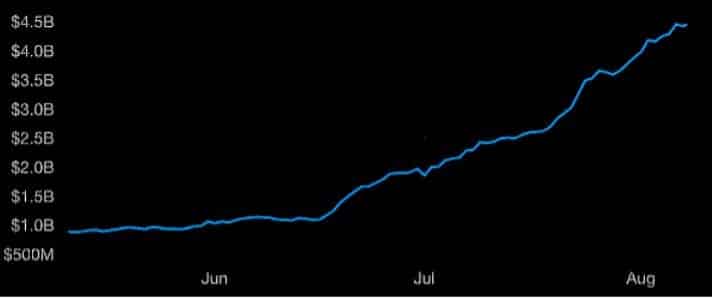

In a remarkable display of growth, decentralized finance (DeFi) applications on the Ethereum blockchain now hold an astounding $4.47 billion worth of crypto assets. This represents a $500 million increase over the past week, mirroring the same growth recorded in the preceding week. With MakerDAO and Compound leading the surge, DeFi continues to redefine the financial landscape, offering innovative solutions for borrowing, lending, and liquidity provision.

Understanding DeFi and Its Rapid Growth

What is DeFi?

DeFi refers to a suite of financial applications built on blockchain networks that operate without intermediaries, such as banks. By leveraging smart contracts, DeFi enables users to access services like lending, borrowing, and trading directly on the blockchain.

Key Metric: Total Value Locked (TVL)

Total Value Locked (TVL) is a critical metric for assessing DeFi’s growth. It represents the total amount of cryptocurrency assets locked in DeFi applications, serving as an indicator of user trust and ecosystem activity. With $4.47 billion now locked on Ethereum-based DeFi platforms, the sector is experiencing exponential growth.

MakerDAO Leads with $1.34 Billion Locked

MakerDAO’s Dominance

MakerDAO, a pioneer in the DeFi space, has seen its TVL soar to $1.34 billion, with a brief peak near $1.4 billion. The platform’s success is largely attributed to its DAI stablecoin, which is backed by collateralized assets such as Ethereum.

Ethereum Collateral on MakerDAO

Currently, MakerDAO holds 2.5 million ETH as collateral, equivalent to over $1 billion. This represents a significant portion of the total assets locked in DeFi, underscoring the platform’s central role in the ecosystem.

Compound Approaches $1 Billion

Growth in Lending and Borrowing

Compound, another leading DeFi protocol, is nearing the $1 billion milestone in TVL. The platform allows users to lend and borrow cryptocurrencies, earning interest or paying it depending on their roles in the ecosystem.

Key Features Driving Growth

Compound’s growth can be attributed to its:

- User-Friendly Interface: Making DeFi accessible to a broader audience.

- Token Incentives: Users are rewarded with COMP tokens, driving engagement.

- Integration with Other Platforms: Enhancing its utility within the DeFi ecosystem.

DAI Market Cap Nears $400 Million

Explosive Growth in DAI

The market capitalization of DAI, MakerDAO’s stablecoin, has surged from $128 million to nearly $400 million in just one month. This represents a significant increase in demand for the stablecoin, driven by its use as collateral and trading pairs on exchanges.

Collateralization in DAI

DAI’s growth is supported by a 3x collateralization ratio, meaning users must deposit $3 worth of assets to mint $1 worth of DAI. This ensures the stability of the stablecoin and mitigates risks during market volatility.

Stability and Liquidity in DeFi

Increased Liquidity

The growing value locked in DeFi protocols like MakerDAO and Compound has enhanced the liquidity of these platforms. This makes DeFi applications more viable for real-world use cases, such as serving as trading pairs on both decentralized and centralized exchanges.

Real-World Applications

The stability and liquidity of DeFi assets like DAI are enabling them to perform critical functions, including:

- Trading Pair: Serving as a base currency on exchanges.

- Lending and Borrowing: Supporting efficient capital allocation.

- Yield Farming: Allowing users to earn returns on their crypto holdings.

Calls for Euro-Backed Stablecoins

Why a Euro Token?

While DAI is pegged to the U.S. dollar, some in the DeFi community are advocating for a euro-backed stablecoin. Given the euro’s relative stability, such a token could diversify the ecosystem and cater to users outside the dollar-dominated markets.

Expanding the Ecosystem

Introducing a euro-backed stablecoin could further DeFi’s global appeal, allowing users in Europe and beyond to participate more seamlessly in decentralized finance.

Challenges and Opportunities

Challenges in DeFi Growth

- Smart Contract Risks: Vulnerabilities in code can lead to exploits and financial losses.

- Regulatory Uncertainty: Lack of clear regulations could impact the adoption and development of DeFi protocols.

- Market Volatility: Sudden price fluctuations in collateralized assets could pose risks to the stability of platforms like MakerDAO.

Opportunities for Innovation

- Expanding Use Cases: Beyond lending and borrowing, DeFi can revolutionize insurance, derivatives, and asset management.

- Cross-Chain Solutions: Integrating with other blockchains could enhance scalability and interoperability.

- Mainstream Adoption: As liquidity and stability improve, DeFi is poised to attract institutional investors and mainstream users.

The Road Ahead for DeFi

Sustained Growth

The consistent weekly increase in TVL underscores the sustained growth of DeFi. Platforms like MakerDAO and Compound are leading the way, but the broader ecosystem is rapidly evolving with new players and innovations.

Bridging the Gap with Traditional Finance

DeFi has the potential to bridge the gap between traditional and decentralized finance by offering transparent, accessible, and efficient alternatives to conventional financial services.

A Global Movement

As DeFi continues to gain traction, it is becoming a global movement, empowering users worldwide to take control of their financial futures.

Conclusion

The rapid growth of DeFi on Ethereum, with $4.47 billion locked and counting, marks a transformative moment in the world of finance. Platforms like MakerDAO and Compound are not just reshaping how we think about lending and borrowing but are also paving the way for a decentralized financial future.

With stablecoins like DAI achieving remarkable growth and the ecosystem becoming more liquid and stable, DeFi is proving its potential to disrupt traditional financial systems. However, challenges like smart contract risks and regulatory uncertainty must be addressed to ensure long-term success.

As the DeFi space evolves, its ability to innovate, expand, and integrate with global financial systems will determine its ultimate impact. For now, the momentum is undeniable, and the future of finance is being built on Ethereum.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.