Do Fee Changes Mean for Institutional Players?

Coinbase recently announced updates to its fee structure, specifically impacting institutional clients dealing with large volumes of USD Coin (USDC) to USD conversions. If you’re an institutional investor moving over $75 million in a 30-day period, you’ll want to pay attention.

The new fees range from 0.1% to 0.2%, scaling with the transaction size. However, it’s not all fees for everyone. Coinbase Prime users with significant holdings or consistent USD/USDC trading volumes might be exempt. These adjustments reflect Coinbase’s ongoing efforts to refine its services and adapt to the evolving needs of its user base, taking user feedback into consideration as they enhance their technology.

Internet Computer (ICP): Navigating the DeFi Rollercoaster

Internet Computer (ICP) once shone brightly in the Decentralized Finance (DeFi) space, promising a revolutionary platform for decentralized applications. Its blockchain-based infrastructure aimed to simplify smart contract execution and data storage, offering developers more freedom in designing flexible software architectures.

While ICP has seen impressive price surges in the past, its future path is shrouded in uncertainty. Price predictions are varied, suggesting both potential peaks and valleys, while regulatory developments add another layer of complexity to its market outlook. Investors should brace for potential volatility as ICP continues to find its footing in the dynamic crypto landscape.

See Also: PYTH Price Surged 20% After Binance Listing Announcement – Will This Momentum Last?

Ethereum Classic (ETC): Steady as She Goes in a Turbulent Market?

Ethereum Classic (ETC) appears to be carving out a niche as a relatively stable cryptocurrency amidst the often wild swings of the broader market. ETC boasts a moderate volatility ranking and has maintained its price above crucial support levels, suggesting a degree of resilience in the face of market turbulence.

Investors are observing ETC’s price action, noting its less dramatic fluctuations and perceived resistance to manipulation compared to some other cryptocurrencies. This positions Ethereum Classic (ETC) as a potentially more predictable, albeit perhaps less explosive, option within the crypto ecosystem for those seeking steadier ground.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading nor financial advice. Bitcoinworld.co.in holds no liability for any trading or investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any trading or investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.