In a bold declaration that’s sending ripples through the financial world, Dan Morehead, CEO of asset management giant Pantera Capital, has positioned Bitcoin (BTC) not just as a viable investment, but as the most compelling opportunity of our generation. Forget bonds, says Morehead, Bitcoin is where the real asymmetric upside lies. Let’s dive into why this seasoned investment guru is so bullish on Bitcoin and what it means for your portfolio.

Why Bitcoin is the “Asymmetric Trade of a Generation”

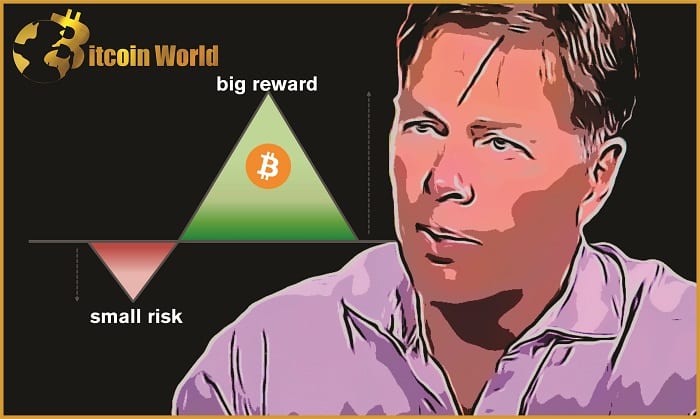

Dan Morehead isn’t new to the investment game. He’s built his career on spotting opportunities where the potential gains far outweigh the risks – what he calls “asymmetric trades.” And according to him, Bitcoin isn’t just asymmetric; it’s the most asymmetric trade in a generation.

Think about it:

- Asymmetric Upside: Imagine an investment where the potential to multiply your returns is significantly greater than the risk of losing your initial capital. That’s asymmetry in action. Morehead sees Bitcoin fitting this bill perfectly.

- Limited Downside vs. Massive Upside: While all investments carry risk, Morehead argues that the downside for Bitcoin, considering its growing adoption and limited supply, is dwarfed by its potential for exponential growth.

- Bonds – The Opposite: In stark contrast, traditional bonds, especially in the current economic climate, offer a limited upside with a very real risk of decline, particularly as interest rates fluctuate and inflation persists.

He puts it bluntly: “Bonds are the polar opposite. The potential upside is only a tiny fraction of the very real downside.”

Calling Out the “Biggest Ponzi Scheme”: Is the US Government Manipulating the Bond Market?

Morehead doesn’t shy away from controversial statements. He directly addresses criticisms leveled against Bitcoin, particularly accusations of market manipulation from institutions like the European Central Bank (ECB) and the U.S. Securities and Exchange Commission (SEC). But he flips the script, arguing that the real manipulation is happening elsewhere – in the traditional bond market.

He pulls no punches, stating, “The biggest Ponzi scheme in history is the US government and mortgage bond market… – 33 trillion-with-a-T dollars – all being driven by one non-economic actor with a… dominant position who is trading based on material, non-public information.”

Let’s unpack this:

- Accusations of Manipulation: Regulators often point fingers at the crypto market for potential manipulation due to its volatility and nascent stage.

- Morehead’s Counter-Argument: He argues that the U.S. government’s actions in the bond market, with its massive scale and influence, constitute a far greater form of market manipulation. He suggests that the government, as a dominant player, operates with non-public information, influencing market dynamics in a way that individual investors cannot.

- Scale of the Bond Market: The sheer size of the US bond market (USD 33 trillion) compared to the Bitcoin market cap (around USD 1 trillion at times, but fluctuating) highlights the potential impact of government actions in the bond market.

Morehead emphasizes that the Bitcoin market, with its significant daily trading volume and decentralized nature, is far less susceptible to manipulation than the bond market. He warns that bond investors are in for a rude awakening when central banks eventually reduce their intervention.

“Bonds investors are going to get absolutely destroyed when the Fed stops manipulating the bond market.”

Bitcoin as a Hedge Against a Looming Bond Bubble: Smart Money Strategy?

So, what’s the takeaway for investors? Morehead’s message is clear: consider Bitcoin and crypto assets as a crucial hedge, especially if you’re heavily invested in traditional bonds. He believes we’re in a bond bubble, and when it bursts, the fallout could be significant.

Here’s why he advocates for Bitcoin as a hedge:

- “Financial Gravity Will Resume Functioning”: Morehead uses this powerful phrase to suggest that the artificial supports propping up the bond market cannot last forever. Eventually, market forces will reassert themselves.

- Diversification Beyond Traditional 60/40: The classic 60/40 stock/bond portfolio might not be as safe as it once was in a world of potential bond bubbles and rising inflation. Morehead suggests diversifying into crypto assets to mitigate risks.

- Bitcoin’s Market Cap – Still Small in the Grand Scheme: He points out that the entire crypto market, even with its growth, is still relatively small compared to the global bond market. This implies significant room for growth and makes it an attractive hedge.

“If you’re an institutional investor with any bonds, but especially if you’re more like the… classic 60/40 stock/bond portfolio, you might want to hedge the… bond bubble with Bitcoin/crypto assets… Buying crypto with only $3 trillion market cap seems like a fantastic hedge.”

In essence, Morehead is urging investors to proactively protect their portfolios by allocating a portion to Bitcoin and other cryptocurrencies. He sees it as a strategic move to safeguard against potential turmoil in traditional fixed-income markets.

Actionable Insights: Is Bitcoin Right for Your Portfolio?

Dan Morehead’s perspective offers a compelling argument for considering Bitcoin beyond just a speculative asset. Here’s a quick checklist to consider:

| Consider Bitcoin if: | Think Twice if: |

|---|---|

| You are looking for high-growth potential investments. | You are extremely risk-averse and cannot tolerate volatility. |

| You are concerned about inflation and potential bond market instability. | You need immediate and guaranteed returns. |

| You want to diversify beyond traditional stocks and bonds. | You don’t understand Bitcoin and are unwilling to learn. |

| You have a long-term investment horizon. | You are looking for quick profits and short-term gains only. |

Disclaimer: Investing in Bitcoin and cryptocurrencies involves risks. Always conduct thorough research and consider consulting with a financial advisor before making any investment decisions. Dan Morehead’s views are his own and should not be taken as financial advice.

Conclusion: Bitcoin – A Strategic Hedge in a Changing Financial Landscape

Dan Morehead’s endorsement of Bitcoin as the “most asymmetric trade” and a vital hedge against bond market risks is a significant statement from a respected figure in asset management. His arguments about bond market manipulation and the potential for a bond bubble add weight to the narrative that Bitcoin is maturing into a crucial asset class for the modern investor. Whether you’re a seasoned institutional investor or just starting to explore crypto, Morehead’s insights offer a compelling reason to seriously consider Bitcoin as part of a diversified and future-proof portfolio. The financial landscape is evolving, and Bitcoin, according to voices like Dan Morehead, is poised to play a central role.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.