Dogecoin (DOGE), the meme-inspired cryptocurrency that captured the hearts of many, is once again making waves in the crypto market. After navigating a period of consolidation, DOGE has decisively broken through the $0.075 resistance barrier and is setting its sights on higher targets. But can this bullish momentum last, or are we about to see a pullback? Let’s dive into the latest price analysis for Dogecoin and explore what the charts are telling us.

Dogecoin Breaks Key Resistance – What’s Fueling the Rally?

For those closely watching Dogecoin, the $0.075 level has been a significant point of contention. This barrier was tested no less than three times before the bulls finally mustered enough strength to push through. This repeated retesting often signals strong underlying support, and in this case, it paved the way for the current uptrend.

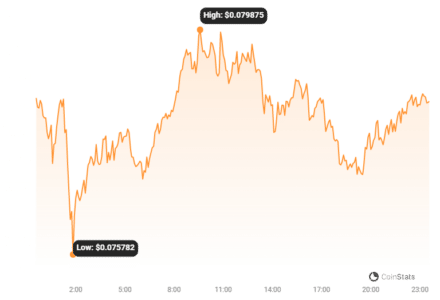

Currently, Dogecoin is facing resistance around the $0.080 mark. As of writing, DOGE reached a high of $0.0798, inching closer to this immediate hurdle. If buyers can overcome this level, the next target on the upside is anticipated to be $0.086. However, as DOGE approaches this target, expect increased selling pressure and potential resistance.

What are the Key Price Levels to Watch for DOGE?

Understanding key price levels is crucial for navigating the volatile crypto market. For Dogecoin, here’s a breakdown of the important levels to keep an eye on:

- Immediate Resistance: $0.080. Breaking above this level is crucial for continued upward momentum.

- Target Price: $0.086. This is the next likely target if the $0.080 resistance is overcome.

- Next Major High (if $0.080 broken): $0.10. A significant psychological level that could attract further buying interest.

- Key Support: $0.069. This level, near the 21-day SMA, is critical for maintaining the current uptrend.

- Strong Support: $0.063. A break below this level could signal a more significant downtrend.

Should the bulls successfully conquer the $0.080 resistance, the path towards $0.10 becomes clearer. Conversely, if bears take control and push the price below the 21-day Simple Moving Average (SMA) or the $0.069 support, we could see a reversal of the current upswing, potentially driving DOGE down to $0.063 or even lower.

Decoding Dogecoin’s Technical Indicators

Technical indicators provide valuable insights into market trends and potential price movements. Let’s examine what the indicators are suggesting for Dogecoin right now:

- 21-day SMA (Simple Moving Average): On November 9th, Dogecoin briefly dipped below the 21-day SMA but swiftly recovered. This “extended candlestick tail,” as it’s known in trading circles, is a positive sign. It indicates strong buying interest at lower price points, suggesting traders are eager to buy DOGE when it dips.

- Price Position Relative to Moving Averages: As long as Dogecoin’s price remains above the sloping moving average lines, the bullish trend is likely to persist. These moving averages are acting as dynamic support levels, pushing the price upwards.

- Potential Trend Reversal: However, it’s crucial to watch for any break below the moving average lines. Should the price fall below these averages, it could signal a weakening of the uptrend and a potential shift in momentum.

Key Technical Levels at a Glance:

For quick reference, here are the critical technical levels for Dogecoin:

| Resistance Levels | Support Levels |

|---|---|

| $0.12 | $0.06 |

| $0.14 | $0.04 |

Read Also: Dogecoin (DOGE) Soars 10% as It Targets Higher Increase

What’s Next for Dogecoin – Will the Rally Continue?

Dogecoin’s current price action is undeniably bullish as it pushes towards higher price levels. The bulls are actively challenging the $0.08 resistance, and a successful break could open the door for further gains. However, it’s important to note that Dogecoin is currently venturing into overbought territory according to some indicators.

An “overbought” condition suggests that the price may have risen too quickly and could be due for a correction. If sellers step in as DOGE enters this overbought zone, the upward momentum could face significant headwinds and potentially lead to a price retracement.

It’s worth remembering that Dogecoin experienced a period of sideways trading starting around November 5th, before eventually dipping below $0.067. This highlights the inherent volatility of the crypto market and the importance of cautious optimism.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.