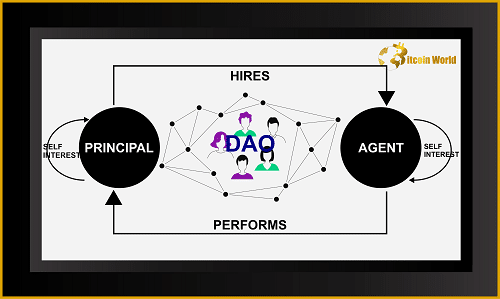

The principal-agent dilemma is an economic conundrum that DAOs attempt to solve. It takes place when one person or entity (the “principal”) gives another person or entity (the “agent”) the power to decide and act on their behalf.

The agent might overlook the interests of the principal if they are driven only by their own interests.

The fact that there can be information imbalance between the principal and the agent makes the issue worse.

Without any method to verify that the agent is acting in their best interests, the principal may never be aware that they are being taken advantage of.

This issue frequently arises when elected officials represent the public, when brokers represent investors, or when managers represent shareholders.

Well-designed incentive mechanisms underlying DAOs can partially solve this issue by enabling a higher level of transparency made possible by blockchain technology.

There is extremely little (or no) knowledge asymmetry, and incentives within the organization are aligned. The operation of DAOs is totally transparent and, in principle, renders them incorruptible because all transactions are tracked on a blockchain.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.