Crypto Projects See Market Caps Lag Behind VC Valuations Despite Bull Market

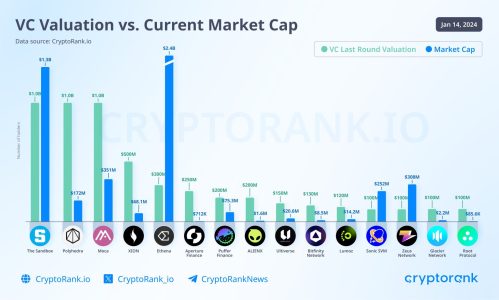

A recent report from CryptoRank.io reveals a surprising trend in the cryptocurrency market: the market caps of most projects are currently lower than the valuations assigned by venture capitalists (VCs) during private funding rounds. This dynamic persists even as the crypto market experiences a bull cycle, raising questions about the gap between VC optimism and actual market performance.

Key Findings from CryptoRank.io

Market Caps vs. VC Valuations

- Discrepancy Observed: Many projects that secured substantial funding during private rounds now have market caps below their VC-assessed valuations.

- Examples of Overvaluation: Projects across sectors, including DeFi, infrastructure, and gaming, have struggled to reach their early investor expectations in public markets.

Bull Market Context

- Despite the ongoing bull cycle, these projects have yet to align their public valuations with private funding estimates, signaling potential overvaluation or delayed growth.

Reasons Behind the Discrepancy

1. VC Overvaluation in Private Rounds

- Aggressive Projections: VCs often base valuations on future potential rather than immediate deliverables, leading to inflated figures during funding rounds.

- Hype-Driven Metrics: Early-stage projects in emerging fields like AI integration or tokenization attract premium valuations, even if their products are unproven.

2. Market Realities

- Token Supply Dynamics: Public market caps often reflect circulating supply rather than fully diluted valuations, creating a mismatch.

- Investor Skepticism: Retail investors may be more cautious than VCs, especially in the absence of strong fundamentals or utility.

3. Regulatory Uncertainty

- Compliance Risks: Concerns over global regulatory policies continue to dampen investor confidence, particularly for newer projects.

Sectors Facing the Biggest Disparities

DeFi Projects

- VC Valuations: Many DeFi projects were valued at hundreds of millions during private funding rounds.

- Current Market Caps: Public market valuations often fall short due to lower-than-expected adoption or competition from established players.

AI and Web3 Startups

- Valuation Bubble: The intersection of AI and blockchain has drawn significant VC attention, but practical implementations are still limited.

Gaming and NFTs

- Slower Adoption: While gaming and NFTs hold immense potential, their current adoption rates haven’t matched VC expectations, leading to lower public valuations.

What This Means for Investors

For Retail Investors

- Caution Advised: Retail investors should critically evaluate project fundamentals rather than relying on VC valuations.

- Opportunities in Undervalued Projects: Some projects with strong long-term potential may be undervalued in public markets, presenting opportunities for savvy investors.

For VCs

- Reassessing Valuation Models: Future funding rounds may adopt more conservative valuation approaches to align with market realities.

- Focus on Milestones: Linking funding to project milestones could ensure better alignment between private and public valuations.

Closing the Gap: What Needs to Happen?

- Stronger Product Development: Projects must demonstrate tangible progress to justify their valuations.

- Community Engagement: Building strong communities and real-world use cases can drive market confidence.

- Regulatory Clarity: Clearer guidelines can reduce uncertainty and attract more retail and institutional investors.

Conclusion

The gap between VC valuations and public market caps underscores the challenges of pricing emerging crypto projects accurately. While the current bull market cycle suggests optimism, many projects still face hurdles in aligning their valuations with market realities. For investors, the focus should remain on fundamentals, transparency, and measurable progress to navigate this complex landscape effectively.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.