In the rollercoaster world of cryptocurrency, few figures have embraced Bitcoin as wholeheartedly as Nayib Bukele, the President of El Salvador. Remember the 2021 bull run? Amidst the hype, President Bukele made a bold move, positioning El Salvador as a pioneer in Bitcoin adoption. But how has this grand crypto experiment fared? Let’s dive into the numbers and see if El Salvador’s Bitcoin gamble is paying off, or if it’s facing a crypto winter.

Bukele’s Bitcoin Journey: A Timeline of Investments

President Bukele’s foray into Bitcoin investment began in 2021, marking a significant moment for both El Salvador and the crypto world. Driven by a vision of financial innovation, the president initiated a series of Bitcoin purchases, publicly announcing each acquisition. His strategy wasn’t just a one-time buy; it evolved into a recurring investment, famously declaring in November 2022 that El Salvador would add one Bitcoin to its treasury every single day. This consistent approach aimed to average out the investment cost and demonstrate long-term faith in Bitcoin.

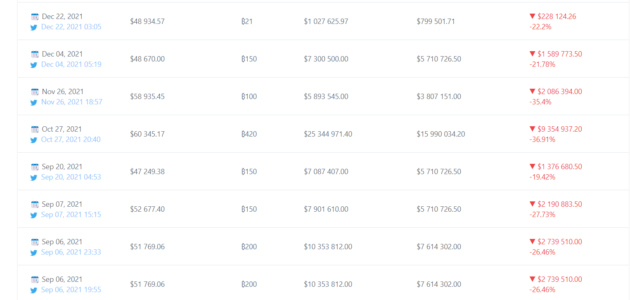

Here’s a snapshot of the key figures:

- Since 2021, President Bukele has invested over $126 million in Bitcoin.

- Currently, the total Bitcoin holdings stand at 3,124 BTC.

- The present value of these holdings is approximately $118 million.

- This translates to a loss of over $8 million on the total investment.

- One of the most significant single purchases, involving 420 BTC at $60,345 each, alone has resulted in a loss of over $9.3 million.

Decoding the Data: Gains and Losses in Detail

To get a clearer picture, let’s break down the performance of Bukele’s Bitcoin investments. Data from NayibTracker, a website dedicated to monitoring these transactions, provides valuable insights. It’s important to note that NayibTracker’s data relies on President Bukele’s public announcements on social media platform X (formerly Twitter), as official government figures are not readily available. This approach offers a reasonable estimate, though it’s not an official government ledger.

See Also: President Javier Milei To Dissolve Argentina’s Central Bank

According to NayibTracker, the average purchase price for Bukele’s total Bitcoin holdings is around $40,496 per coin. While the overall investment shows a loss at the time of writing, the picture is nuanced when we examine individual purchase rounds.

Let’s look at a comparative overview:

| Investment Batch | BTC Purchased | Total Investment | Average Price per BTC | Current Value | Profit/Loss | Status |

|---|---|---|---|---|---|---|

| Most Expensive Batch (Oct 2021) | 420 | $25,345,000 | $60,345 | ~$15,990,063 | -$9,354,937 | Loss |

| Last Tracked Purchase | 372 | $9,680,000 | $26,021 | ~$14,156,768 | +$4,476,768 | Profit |

| Overall Portfolio | 3,124 | $126,408,000 | $40,496 | ~$117,526,592 | -$8,881,408 | Loss |

(Note: Current values are approximate and fluctuate with Bitcoin’s price.)

A Story of Two Halves: Profitability and Losses

Interestingly, while the overall Bitcoin investment is currently in the red, not all purchases have resulted in losses. As the data reveals, Bukele’s most recent Bitcoin acquisitions are actually showing significant profits. Specifically, the last tracked purchase of 372 Bitcoins, made at an average price of $26,021, has yielded a return of nearly 50%! This translates to a profit of approximately $4.4 million on this particular investment alone.

In fact, out of the 12 tracked investment rounds, the latest three are in the green at the time of writing. However, it’s crucial to acknowledge that the remaining nine rounds are facing substantial losses, some in double-digit percentages. This highlights the volatile nature of Bitcoin and the inherent risks associated with such investments.

Why Bitcoin? Understanding Bukele’s Crypto Strategy

Why did President Bukele decide to plunge El Salvador into the world of Bitcoin? His motivations are multifaceted and include:

- Financial Inclusion: Bitcoin was touted as a way to provide financial access to the unbanked population of El Salvador, allowing them to participate in the digital economy.

- Economic Innovation: Bukele aimed to position El Salvador as a hub for crypto innovation, attracting investment and technological development.

- Hedge Against Inflation: Bitcoin was presented as a potential hedge against inflation and the devaluation of fiat currencies.

- Remittance Efficiency: Reducing the reliance on traditional remittance services, which often incur high fees, was another stated benefit.

Challenges and Criticisms: The Roadblocks to Crypto Adoption

El Salvador’s Bitcoin experiment has not been without its challenges and criticisms. Some of the key concerns raised include:

- Volatility Risks: The inherent volatility of Bitcoin poses significant risks to a nation’s treasury, as demonstrated by the current losses.

- Lack of Transparency: The reliance on unofficial trackers due to the absence of official government data raises concerns about transparency and accountability.

- Economic Impact: Critics question the allocation of public funds to a volatile asset like Bitcoin, especially when El Salvador faces other economic challenges.

- IMF Concerns: International Monetary Fund (IMF) has expressed concerns about the financial and economic stability risks associated with Bitcoin adoption.

Looking Ahead: What’s Next for El Salvador’s Bitcoin Experiment?

El Salvador’s Bitcoin journey is an ongoing experiment with significant implications for the future of digital currency adoption by nations. While the current investment may be showing a net loss, the recent profitable purchases offer a glimmer of hope. The long-term success of this strategy will depend on various factors, including Bitcoin’s price trajectory, El Salvador’s economic policies, and the broader global crypto landscape.

Key Takeaways:

- Nayib Bukele’s Bitcoin investment is a bold, high-stakes gamble with potential rewards and significant risks.

- The current valuation indicates a net loss, but recent purchases are profitable, highlighting Bitcoin’s volatility.

- Transparency and official data are crucial for assessing the true impact of this experiment.

- El Salvador’s experience offers valuable lessons for other nations considering Bitcoin adoption.

In Conclusion: A Crypto Case Study in Progress

President Bukele’s Bitcoin experiment in El Salvador remains a fascinating case study in the intersection of cryptocurrency and national economics. It’s a real-world example of the potential and pitfalls of embracing digital assets on a national scale. As the crypto market continues to evolve, the world will be watching to see if El Salvador’s Bitcoin bet ultimately pays off, or serves as a cautionary tale in the volatile world of digital finance. Only time will tell the final chapter of this crypto saga.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.