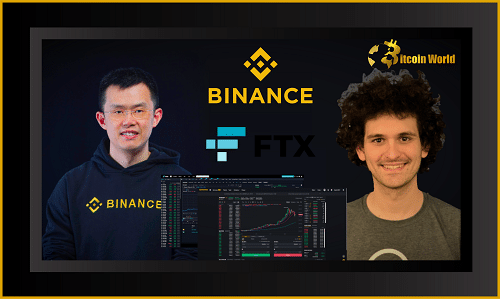

The ever-watchful eye of the crypto world is currently glued to a simmering debate ignited by none other than Changpeng “CZ” Zhao, the CEO of Binance. CZ recently voiced concerns about “trade jitters” on certain cryptocurrency exchanges, a comment that has sent ripples through the crypto community, many interpreting it as a subtle jab at rival exchange FTX, led by Sam Bankman-Fried (SBF). But what exactly are these ‘jitters,’ and why is everyone buzzing about them? Let’s dive into the heart of this crypto drama.

What are ‘Trade Jitters’ in Crypto, and Why Should You Care?

Imagine placing a trade order, feeling confident, only to watch it frustratingly stall and slip down the order book. That, in essence, is what ‘trade jitters’ are in the cryptocurrency realm. In more technical terms, trade jitters occur when a buy or sell order gets stuck, allowing subsequent orders to be executed ahead of it. This can be incredibly frustrating for traders, potentially leading to missed opportunities and less favorable execution prices.

Think of it like waiting in line at a busy coffee shop. You place your order, but suddenly, everyone else’s orders are being filled first, pushing you further back. In crypto trading, this ‘slippage’ can translate to real financial impact.

CZ’s Tweet: A Shot Across the Bow at FTX?

While CZ’s initial tweet (above) didn’t explicitly name any exchange, the crypto Twitterverse immediately connected the dots to FTX. The community’s reaction suggests a widespread perception that ‘jitters’ might be a more prevalent issue on FTX compared to Binance. When a user commented that “jitters” are a normal occurrence, CZ doubled down, implying it wasn’t just normal market fluctuations he was referring to.

CZ further stated that Binance VIP traders were aware of “illegal trade activity,” adding fuel to the fire and strengthening the implicit accusation against FTX. This subtle online sparring match unfolds against the backdrop of another significant event involving FTX – a warning from the Federal Deposit Insurance Corporation (FDIC).

FDIC Steps In: Cease-and-Desist Letters to FTX and Crypto Companies

Adding another layer of complexity to the situation, the FDIC recently issued cease-and-desist letters to FTX US, along with SmartAssets, FDICCrypto, Cryptonews, and Cryptosec. The FDIC alleges these companies misled investors by suggesting their products were FDIC-insured. FDIC insurance is a crucial aspect of traditional finance, guaranteeing the safety of deposits in banks up to a certain limit. However, cryptocurrencies and crypto exchanges generally do not have this protection.

Following the FDIC directive, Brett Harrison, President of FTX US, deleted a tweet that contained statements refuted by the FDIC. However, eagle-eyed Crypto Twitter users were quick to unearth past instances where Harrison allegedly misrepresented the existence of FDIC insurance. This quickly escalated into a public relations challenge for FTX.

In response, SBF attempted to manage the fallout, clarifying that “FTX US isn’t FDIC insured” and expressing a willingness to collaborate with the FDIC in the future. This damage control effort highlights the importance of clear and accurate communication regarding regulatory compliance and investor protection in the crypto space.

Privacy Concerns: FTX and zk.money Account Restrictions

Adding yet another twist to the narrative, reports surfaced that FTX had begun restricting accounts that had interacted with zk.money, a privacy-focused layer-2 chain on Ethereum developed by Aztec Network. zk.money aims to enhance transaction privacy, a feature that, while beneficial for some, can raise red flags for regulatory compliance, particularly concerning Anti-Money Laundering (AML) measures.

SBF defended FTX’s decision to monitor these accounts, citing AML compliance as the primary reason. He clarified that while accounts were being monitored, it didn’t necessarily mean they were frozen, aiming to alleviate concerns about widespread account freezes. This incident underscores the delicate balance crypto exchanges must strike between user privacy and regulatory obligations.

The Bigger Picture: Competition and Regulation in the Crypto World

The exchange between CZ and the crypto community, coupled with the FDIC warnings and zk.money account monitoring, paints a picture of the intense competition and increasing regulatory scrutiny within the cryptocurrency industry. Here’s a quick recap of the key takeaways:

- ‘Trade Jitters’ Debate: CZ’s remarks have ignited a discussion about potential issues on certain crypto exchanges, implicitly pointing towards FTX and raising questions about trading fairness.

- FDIC Scrutiny: The FDIC’s cease-and-desist letters highlight the importance of accurate advertising and investor protection in crypto, particularly concerning claims of insurance or regulatory backing.

- Privacy vs. Compliance: FTX’s monitoring of zk.money related accounts underscores the ongoing tension between user privacy and the need for crypto exchanges to comply with AML and other regulations.

- Market Dynamics: This series of events showcases the dynamic and often contentious nature of the crypto exchange market, with leading players like Binance and FTX constantly vying for market share and navigating a complex regulatory landscape.

As the cryptocurrency market matures, expect to see continued scrutiny from regulatory bodies and ongoing competition among exchanges. For crypto traders and investors, staying informed about these developments is crucial for navigating this evolving landscape and making informed decisions. The CZ vs. SBF Twitter exchange might seem like a minor spat, but it reflects deeper trends shaping the future of crypto trading and regulation.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.