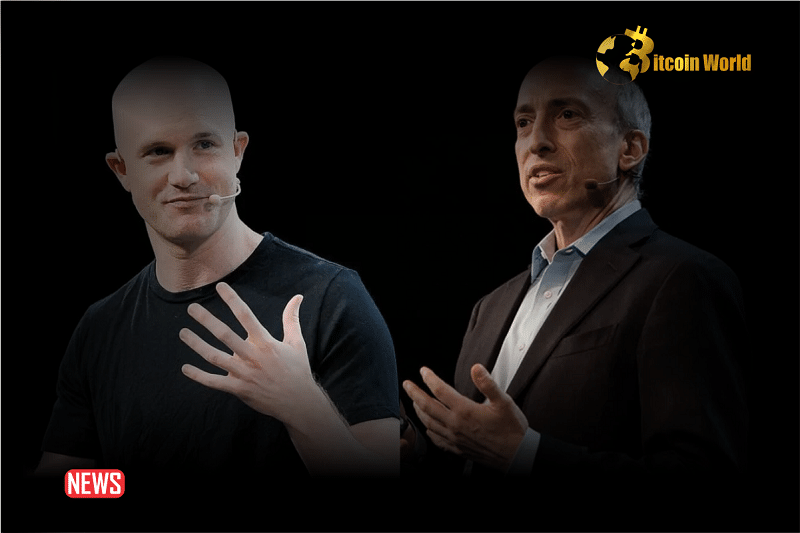

The crypto world is watching closely as the legal battle between Coinbase and the U.S. Securities and Exchange Commission (SEC) unfolds. At stake? The very definition of what constitutes a security in the digital asset space. And according to a recent Bloomberg analysis, the odds might be tipping in favor of the crypto exchange giant.

Is Coinbase Poised to Win Against the SEC? Experts Weigh In

The SEC has sued Coinbase, alleging that the platform is selling unregistered securities and operating an illegal staking service. This lawsuit hinges on a fundamental question: Where do we draw the line between a security and a collectible in the realm of cryptocurrencies?

During a recent court hearing, Judge Katherine Polk Failla raised critical questions for the SEC’s legal team, particularly regarding the breadth of the agency’s definition of ‘collectibles.’ This judicial scrutiny has led Bloomberg senior litigation analyst Elliott Stein to suggest that Coinbase is gaining ground in this high-stakes legal fight.

See Also: Binance vs. SEC Case Is Tomorrow: Here Is What To Know

Stein summarized his analysis on X (formerly Twitter), stating:

“The judge wanted a limiting principle to the SEC definition of “investment contract” that wouldn’t encompass collectibles. We view the one offered by Coinbase as more compelling, requiring investment in a business vs. just an ecosystem, along with an enforceable obligation,” wrote.

The Core Argument: Securities vs. Collectibles – What’s the Difference?

Coinbase’s defense hinges on the argument that not every cryptocurrency purchase should be classified as an investment contract. Their legal team drew an analogy to illustrate this point:

“investing in Beanie Baby Inc. and buying Beanie Babies.”

This analogy highlights the distinction between investing in a company with the expectation of profit based on their efforts, versus simply purchasing a collectible item. Coinbase argues that many cryptocurrencies function more like collectibles or commodities than traditional securities.

Ecosystem or Not? Bitcoin Enters the Debate

Another crucial aspect of the case revolves around the concept of an ‘ecosystem’ behind the tokens. Lawyers from both sides presented differing views, even on whether Bitcoin itself constitutes an ecosystem. The SEC’s legal team reportedly argued that Bitcoin does not.

Judge Remains Undecided, But Coinbase’s Motion in Focus

After a four-hour hearing filled with intense questioning, Judge Failla refrained from issuing an immediate ruling. She indicated the need for more time to carefully consider the complex arguments presented.

The immediate focus is on Coinbase’s motion to dismiss the case. While Bloomberg’s analysis suggests Coinbase might not win this initial motion outright, their long-term outlook remains positive. Should the motion be denied, either partially or fully, the case will proceed to the discovery phase, involving further investigation and evidence gathering.

See Also: The Role Of Crypto In The Forthcoming US Elections: Former US SEC Official John Reed Stark

Looking Ahead: Supreme Court and the Howey Test?

Bloomberg analyst Elliott Stein’s analysis provides a compelling outlook for Coinbase:

“Our Thesis: Coinbase is 70% likely to beat the SEC, if not outright on this motion, then later,”

He further suggests the potential for this case to reach the highest court in the land:

“Even if the case survives, it likely reaches the Supreme Court, which we think will narrow Howey,”

The ‘Howey Test’ is the established legal framework used to determine if an asset qualifies as a security under U.S. law. Stein’s prediction of a potential Supreme Court review and a narrowing of the Howey Test signals the profound implications this case could have for the entire crypto industry’s regulatory landscape.

Key Takeaways: Coinbase vs. SEC Case

- Bloomberg Analysis: Points to a 70% likelihood of Coinbase winning against the SEC, either in the current motion or later stages.

- Judicial Scrutiny: Judge Failla’s questioning suggests a critical look at the SEC’s broad definition of securities in the crypto context.

- Security vs. Collectible Debate: The core of the case revolves around differentiating between investment contracts and collectibles in the crypto space.

- Potential Supreme Court Impact: The case could potentially reach the Supreme Court, leading to a re-evaluation and possible narrowing of the Howey Test.

- Industry-Wide Implications: The outcome of this case will significantly shape the regulatory future of cryptocurrencies in the United States.

Conclusion: A Pivotal Moment for Crypto Regulation

The Coinbase vs. SEC lawsuit is far more than just a legal battle for one company. It’s a landmark case that could redefine the regulatory boundaries for the entire cryptocurrency industry. With analysts suggesting a high probability of Coinbase’s victory and the potential for Supreme Court involvement, this case is poised to be a pivotal moment in shaping the future of crypto regulation in the U.S. The crypto community and market participants are keenly awaiting further developments and Judge Failla’s crucial decision on Coinbase’s motion to dismiss.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.