Decentralized finance (DeFi) continues to draw massive interest, with investors locking over $67 million worth of stablecoins into APY.Finance within just an hour of its launch. This new yield farming project aims to optimize returns for liquidity providers across various DeFi platforms while rewarding participants with its APY governance token.

While the project has quickly gained traction, concerns about token distribution and accessibility have sparked debate within the crypto community. Here’s everything you need to know about APY.Finance and its impact on the DeFi landscape.

What is APY.Finance?

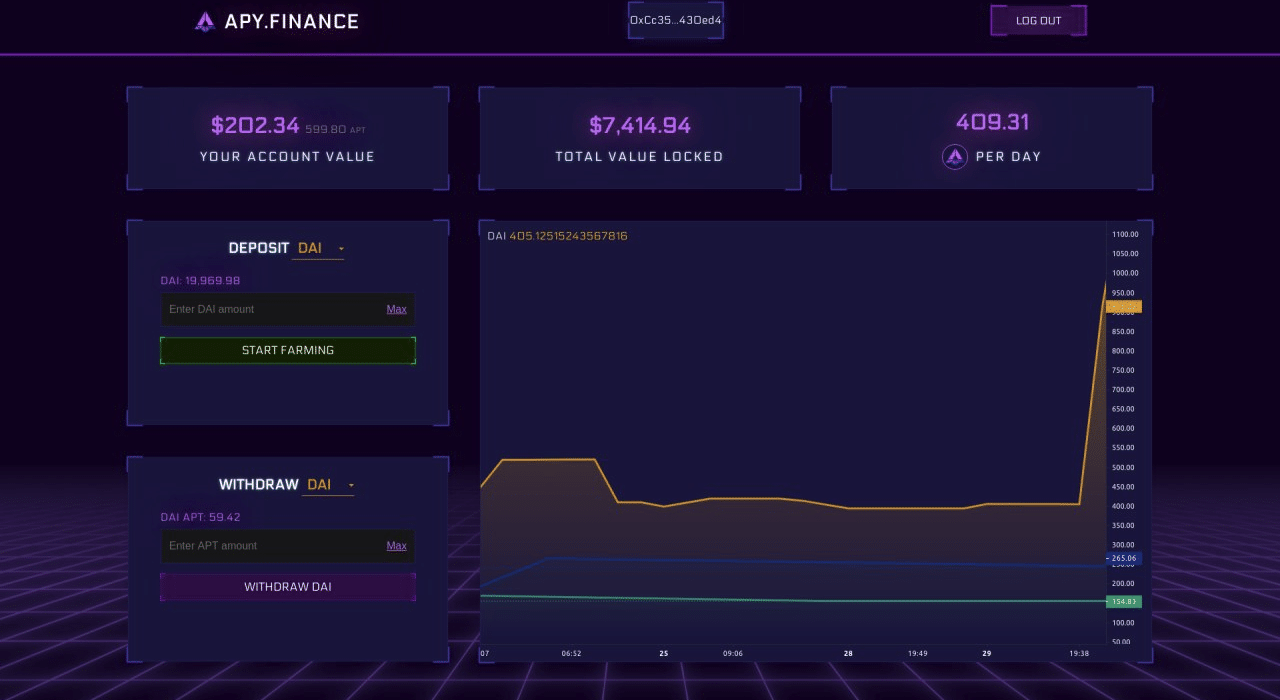

APY.Finance is a yield farming platform that uses smart contracts to maximize returns for users who deposit stablecoins like DAI, USDC, and USDT. The platform automatically allocates liquidity to other DeFi protocols to generate optimal interest rates while rewarding participants with APY tokens, the platform’s governance token.

Key Features

- Automated Yield Optimization: The platform uses algorithms to distribute liquidity among high-yield DeFi opportunities.

- Rewards in APY Tokens: Liquidity providers earn APY tokens for their contributions, which also serve as governance tokens for the project.

- Stablecoin Support: DAI, USDC, and USDT are supported, providing stable and accessible entry points for users.

APY Tokenomics and Distribution Model

APY.Finance launched with an ambitious tokenomics model, setting aside 31.2 million APY tokens (31.2% of its total supply) for liquidity mining over time.

Initial Liquidity Mining

- 900,000 APY tokens will be distributed in the first month.

- Incentivization details will vary month-to-month to maintain engagement and adjust to market conditions.

Token Allocation

- 20% to seed round investors: At $0.09 per token.

- 16.5% to strategic investors: At $0.135 per token.

- 31.2% for liquidity mining: Allocated over an extended period to incentivize participation.

While the distribution model incentivizes early adopters, it has also raised concerns regarding accessibility for retail investors.

Concerns Over Token Distribution

Despite the rapid success of its launch, APY.Finance has faced criticism within the cryptocurrency community.

Whales vs. Retail Investors

Some argue that the token distribution model favors whales and venture capitalists, making it difficult for average users to compete effectively. The project raised $3.6 million in a private sale from prominent investors like Arrington XRP Capital and Alameda Research, sparking further concerns about centralized control.

Transparency Issues

Details about the private sale, including the exact number of tokens sold and their pricing, remain unclear. Critics have called for greater transparency to ensure fairness in the project.

The APY.Finance Effect on DeFi

APY.Finance’s rapid success is a testament to the ongoing demand for innovative yield farming projects in the DeFi space.

Massive Initial Inflows

The platform saw $67 million locked within an hour of its launch, showcasing the growing appetite for automated yield farming solutions.

Competition with Established Platforms

APY.Finance enters a crowded market, competing with platforms like Yearn.Finance and Harvest Finance, which also provide yield optimization services. However, its focus on stablecoins and unique APY token rewards could differentiate it from its competitors.

Driving DeFi Growth

The project’s ability to attract such significant investment underscores the continued growth and evolution of the DeFi sector. It also highlights the challenges of balancing innovation with equitable participation.

How Does APY.Finance Work?

For Liquidity Providers

- Deposit stablecoins like DAI, USDC, or USDT into the platform.

- APY.Finance allocates your liquidity to DeFi protocols offering the best returns.

- Earn APY tokens as rewards for your contributions.

For Traders and Investors

The platform’s APY token can be used for governance, giving holders a say in the platform’s future development and decisions.

The Road Ahead for APY.Finance

Opportunities

- DeFi Adoption: As more users look for passive income opportunities, APY.Finance is well-positioned to capture a significant share of the market.

- Scalability: The platform’s automated approach reduces the complexity of yield farming, making it accessible to a broader audience.

Challenges

- Equitable Access: Addressing concerns about token distribution will be crucial for long-term success.

- Regulatory Scrutiny: As DeFi projects gain prominence, regulatory challenges may arise, particularly for platforms that raise substantial funds through private sales.

Conclusion: A Milestone for DeFi or a Missed Opportunity?

APY.Finance’s successful launch underscores the growing demand for automated yield farming solutions in the DeFi ecosystem. With over $67 million locked within an hour, the platform has captured the attention of both retail and institutional investors.

However, concerns about token distribution and accessibility highlight the need for greater transparency and inclusivity in the DeFi space. As APY.Finance evolves, addressing these challenges will be critical to ensuring its success and maintaining user trust.

For now, APY.Finance remains a key player in the DeFi sector, offering both opportunities and lessons for future projects.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.