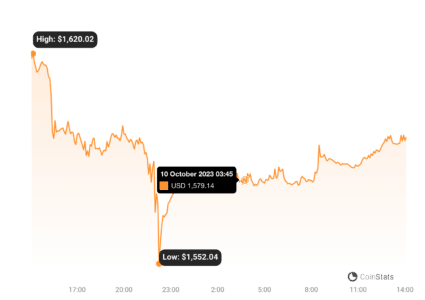

Cryptocurrency enthusiasts, buckle up! Ethereum (ETH), the second-largest cryptocurrency, is currently navigating a critical juncture. Like a tightrope walker, ETH’s price is balancing near the crucial $1,600 support level against the US dollar. The big question on everyone’s mind: Will Ethereum muster the strength to overcome the $1,650 and $1,665 hurdles, or are we looking at a potential dip? Let’s dive into the charts and dissect what’s happening with ETH’s price action.

Check the Live Ethereum Price Here

Ethereum’s Battle at $1,600: Support or Surrender?

Ethereum is currently in a tug-of-war, striving to stay afloat above the critical $1,600 support zone. Trading below $1,640 and facing downward pressure from the 100-hourly Simple Moving Average (SMA), the situation might seem precarious. However, there’s a silver lining!

An interesting development has emerged on the hourly chart for ETH/USD (data courtesy of Kraken). A connecting bullish trend line is forming, offering support around the $1,620 mark. This could be a signal for a potential upward move, but only if ETH can successfully break through the resistance levels at $1,650 and $1,665. Let’s break down these key levels:

- Current Situation: ETH is trading below $1,640 and the 100-hourly SMA, indicating bearish pressure.

- Support at $1,600: This is a crucial level that needs to hold to prevent further declines.

- Bullish Trend Line: Forming around $1,620, offering immediate short-term support.

- Resistance Hurdles: $1,650 and $1,665 are the key levels ETH needs to overcome to initiate a significant upward trend.

Can Ethereum Conquer the $1,650 Resistance?

Ethereum’s attempts to break past the $1,650 resistance have been met with challenges. Despite valiant efforts, ETH is struggling to firmly establish itself above this level and the subsequent $1,665 barrier. Adding to the pressure, Ethereum’s performance is currently lagging behind Bitcoin. Is this a sign of weakness, or just a temporary setback?

After reaching a peak around $1,664, ETH experienced a pullback, testing the $1,620 support and bottoming out near $1,617. However, there’s a glimmer of hope as ETH is currently attempting an upward recovery, having already breached the $1,625 level. Will this momentum continue?

Key Price Levels to Watch Closely

Let’s pinpoint the crucial price levels that will likely dictate Ethereum’s next move. Understanding these levels can help you navigate the market more effectively.

- Immediate Resistance: $1,640. Breaking above this level is the first step for bullish momentum.

- 100-hourly SMA: Acting as dynamic resistance, ETH needs to overcome this moving average to signal a trend change.

- 50% Fibonacci Retracement: Located near the immediate resistance, this level adds confluence around $1,640. It’s measured from the recent drop from $1,664 to $1,617.

- Next Resistance: $1,650 and the 76.4% Fibonacci retracement level (also from the $1,664-$1,617 drop). These are significant barriers for ETH to overcome.

- Critical Resistance: $1,665. This is the major hurdle. A successful break above $1,665 could pave the way towards the $1,750 resistance zone.

Here’s a table summarizing the resistance levels for a clearer picture:

| Resistance Level | Significance |

|---|---|

| $1,640 | Immediate Resistance, 50% Fibonacci Retracement, 100-hourly SMA |

| $1,650 | Next Resistance, 76.4% Fibonacci Retracement |

| $1,665 | Critical Resistance, Major Hurdle |

| $1,750 | Pivotal Resistance Target after $1,665 Break |

The Downside Risk: What if $1,665 Resistance Holds?

While we’re hoping for an upward surge, we also need to consider the bearish scenario. If Ethereum fails to break through the $1,665 resistance, a potential downturn is on the cards. Let’s examine the key support levels to watch if the bears take control:

- Initial Support: $1,620. This level, aligned with the bullish trend line, provides immediate support.

- Critical Support: $1,600. A break below this level could trigger significant selling pressure.

- Next Support Level: $1,585. If $1,600 fails, $1,585 becomes the next line of defense.

- Potential Downside Target: $1,540. A break below $1,585 could lead to a move towards $1,540.

- Further Downside Risk: $1,500. Continued bearish momentum could even push ETH towards the $1,500 psychological level.

Here’s a table summarizing the support levels in case of a downturn:

| Support Level | Significance |

|---|---|

| $1,620 | Immediate Support, Bullish Trend Line |

| $1,600 | Critical Support, Major Level |

| $1,585 | Next Support Level |

| $1,540 | Potential Downside Target |

| $1,500 | Further Downside Risk, Psychological Level |

Key Takeaways and Actionable Insights

So, what does this all mean for you? Here are the key takeaways and some actionable insights:

- Ethereum is at a Crossroads: The price is hovering near a critical support level, and the next move is crucial.

- Watch $1,665 Resistance: A break above this level could signal a bullish trend towards $1,750.

- Monitor $1,600 Support: Failure to hold this level could lead to further declines towards $1,540 or even $1,500.

- Bullish Trend Line at $1,620: Provides short-term support and a potential entry point if ETH bounces.

- Stay Informed: Keep an eye on price charts and market news to react to potential breakouts or breakdowns.

In Conclusion: Navigating Ethereum’s Price Swings

Ethereum’s price action is currently finely balanced. The battle between bulls and bears around the $1,600-$1,665 range will determine the short-term trajectory. Whether ETH will surge past the resistance and aim for higher targets, or succumb to bearish pressure and retrace lower, remains to be seen. Traders and investors should closely monitor these key levels and exercise caution as Ethereum navigates this critical phase. Stay tuned for further updates as the Ethereum saga unfolds!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.