Hey crypto enthusiasts! Ever wondered what’s going on with Dogecoin (DOGE), the original meme coin that captured the hearts (and wallets) of many? Well, buckle up, because we’re diving deep into the latest Dogecoin price movements and market dynamics to see what’s really happening with this popular digital currency. Is it a dip, a correction, or a sign of something bigger? Let’s find out!

Dogecoin’s Price Snapshot: A Tale of Two Timeframes

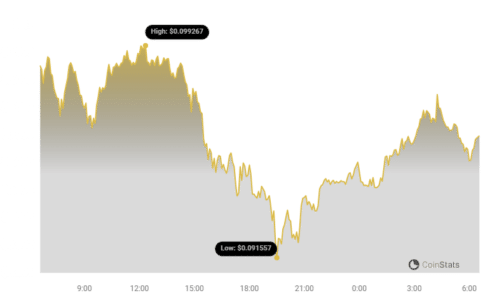

In the fast-paced world of crypto, things change in a blink. Over the last 24 hours, Dogecoin has experienced a downturn, with its price falling by 8.55% to around $0.091. Ouch! That might sting a bit for DOGE holders who are watching the market closely.

However, zooming out to a weekly perspective paints a slightly different picture. Despite the recent daily dip, Dogecoin has actually shown a positive trend over the past week, gaining about 5.0%. It started the week around $0.099 and, even with the dip, is hovering around $0.09. So, it’s a bit of a mixed bag, right?

To get a clearer visual, check out this chart that compares Dogecoin’s price action over these two crucial timeframes:

Notice the contrast between the daily and weekly movements. It highlights how important it is to look at different timeframes when analyzing crypto price trends. Short-term dips can sometimes be misleading if you don’t consider the broader context of weekly or even monthly performance.

Decoding Volatility with Bollinger Bands: Are Things Getting Bumpy?

Volatility is crypto’s middle name, and Dogecoin is no exception. To understand just how bumpy the ride is, we can use Bollinger Bands. These bands, represented by the gray areas in the charts, are like volatility meters.

Here’s a simple breakdown of what Bollinger Bands tell us:

- Wider Bands = Higher Volatility: When the gray bands widen, it means the price is swinging more dramatically, both up and down. Think of it like a rollercoaster with bigger drops and climbs.

- Narrower Bands = Lower Volatility: Conversely, when the bands tighten, it indicates a period of relative price stability. The rollercoaster slows down a bit.

Looking at the Dogecoin charts with Bollinger Bands, we can visually assess the level of price fluctuation over the last 24 hours and the past week. Are the bands wide or narrow? This gives us a quick indication of whether Dogecoin is experiencing a period of high or low volatility.

Trading Volume vs. Circulating Supply: What’s the Story?

Now, let’s dig into some other key metrics: trading volume and circulating supply. These can offer clues about the underlying market sentiment and the health of the Dogecoin ecosystem.

Interestingly, Dogecoin’s trading volume has surged by 44.0% over the past week. That’s a significant jump! Increased trading volume often suggests heightened interest and activity around a cryptocurrency. It could be due to various factors, like news, market trends, or just increased speculative interest.

On the other hand, the circulating supply of Dogecoin has slightly decreased by 0.14%. While seemingly small, any decrease in circulating supply can, in theory, put upward pressure on price if demand remains constant or increases. However, with Dogecoin’s massive supply, a 0.14% decrease is unlikely to be a major price driver on its own.

Let’s visualize this relationship between circulating supply and trading volume:

The divergence between rising trading volume and slightly decreasing circulating supply is something to keep an eye on. It could indicate growing interest despite minor supply adjustments.

Dogecoin’s Market Standing: Still a Top Dog?

Where does Dogecoin stand in the grand scheme of the crypto market? Well, according to the latest data, Dogecoin currently holds the #10 spot in market cap ranking. That’s pretty impressive for a meme coin that started as a joke!

With a market cap of $13.15 billion, Dogecoin is a significant player in the crypto space. It’s rubbing shoulders with some of the biggest names in the industry. This market cap reflects the total value of all Dogecoin in circulation and gives us a sense of its overall size and importance in the crypto ecosystem.

Is Dogecoin Poised for a Rebound? Signs of Recovery

Despite the recent 24-hour dip, there’s a glimmer of hope for DOGE enthusiasts. The article mentions that Dogecoin is “gradually rising to retake its position” and is currently trading around $0.095 at press time. This suggests that the dip might be a short-term correction, and Dogecoin could be finding its footing again.

Of course, the crypto market is notoriously unpredictable, and past performance is never a guarantee of future results. However, this indication of a potential rebound is encouraging for those who are bullish on Dogecoin.

See Also: Justin Sun Has Announced 10,000 TRX Airdrop On Binance Square

What Factors Could Influence Dogecoin’s Future Price?

Looking ahead, what could drive Dogecoin’s price up or down? Several factors come into play in the volatile world of crypto:

- Broader Market Sentiment: Dogecoin, like most cryptocurrencies, is often influenced by the overall sentiment of the crypto market. If Bitcoin and Ethereum are doing well, it can lift the entire market, including DOGE. Conversely, market-wide corrections can drag Dogecoin down.

- Meme Power and Social Media Buzz: Dogecoin’s origins as a meme coin mean that social media trends and online communities play a significant role in its price movements. Viral trends and endorsements can trigger rapid price surges.

- Elon Musk’s Tweets (and other Influencers): Let’s be honest, Elon Musk’s tweets have had a noticeable impact on Dogecoin’s price in the past. Mentions and endorsements from high-profile figures can still sway market sentiment.

- Utility and Adoption: While Dogecoin started as a meme, increasing real-world utility and adoption could be crucial for its long-term sustainability and price growth. This includes wider acceptance by merchants and integration into different platforms.

- Development Activity: Ongoing development and improvements to the Dogecoin network can also inspire confidence and potentially drive price appreciation.

Final Thoughts: Navigating the Dogecoin Rollercoaster

Dogecoin’s price action is a fascinating case study in the crypto market. It’s a blend of meme culture, market dynamics, and good old-fashioned volatility. While the recent 24-hour dip might be concerning to some, the weekly gains and signs of a potential rebound offer a more nuanced perspective.

As always, remember that the cryptocurrency market is highly speculative and carries significant risks. It’s essential to do your own research, understand your risk tolerance, and never invest more than you can afford to lose.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.