Ever wondered what happens when crypto prices plummet faster than a DeFi user’s leverage ratio? Well, dYdX, a leading decentralized exchange, recently found out firsthand. They had to dip into their insurance fund – to the tune of $9 million! – to cover user liquidations. The culprit? A wild price swing in Yearn Finance (YFI). Let’s dive into what triggered this dramatic event and what it means for the DeFi space.

The $9 Million Question: What Caused the Insurance Fund Drain?

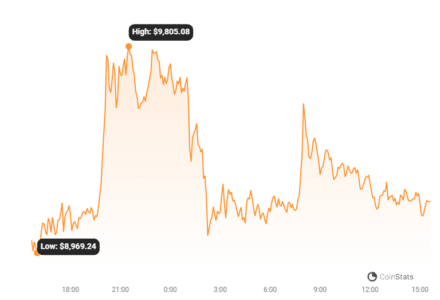

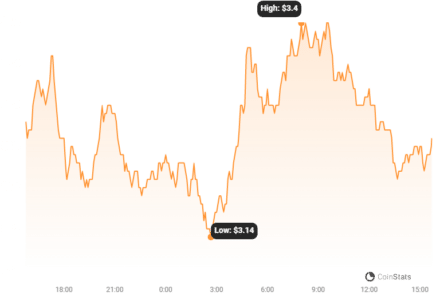

Saturday, November 18th, wasn’t a great day for Yearn Finance (YFI) holders. The token experienced a brutal 43% price drop. Imagine watching nearly half the value of your investment vanish in a blink! This flash crash triggered a cascade of liquidations, wiping out a staggering $50 million in YFI Open Interest. Think of it like a domino effect – when the price falls sharply, leveraged positions get automatically closed to prevent exchanges from incurring losses. In this case, the speed and severity of the drop pushed dYdX’s systems to their limits.

But what fueled this sudden YFI nosedive? Whispers of potential market manipulation and overall negative market sentiment created a perfect storm. The crypto community, always quick to react, buzzed with FUD (Fear, Uncertainty, and Doubt). Some even speculated about an exit scam, adding fuel to the fire.

dYdX, in a post on X (formerly Twitter), revealed the extent of the damage control. Approximately $9 million from their v3 insurance fund was deployed to bridge the gap caused by these YFI market liquidations.

On November 18th, the YFI market experienced extreme volatility, resulting in approximately $9M of losses for the dYdX v3 Insurance Fund. No user funds were impacted.

Our team is currently investigating the incident. We will provide a full post-mortem and risk parameter changes as soon as possible.

— dYdX (@dYdX) November 19, 2023

Let’s understand what this insurance fund is all about. According to dYdX’s website, it’s essentially a safety net. It’s designed as the primary buffer to maintain the platform’s solvency when user accounts slip into negative balance territory – a crucial mechanism in leveraged trading. Interestingly, this fund isn’t governed by a decentralized autonomous organization (DAO). Instead, the dYdX team directly manages deposits and withdrawals.

While the $9 million withdrawal sounds significant, dYdX reassured users that the insurance fund remains “well-funded,” still holding $13.5 million. However, it’s worth noting that this event consumed roughly 40% of the fund’s initial reserves. It’s a stark reminder of the volatile nature of crypto markets and the potential strain even robust systems can face.

Crucially, dYdX emphasized that no user funds were affected. This is a key point for user confidence. The team also stated they are actively investigating the incident to understand the full scope of what happened and prevent future occurrences.

Adding to the drama, on-chain data from Lookonchain revealed significant YFI deposits to exchanges during the price crash. One crypto whale, in particular, was observed selling off YFI as prices plummeted, suggesting possible coordinated selling pressure.

During the $YFI plunge, a whale deposited 200 $YFI($1.47M) into @binance at an average price of $7,360 and sold them immediately.

And then deposited 200 $YFI($1.23M) into @kucoincom at an average price of $6,150 and sold them immediately.

The whale sold 400 $YFI at an average price of $6,755, worth $2.7M. pic.twitter.com/R9o7q8Z2QJ

— Lookonchain (@lookonchain) November 18, 2023

‘Targeted Attack’ or Market Volatility? dYdX Founder Speaks Out

Adding another layer of intrigue, dYdX founder Antonio Juliano didn’t mince words. He publicly suggested that the YFI price crash was not just random market volatility, but a “targeted attack against dYdX,” explicitly mentioning “market manipulation of the entire $YFI market.”

This was pretty clearly a targeted attack against dYdX, including market manipulation of the entire $YFI market. https://t.co/QZESa1d0tW

— Antonio | dYdX (@AntonioMJuliano) November 19, 2023

Juliano reiterated the ongoing investigation, promising full transparency in sharing their findings. He also indicated a review of dYdX’s risk parameters is underway. This could lead to adjustments in both their v3 platform and potentially the software powering the upcoming dYdX Chain, aiming to strengthen their defenses against similar events.

Despite this incident, dYdX remains a DeFi powerhouse. With a total value locked (TVL) of $372 million (as per DefiLlama data at the time of writing), it’s still a major player in the decentralized trading landscape. The event, however, serves as a crucial reminder of the inherent risks in crypto, especially in leveraged trading and less liquid markets like YFI.

Key Takeaways:

- Volatility is King (and Sometimes a Problem): The YFI price crash highlights the extreme volatility that can exist in even established crypto markets.

- Insurance Funds are Vital: dYdX’s insurance fund worked as intended, protecting user funds during a stressful event. This underscores the importance of such mechanisms in DeFi.

- Market Manipulation Concerns: The allegations of a “targeted attack” raise serious questions about market integrity and the potential for manipulation, especially in smaller cap tokens.

- Risk Management is Key: dYdX’s review of risk parameters shows a proactive approach to learning from this event and strengthening its platform.

- DeFi Resilience: Despite the $9 million hit, dYdX remains operational and well-funded, demonstrating the resilience of the DeFi ecosystem even under pressure.

What’s Next?

Keep an eye on dYdX’s post-mortem report. The findings will be crucial in understanding the exact nature of the YFI price crash and the steps dYdX will take to prevent similar incidents. It will also be interesting to see if regulatory bodies take note of these market manipulation claims and consider further oversight in the DeFi space. For now, this event serves as a valuable lesson for both DeFi platforms and users about the importance of risk management and the ever-present volatility of the crypto market.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.