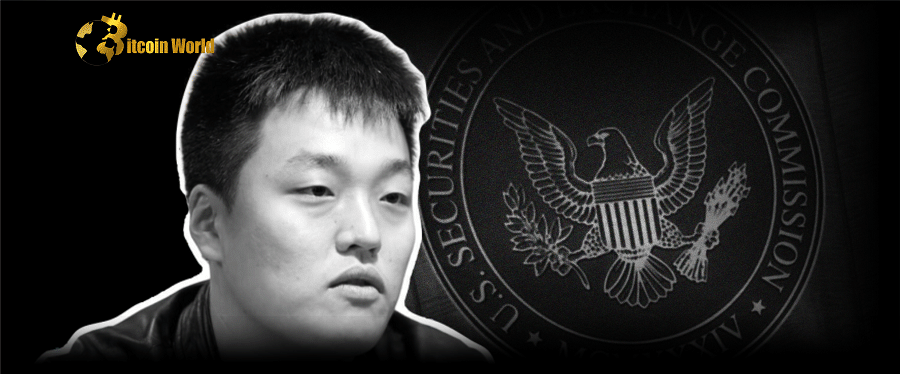

The cryptocurrency world is once again rocked by legal action, this time with the U.S. Securities and Exchange Commission (SEC) leveling serious fraud charges against Terraform Labs and its CEO, Do Hyeong Kwon. This isn’t just another headline; it’s a significant development that sends ripples across the crypto market and raises crucial questions about investor protection and regulatory oversight.

What Exactly Happened? The SEC vs. Terraform Labs & Do Kwon

On February 16th, the SEC announced charges against Singapore-based Terraform Labs and Do Kwon, accusing them of orchestrating a “multi-billion dollar crypto asset securities fraud.” The allegations paint a picture of a complex scheme that allegedly defrauded investors through the marketing and sale of interconnected crypto asset securities. Think of it as a financial thriller unfolding in the digital age, with the SEC playing the role of investigator and prosecutor.

To put it in perspective, one online community, referencing the popular game Grand Theft Auto V (GTA), has even dubbed Do Kwon’s situation as reaching a “5-star wanted level.” This highlights the severity and public perception of the accusations.

Key Allegations at a Glance:

- Unregistered Securities: The SEC claims Terraform Labs and Kwon raised billions by selling a suite of crypto asset securities without proper registration.

- mAssets Misleading Marketing: The company allegedly used “mAssets,” crypto derivatives mirroring stock prices, to lure investors into their ecosystem, suggesting stability and profitability that didn’t reflect reality.

- MIR and LUNA Tokens: The complaint specifically mentions the sale of MIR (mirror) tokens and LUNA tokens as crypto asset securities.

- False Promises of Profit: Kwon allegedly promoted these tokens by consistently claiming they would increase in value, enticing investors with the prospect of easy gains.

- UST Stablecoin Deception: Perhaps the most damaging allegation is the misleading promotion of UST (TerraUSD) as a “yield-bearing stablecoin” promising an astonishing 20% return. The SEC argues Terraform Labs misrepresented the stability of UST, which ultimately played a central role in the Terra/Luna ecosystem’s catastrophic collapse in May of last year.

Remember the dramatic crash of Terra/Luna? That event wiped out billions of dollars in investor funds and sent shockwaves through the entire crypto market. The SEC’s charges directly link Terraform Labs and Do Kwon to this devastating collapse, alleging their actions were not just mistakes but deliberate fraud.

Where is Do Kwon Now? The Hunt for the Crypto Kingpin

Adding to the intrigue, Do Kwon has been on the run since Terraform Labs imploded. Reports suggest South Korean authorities last tracked him to Serbia. This international manhunt element further intensifies the narrative and underscores the seriousness of the charges against him.

The Stablecoin Stability Myth: UST and the 20% APY Promise

The case heavily revolves around UST, Terraform’s algorithmic stablecoin. The SEC alleges that Terraform Labs and Kwon actively misled investors about UST’s stability, especially regarding its touted 20% annual percentage yield (APY). This high yield was a major draw for investors, but according to the SEC, it was built on shaky foundations and misrepresented as a safe, stable investment.

Gary Gensler, the Chair of the SEC, minced no words in his statement:

“They perpetrated fraud by repeating false and deceptive remarks to establish trust before creating terrible losses for investors.”

Gensler further emphasized the SEC’s stance on crypto regulation, stating that this case:

“demonstrates the lengths to which certain crypto businesses will try to avoid compliance with the securities laws.”

He and the SEC maintain that many crypto assets are indeed securities and should be regulated as such – a point of contention within the crypto industry, which often argues for a different classification.

Legal Battles Ahead: What are the Charges?

The charges against Kwon and Terraform Labs were filed in Manhattan federal court, specifically in the Southern District of New York. They face accusations of violating both registration and anti-fraud provisions of the Securities and Exchange Act. This sets the stage for a potentially lengthy and complex legal battle.

Key Charges:

- Securities Act Registration Violations: Failing to register securities offerings with the SEC.

- Securities and Exchange Act Anti-Fraud Violations: Engaging in fraudulent activities related to the sale of securities.

What Does This Mean for Crypto Investors?

This SEC action against Terraform Labs and Do Kwon carries significant implications for crypto investors:

- Increased Regulatory Scrutiny: It signals a continued and potentially intensified focus from regulatory bodies like the SEC on the crypto industry. Expect more scrutiny on crypto projects, especially those promising high yields or marketed as stablecoins.

- Investor Protection: The case underscores the importance of investor protection in the volatile crypto market. It highlights the risks associated with unregistered securities and misleading marketing tactics.

- Due Diligence is Crucial: For investors, this serves as a stark reminder to conduct thorough due diligence before investing in any crypto project. Promises of unrealistic returns, especially from seemingly “stable” investments, should be treated with extreme caution.

- Industry Compliance: Crypto businesses are put on notice that regulatory compliance is not optional. The SEC is sending a clear message that it will pursue companies and individuals who attempt to circumvent securities laws.

A Silver Lining? Albright Capital Lawsuit Dismissal

Interestingly, there’s a twist in the tale. In January, Albright Capital voluntarily dismissed a class-action lawsuit against Terraform Labs. While the details of this dismissal aren’t fully clear from the provided information, it adds another layer to the complex legal landscape surrounding Terraform Labs.

In Conclusion: Navigating the Crypto Regulatory Maze

The SEC’s charges against Terraform Labs and Do Kwon are a watershed moment in the ongoing saga of crypto regulation. It’s a stark reminder of the risks inherent in the crypto market and the critical need for both robust regulatory oversight and investor vigilance. As the legal proceedings unfold, the crypto world will be watching closely, as the outcome could set significant precedents for future enforcement actions and the overall regulatory framework governing digital assets. For investors, the key takeaway is clear: approach crypto investments with caution, skepticism, and a strong understanding of the risks involved. The era of unchecked crypto innovation is increasingly giving way to an era of regulatory accountability.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.