Ethereum’s average transaction fees have recently spiked, reaching levels not seen in four months. This surge comes as the price of ETH has broken above $2,000, signaling increased activity on the network. But what does this mean for you, the Ethereum user? Let’s dive into the details.

Why Are Ethereum Gas Fees So High Right Now?

- Increased Network Activity: The primary driver of higher gas fees is increased activity on the Ethereum network. As more users transact, the demand for block space increases, leading to a bidding war for faster transaction processing.

- Limited Block Capacity: Ethereum has a limited capacity for processing transactions per block. This limitation means that during periods of high demand, users must offer higher fees to incentivize miners to include their transactions in the next block.

- Market Volatility: Recent price rallies often trigger increased trading activity. Investors react to price movements, leading to more transactions and, consequently, higher gas fees.

Think of it like rush hour on a highway. More cars (transactions) vying for limited space lead to congestion (higher fees) to get ahead.

According to data from Santiment, the average transaction fees on the ETH network have shot up as the cryptocurrency has recently broken above the $2,000 level.

The relevant metric here is the “average fees,” which keeps track of the mean amount of fees that the users on the Ethereum blockchain are attaching with their transfers right now.

Generally, the value of this metric rises whenever the user activity on the network goes up. The reason behind this is that the ETH network only has a limited capacity to handle transactions.

If a user wants to get their transfer through as soon as possible during a period of rush, they have no choice but to attach a fee that’s higher than the average so that the validators have some incentive to process their move first.

When the traffic is especially high, the average fees can quickly spiral out of control as users compete against each other. On the other hand, when there is little activity on the network, senders have no reason to go for a high fee, so the mean on the blockchain naturally remains low.

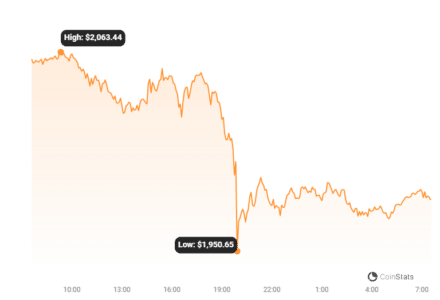

Now, here is a chart that shows the trend in the Ethereum average fees over the past few months:

https://twitter.com/santimentfeed/status/1724319912552996864

As displayed in the above graph, the Ethereum average fees have gone up recently as the cryptocurrency’s price has observed a rally. Historically, the fees going up during such a period of volatility hasn’t been that unexpected, as the investors find sharp price action exciting, so they tend to make more moves.

Instead, it’s more worrying if a rally doesn’t accompany a spike in network usage, as it means that the holders aren’t paying attention to the cryptocurrency. Without a high trader interest, surges can easily run out of fuel, thus dying off before long.

Read Also: Ethereum Falls More Than 5% In 24 hours

This weekend, the Ethereum average fees hit a value of about $5.72, the highest level that the indicator has touched since the 4th of July, more than four months ago. However, these levels are still not much compared to the $14 values in May.

Below the chart, Santiment has also attached the data for the distribution of the fees across the various tokens on the blockchain. Wrapped ETH (WETH) appears to have shown the most dominant activity in the past week.

As for what these high fees could mean for the asset, the current high usage naturally implies that the investors are actively participating in the market. However, the outcome of this doesn’t necessarily have to be bullish.

This high activity, if it keeps up, could result in more price volatility as many investors make moves at once, but its direction can go either way.

ETH Price

As the chart shows, Ethereum has continued to move flat above the $2,000 mark in the past few days.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.