Are you feeling more optimistic about crypto lately? You’re not alone! The cryptocurrency market is showing a notable shift in investor sentiment. The well-known Fear and Greed Index, a key indicator for crypto traders, has just climbed to 55. This jump signifies a move from a neutral market mood into ‘greed’ territory. Let’s dive into what this shift means for you and your crypto portfolio.

Decoding the Crypto Fear and Greed Index: Your Sentiment Compass

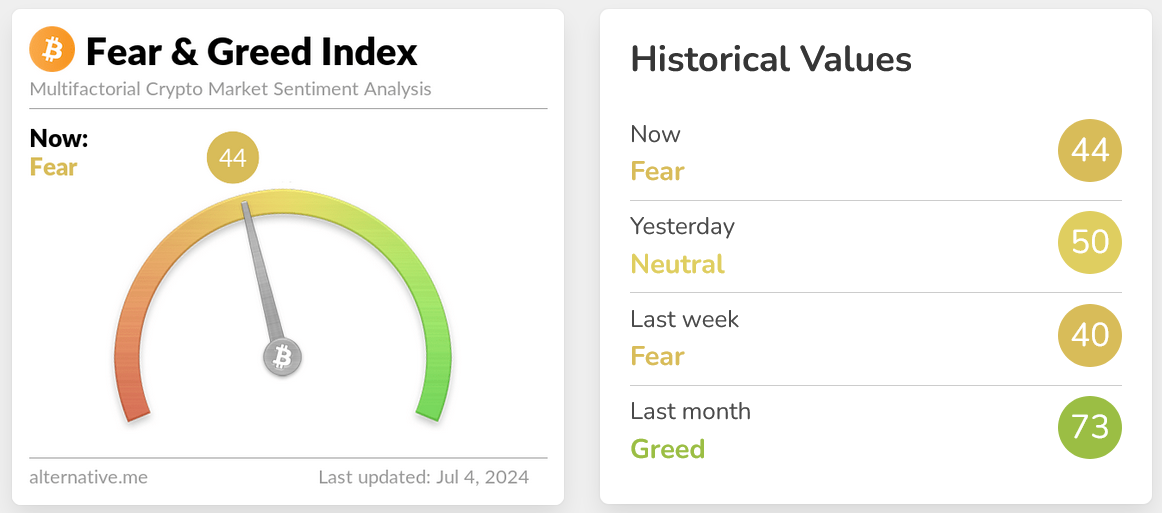

Think of the Fear and Greed Index as your emotional weather forecast for the crypto market. Created by Alternative.me, this index is a powerful tool that helps us understand the overall sentiment driving cryptocurrency investments. It works on a simple scale:

- 0-24: Extreme Fear – Investors are very worried, often indicating a potential buying opportunity.

- 25-49: Fear – Market participants are cautious and apprehensive.

- 50-74: Greed – Optimism is rising, and investors are becoming more enthusiastic.

- 75-100: Extreme Greed – The market is overly bullish, which could signal an impending correction.

Currently, the index sits at 55, a slight increase from 54 the previous day. While a single point might seem insignificant, in the world of market psychology, it’s a telling sign. We’ve officially moved past neutral and are dipping our toes into ‘greed’. But what does ‘greed’ really mean in the crypto context?

‘Greed’ in Crypto: Is It a Green Light or a Red Flag?

When the Fear and Greed Index creeps into ‘greed’, it’s like the market putting on rose-tinted glasses. Investors start feeling good about the future of crypto, and this optimism can fuel some exciting market movements. Here’s what typically happens:

- Increased Buying Pressure: Optimism often translates to more buying. As people rush to invest, demand increases, potentially pushing prices upwards.

- Price Appreciation: With more buyers than sellers, prices tend to rise. This can lead to short-term gains and a feeling of euphoria in the market.

- Bubble Territory?: However, excessive greed can also be a warning sign. Unrestrained optimism can inflate asset valuations beyond sustainable levels, creating market bubbles that are prone to bursting.

- Higher Volatility: Greed often encourages risk-taking. This can lead to increased market volatility, meaning prices can swing more dramatically, both up and down.

As the index climbs higher towards 100, the risk of a market correction intensifies. History often shows us that extreme greed can precede sharp market downturns. So, while a little greed can be good, too much can be risky!

What’s Behind the Numbers? Unpacking the Index Factors

Ever wondered what actually makes the Fear and Greed Index tick? It’s not just pulled out of thin air! It’s calculated by analyzing a mix of market indicators. Here’s a breakdown of the factors and their weight in the index:

| Factor | Weight | Impact on Fear/Greed |

|---|---|---|

| Volatility | 25% | High volatility often signals fear; low volatility can suggest greed (stability). |

| Market Momentum/Volume | 25% | High buying volume usually points towards growing greed. |

| Social Media Sentiment | 15% | Positive social media buzz around crypto fuels greed. |

| Surveys | 15% | Survey responses reflecting bullish market expectations increase greed. |

| Bitcoin Market Cap Dominance | 10% | Lower Bitcoin dominance often indicates a risk-on, greed-driven market as investors explore altcoins. |

| Google Trends | 10% | Surges in crypto-related Google searches can be a sign of growing market interest and greed. |

Investor Playbook: Navigating a ‘Greedy’ Market

So, the Fear and Greed Index is flashing ‘greed’ – what should you do as an investor? Here are some actionable insights:

- Proceed with Caution: While market optimism can be exciting, now might be the time for a more cautious approach. Greed can sometimes blind investors to potential risks.

- Review Your Portfolio: Consider rebalancing your portfolio. If some of your crypto holdings have significantly increased in value due to market optimism, you might want to take some profits.

- Diversification is Key: Don’t put all your eggs in one basket. Diversifying your investments can help mitigate risk, especially in a potentially volatile market.

- Use Multiple Tools: The Fear and Greed Index is valuable, but it’s just one piece of the puzzle. Combine it with other forms of analysis like fundamental analysis (looking at the underlying value of projects), technical analysis (studying price charts and patterns), and keeping an eye on broader market trends.

Beyond the Index: External Forces at Play

Remember, the Fear and Greed Index isn’t the only factor influencing the crypto market. External events play a significant role too. Keep an eye on:

- Macroeconomic Conditions: Overall economic health, inflation rates, and interest rate decisions can impact investor sentiment and risk appetite.

- Regulatory Landscape: News about crypto regulations, whether positive or negative, can heavily influence market sentiment and the Fear and Greed Index. Positive regulatory developments can drive greed, while crackdowns can trigger fear.

- Global Events: Major global events, from geopolitical tensions to technological breakthroughs, can create ripples in the crypto market and affect investor psychology.

Final Thoughts: Staying Sharp in a Shifting Market

The cryptocurrency market is a dynamic and ever-changing space. As the Fear and Greed Index signals a shift towards greed, it’s a reminder to stay informed and adaptable. While optimism can fuel market growth, it’s essential to remain vigilant and strategic. By using tools like the Fear and Greed Index, combined with your own research and risk assessment, you can navigate these market shifts more effectively. Understanding market sentiment is a crucial skill for any crypto investor looking to thrive in this exciting, yet sometimes unpredictable, world. Keep watching those market signals, and happy investing!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.