Ever wondered what’s really driving Bitcoin’s price? A significant portion of BTC is locked away by long-term holders, creating a supply squeeze that could send prices soaring. Let’s dive into the data and explore what this means for the future of Bitcoin.

What Does It Mean That 57% of Bitcoin Hasn’t Moved in Over Two Years?

According to on-chain data, a whopping 57% of all Bitcoin hasn’t been touched in at least two years. This is a significant indicator of the conviction of long-term holders (LTHs) and their belief in Bitcoin’s future. Charles Edwards, founder of Capriole Investments, highlighted this trend on X, noting that this dormant BTC supply has been hitting all-time highs.

Who Are These “Long-Term Holders” (LTHs)?

Long-term holders are generally defined as investors who have held their coins for at least 155 days. The longer they hold, the less likely they are to move their coins, making them a steadfast force in the Bitcoin market. The 2+ years segment represents the most dedicated HODLers, those with unwavering conviction.

Why does this matter? Because these holders are less likely to sell during market dips, reducing the available supply and potentially driving up prices when demand increases.

The chart above illustrates the percentage of the total circulating Bitcoin supply held by these long-term holders. Notice the upward trend, especially since the FTX collapse. This indicates a growing belief in Bitcoin as a store of value.

The Supply Squeeze: What Is It and Why Is It Important?

With a large percentage of Bitcoin locked up by LTHs, the available supply for trading and new investors decreases. This is what’s known as a supply squeeze. When demand outstrips supply, prices tend to rise. Edwards points out that similar trends have preceded past Bitcoin bull runs.

The recent approval of Bitcoin spot ETFs by the US SEC could exacerbate this supply shock. Since these ETFs are approved for CASH subscriptions only, every purchase takes more Bitcoin off the market, further reducing supply.

What’s Happening with Bitcoin on Exchanges?

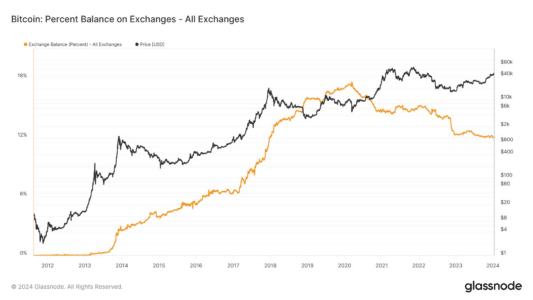

Another angle to consider is the amount of Bitcoin held on centralized exchanges. Analyst James V. Straten shared data showing a decline in the percentage of Bitcoin held on these platforms.

With only about 12% of all BTC currently stored on exchanges, the readily available supply for trading is shrinking. This further intensifies the potential for a supply squeeze and price appreciation.

Bitcoin Price Analysis

As of now, Bitcoin is trading around $45,900, showing a gain of over 4% in the past week. The decreasing supply, coupled with increasing demand, creates a favorable environment for potential price increases.

Key Takeaways

- A significant portion of Bitcoin is held by long-term holders, reducing the available supply.

- The approval of Bitcoin spot ETFs could intensify the supply squeeze.

- The amount of Bitcoin on exchanges is decreasing, further limiting the trading supply.

- These factors combined create a potentially bullish scenario for Bitcoin’s price.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.