The crypto market can be a rollercoaster, right? Just when you think you’ve got a handle on things, the market dips, and you’re left wondering what to do next. But guess who’s not panicking? Ethereum whales! These deep-pocketed investors, holding the largest Ethereum wallets, are seeing the dip as a golden opportunity. Let’s dive into what these crypto giants are up to and which altcoins are catching their eye.

Ethereum Whales: Buying the Dip Like Pros

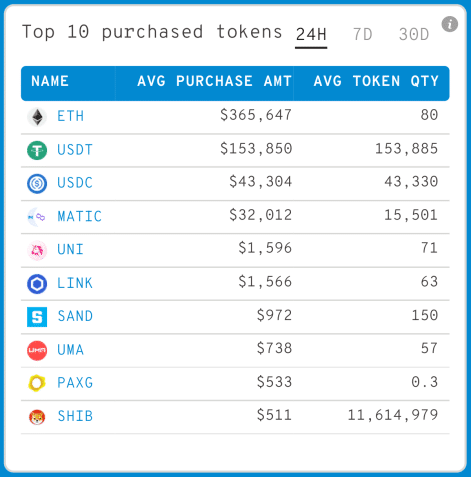

According to WhaleStats, a platform that tracks crypto whale activity, the top 1,000 non-exchange Ethereum wallets are on an accumulation spree. Over the last 24 hours, they’ve been scooping up an average of:

- $365,000 worth of ETH

- $154,000 of Tether (USDT)

- $43,000 of USD Coin (USDC)

That’s a significant amount of buying power! It signals strong confidence from these major players in the Ethereum ecosystem and the broader crypto market’s potential for recovery. But it’s not just ETH and stablecoins they’re after. Let’s look at the altcoins making waves in the whale wallets.

Beyond ETH: Which Altcoins Are Whales Bullish On?

Ethereum whales are diversifying their bags beyond just ETH. Several altcoins are experiencing notable accumulation. Here’s a breakdown of some of the key players:

DeFi and Oracle Giants: UNI and LINK

Decentralized Finance (DeFi) and oracle solutions remain crucial components of the crypto space. Whales are showing strong interest in:

- Uniswap (UNI): The leading decentralized exchange token is being accumulated at an average of around $1,500 per purchase by whales. This suggests continued belief in the growth and importance of DEX platforms.

- Chainlink (LINK): Another DeFi heavyweight, Chainlink, a blockchain oracle network, is also seeing similar accumulation levels to UNI, averaging about $1,500 per purchase. This highlights the ongoing demand for reliable data feeds in the blockchain ecosystem.

Interestingly, the accumulation of UNI and LINK is significantly higher than some other altcoins, indicating a potentially stronger long-term conviction in these projects.

Meme Coin Mania: Shiba Inu (SHIB) Still on the Radar?

Even meme coins haven’t been entirely ignored. Shiba Inu (SHIB), despite its volatility, is still seeing whale activity, although at a lower scale compared to UNI and LINK.

- Shiba Inu (SHIB): Whales are purchasing an average of $511 worth of SHIB. While this is less than UNI and LINK, it still demonstrates some level of interest in the meme coin space, perhaps as a higher-risk, higher-reward play.

It’s worth noting that the SHIB accumulation is about 3x less than that of UNI and LINK, suggesting a more cautious approach to meme coins compared to established DeFi projects.

Exploring the Metaverse and Beyond: SAND, UMA, and PAXG

Whales are also venturing into other sectors, including the metaverse, DeFi infrastructure, and even traditional assets tokenized on the blockchain. They appear to be accumulating:

- The Sandbox (SAND): This metaverse gaming altcoin is attracting whale attention, suggesting continued interest in the growth of virtual worlds and NFTs.

- UMA (UMA): UMA, a DeFi platform, is also on the accumulation list, indicating ongoing interest in decentralized financial instruments and infrastructure.

- Paxos Gold (PAXG): This gold-backed stablecoin is an interesting addition, possibly reflecting a move towards hedging strategies and exposure to traditional assets within the crypto space.

MATIC Takes Center Stage: Polygon Leading the Altcoin Pack

While the altcoins mentioned above are seeing whale accumulation, one stands out from the crowd: Polygon (MATIC). This Ethereum layer-2 scaling solution is proving to be exceptionally popular among whales.

- Polygon (MATIC): MATIC is being accumulated more than any other altcoin over the past day, with an average purchase amount of approximately $32,000. This significant investment underscores the strong belief in layer-2 solutions and Polygon’s role in scaling Ethereum.

The popularity of MATIC is further highlighted by the activity of the fourth-largest Ethereum whale, who recently added a staggering 8,000,000 MATIC, worth $16.5 million at the time!

This massive purchase emphasizes the strong conviction some whales have in Polygon’s future and its potential to address Ethereum’s scalability challenges.

Galaxy Interactive Rises Additional $325M Fund For Metaverse and Next Gen…>>

Related Posts – Bank DBS’s Crypto Business Grows Massively Due To Growing Demand From Investors

What Does Whale Accumulation Mean for the Market?

Whale activity is often seen as a potential indicator of market direction. Massive accumulation during a dip can suggest that large investors believe the dip is temporary and that prices are likely to rebound. However, it’s crucial to remember that whale activity is just one factor to consider. The crypto market is influenced by numerous elements, including macroeconomic trends, regulatory developments, and technological advancements.

Key Takeaways:

- Ethereum whales are actively buying the dip, accumulating ETH, stablecoins, and various altcoins.

- MATIC (Polygon) is the most accumulated altcoin, highlighting the strong interest in layer-2 scaling solutions.

- DeFi tokens like UNI and LINK are also seeing significant whale accumulation.

- Even meme coins like SHIB are attracting some whale attention, albeit at a lower scale.

- Whale activity can be a bullish signal, but it’s not the only factor determining market direction.

Final Thoughts: Are We in a Bullish Accumulation Phase?

The current accumulation trend by Ethereum whales is certainly noteworthy. It suggests that smart money is positioning itself for a potential market recovery. Whether this accumulation will indeed trigger a bullish phase remains to be seen. However, keeping an eye on whale activity can provide valuable insights into market sentiment and potential future trends. As always, do your own research and consider various factors before making any investment decisions in the volatile crypto market.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.