Hold onto your hats, crypto enthusiasts! The crypto market just experienced another rollercoaster, and this time, it’s tied to legal action against a well-known name in the crypto wallet space. Samourai Wallet, known for its privacy-focused Bitcoin services, is now under the spotlight as its CEO and CTO face serious charges from the U.S. Department of Justice (DOJ). Let’s dive into what happened, how it impacted the market, and what it could mean for the future of crypto privacy.

Why is Samourai Wallet in the Crosshairs?

On April 24th, the DOJ announced the arrest of Keonne Rodriguez, CEO, and William Hill, CTO, of Samourai Wallet. The charges? Conspiracy to commit money laundering and conspiracy to operate an unlicensed money transmitting business. These are hefty accusations that have sent ripples through the crypto community.

According to the DOJ, Samourai Wallet allegedly facilitated over $100 million in illicit transactions, essentially acting as an unlicensed money transmitter. This action comes as regulatory scrutiny on crypto intensifies globally, particularly in the U.S.

Crypto Market Feels the Jitters: Price Dips and Liquidations

The news of the arrests hit the crypto market hard, adding to existing anxieties from geopolitical tensions in the Middle East and the post-Bitcoin halving volatility. Let’s take a look at how major cryptocurrencies reacted:

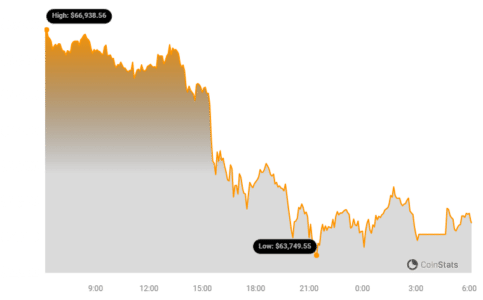

- Bitcoin (BTC): The king of crypto saw a sharp 3.6% drop within an hour of the DOJ announcement. It briefly dipped below the $64,000 mark, hitting a low of $63,710 before a slight recovery to around $64,546.

- Ethereum (ETH): Ethereum wasn’t spared either, falling by 2.51% in the same timeframe. Unlike Bitcoin, ETH struggled to bounce back immediately and continued its downward trend, reaching $3,158.

- Altcoins: Major altcoins also experienced a downturn:

- PEPE: Briefly plunged by 6.4%.

- Shiba Inu (SHIB): Declined by 2.7%.

- Dogecoin (DOGE): Dipped by 3.2%.

These sudden price drops triggered significant liquidations, especially for traders in long positions (bets that prices would go up). In just 12 hours:

- Bitcoin Long Liquidations: $33.08 million

- Ethereum Long Liquidations: $29.88 million

- Total Crypto Market Long Liquidations (excluding BTC & ETH): Approximately $23 million

These figures, according to CoinGlass data, highlight the immediate financial impact of the news on leveraged crypto traders.

Geopolitical Tensions and Post-Halving Jitters: A Perfect Storm?

The Samourai Wallet news isn’t happening in a vacuum. The crypto market is already navigating a complex landscape influenced by:

- Middle East Tensions: Escalating geopolitical unrest, particularly in the Middle East, adds uncertainty to global markets, including crypto. Recent reports indicate increased military actions in the region, like the Israeli military strikes in Southern Lebanon.

- Bitcoin Halving Aftermath: The recent Bitcoin halving on April 20th, a significant event that reduces the reward for mining new Bitcoin, often brings about short-term market volatility as the market adjusts to reduced supply.

What Does the Crypto Community Say? Concerns Over Privacy and Regulation

The crypto community has reacted strongly to the arrests, with many expressing concerns about government overreach and the implications for crypto privacy. Here’s a glimpse into the sentiment:

- Ryan Adams (Crypto Analyst): In a tweet, Adams highlighted the severity of the charges, stating, “These developers face up to 25 yrs in prison for writing code. The US is sending a message. No transaction will be private.”

These developers face up to 25 yrs in prison for writing code.

The US is sending a message.

No transaction will be private.

— RYAN SΞAN ADAMS – rsa.eth 🦇🔊 (@RyanSAdams) April 24, 2024

- Fred Krueger: Krueger expressed concern about the broader impact on Bitcoin’s image, tweeting that the arrest was “not a good look for Bitcoin in general.”

Not a good look for Bitcoin in general. https://t.co/y3vjWpWw5k

— Fred Krueger (@dotkrueger) April 24, 2024

- Luke Mikic (Crypto Commentator): Mikic emphasized the significance of the action, telling his followers that this “attack by the US Government on Samourai wallet is bigger than most people think.”

This attack by the US Government on Samourai wallet is bigger than most people think. https://t.co/lWTWw5d1hB

— Luke Mikic (@LukeMikic21) April 24, 2024

These reactions underscore the growing tension between crypto’s ethos of privacy and the increasing regulatory pressure from governments worldwide.

Is it All Doom and Gloom? Market Sentiment Remains Positive (For Now)

Interestingly, despite the market turbulence and the concerning news, underlying investor sentiment in the crypto market remains relatively positive. The Fear and Greed Index, a measure of market sentiment, actually increased this week to 72, a 15-point jump from the previous week, indicating a “greed” sentiment prevailing in the market. This suggests that while news events can cause short-term volatility, the overall long-term outlook for crypto might still be optimistic for many investors.

According to the Fear and Greed Index, the score reflects a continued, albeit potentially cautious, enthusiasm in the crypto space.

Looking Ahead: What’s Next for Samourai Wallet and the Crypto Market?

The Samourai Wallet case is a developing story with significant implications. Here’s what to watch out for:

- Legal Proceedings: The outcome of the legal case against Rodriguez and Hill will be crucial. The charges are serious, and the result could set precedents for how crypto privacy tools and services are regulated in the U.S.

- Regulatory Landscape: This event is likely to further fuel the debate around crypto regulation. Governments worldwide are grappling with how to regulate crypto, balancing innovation with concerns about illicit finance.

- Market Volatility: Expect continued market volatility in the short term as the market digests this news and reacts to further developments in the legal case and the broader regulatory environment.

In conclusion, the arrest of Samourai Wallet’s founders has injected a dose of uncertainty into the crypto market, highlighting the ongoing tension between crypto privacy and regulatory compliance. While the market experienced a temporary dip, underlying sentiment suggests a degree of resilience. The coming weeks and months will be critical in determining the long-term impact of this event on Samourai Wallet, the crypto industry, and the future of crypto privacy. Stay tuned for further updates as this story unfolds.

See Also: US Authorities Arrest And Charge William Morro, A New Figure In Onecoin Scheme

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.