The largest crypto whales in the Ethereum ecosystem are leveraging on the market dip to bag more ETH. Also, dollar-pegged stablecoins and seven additional altcoins on the leading smart contract platform.

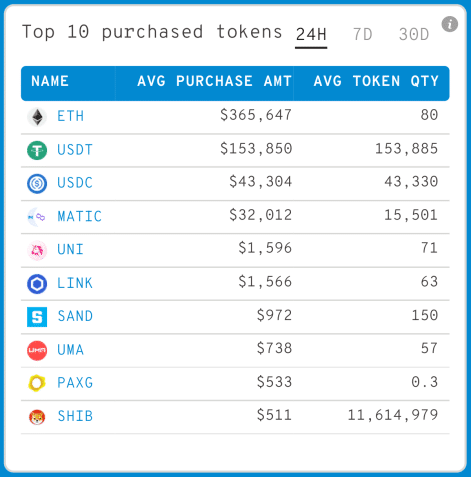

Furthermore, as per information by the crypto whales tracker WhaleStats. So, it notes that the largest 1,000 non-exchange Ethereum wallets is bagging an average amount of approximately. Of course, $365,000 worth of ETH, $154,000 of Tether (USDT) and $43,000 of USD Coin (USDC) over the last 24 hours.

More so, we record massive accumulation by Ethereum whales of the decentralized exchange (DEX) token Uniswap (UNI). Also, blockchain oracle Chainlink (LINK) at an average amount of approximately $1,500 per coin.

Notably, This is 3x the amount that whales are bagging up the meme-coin Shiba Inu (SHIB). Of course, recording an average purchase amount of $511 worth of SHIB over the same period.

Furthermore, It seems like Ethereum whales are leveraging on small to mid-cap krill like the metaverse gaming altcoin The Sandbox (SAND). Then, decentralized finance (DeFi) platform UMA (UMA). Also, and gold-backed Paxos stablecoin PAX Gold (PAXG).

More so, this is not just from Ethereum, USDT, and USDC. Also, whales are accumulating Ethereum layer-2 solution Polygon (MATIC) more than any other altcoin over the past day. Of courses with a record of an average purchase amount worth approximately $32,000.

Notably, Polygon is so popular amongst Ethereum whales that the fourth-largest whale in existence adds 8,000,000 MATIC worth $16.5 million.

Lastly, 8 million MATIC is worth over $16 million at the time of purchase.

Galaxy Interactive Rises Additional $325M Fund For Metaverse and Next Gen…>>

Related Posts – Bank DBS’s Crypto Business Grows Massively Due To Growing Demand From Investors