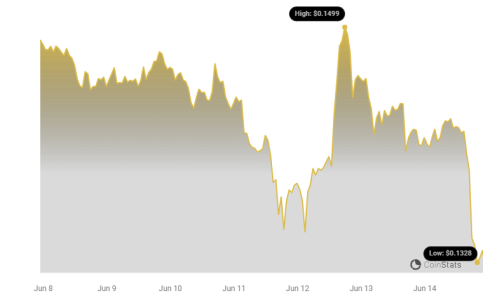

Is your Dogecoin portfolio feeling the chill? The popular meme cryptocurrency, Dogecoin (DOGE), has experienced a notable downturn recently, leaving investors wondering what’s next. In the last 24 hours alone, DOGE’s price has slid by 7.02%, currently sitting at $0.13. This dip extends a week-long bearish trend, with Dogecoin losing 9.0% of its value from $0.15. Let’s dive into the details of this price movement and explore what factors might be influencing Dogecoin’s current market behavior.

Dogecoin Price Decline: A Closer Look at the Numbers

The numbers don’t lie. Dogecoin is experiencing a significant price correction. Here’s a breakdown of the key figures:

- 24-Hour Price Change: -7.02%

- Current Price: $0.13

- 7-Day Price Change: -9.0%

- Price 7 Days Ago: $0.15

This consistent downward pressure over both the short and medium term suggests a prevailing selling sentiment in the market. But what does this mean in the context of volatility and trading activity?

Volatility and Price Movement: Decoding the Charts

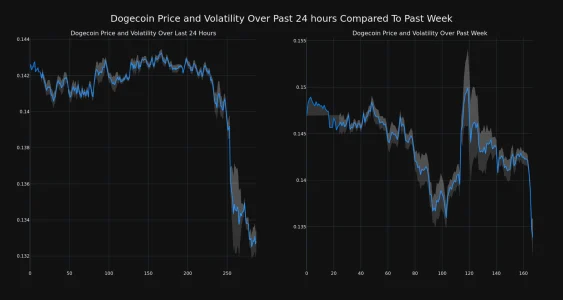

Visualizing price movements can offer valuable insights. The charts below provide a comparative look at Dogecoin’s price fluctuations and volatility over the past 24 hours versus the last week.

The gray bands you see in these charts are called Bollinger Bands. They are a technical analysis tool used to measure market volatility. Think of them as dynamic ranges around the average price. Here’s how to interpret them:

- Wider Bands = Higher Volatility: When the gray bands widen, it indicates increased price fluctuations and greater uncertainty in the market.

- Narrower Bands = Lower Volatility: Conversely, narrower bands suggest a period of relative price stability.

By observing the Bollinger Bands, we can gauge the degree of price swings Dogecoin is experiencing. Currently, the charts can help visualize if the volatility is increasing or decreasing over these timeframes.

Trading Volume and Circulating Supply: Are Investors Losing Interest?

Beyond price and volatility, other key metrics provide a more complete picture of Dogecoin’s market health. Let’s examine trading volume and circulating supply:

- Trading Volume (Past Week): Decreased by 41.0%

- Circulating Supply Change (Past Week): Decreased by 0.11%

- Current Circulating Supply: Over 144.68 billion DOGE

A significant drop in trading volume, like the 41.0% decrease observed, could suggest waning investor interest or reduced market participation. While a slight decrease in circulating supply might seem minor, it can subtly influence price dynamics.

Dogecoin’s Market Cap: Still a Top Contender?

Despite the recent price decline, Dogecoin still holds a prominent position in the cryptocurrency market. Currently:

- Market Cap Ranking: #10

- Market Cap: $19.20 billion

Maintaining a top 10 market cap ranking underscores Dogecoin’s significant market presence and the substantial value still invested in it. However, the downward price trend warrants attention and careful consideration for investors.

What’s Driving the Dogecoin Downtrend?

While pinpointing the exact reasons for price fluctuations in the volatile crypto market is challenging, several factors could be contributing to Dogecoin’s recent downturn:

- Broader Market Sentiment: The entire cryptocurrency market can be influenced by macroeconomic factors, regulatory news, and overall investor sentiment. A general bearish trend in Bitcoin or other major cryptocurrencies often drags altcoins like Dogecoin down with it.

- Profit-Taking: After periods of price appreciation, some investors may choose to take profits, leading to selling pressure and price corrections.

- Meme Coin Volatility: Meme coins like Dogecoin are known for their high volatility. Price swings, both upwards and downwards, can be more pronounced compared to more established cryptocurrencies.

- Lack of Major Catalysts: The absence of significant positive news or developments specifically for Dogecoin could also contribute to a lack of buying pressure.

Navigating the Dogecoin Dip: Key Takeaways for Investors

For those holding Dogecoin or considering investing, here are some important points to consider:

- Volatility is Inherent: Cryptocurrency markets are inherently volatile. Price drops are a normal part of the cycle.

- Do Your Own Research (DYOR): Never invest based solely on hype or social media trends. Conduct thorough research and understand the risks involved.

- Risk Management is Crucial: Only invest what you can afford to lose. Diversify your portfolio and avoid putting all your eggs in one basket.

- Long-Term Perspective: Consider your investment horizon. Are you looking for short-term gains or a long-term investment? Dogecoin’s long-term prospects remain uncertain.

In Conclusion: Riding the Waves of the Crypto Market

Dogecoin’s recent price dip serves as a reminder of the dynamic and often unpredictable nature of the cryptocurrency market. While the 7% drop in 24 hours and the 9% decline over the week are significant, understanding the underlying market dynamics, volatility, and trading activity provides a more nuanced perspective. As with any investment in the crypto space, staying informed, practicing prudent risk management, and conducting thorough research are paramount. Whether this dip presents a buying opportunity or signals further decline remains to be seen, and depends heavily on broader market trends and investor sentiment.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.