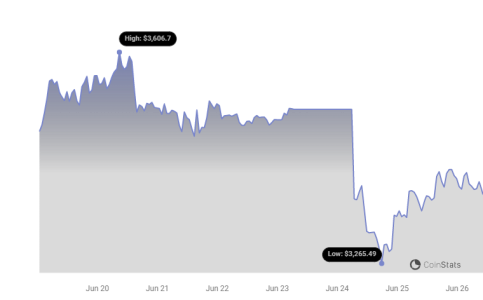

The cryptocurrency market is experiencing a turbulent phase, with both Bitcoin and Ethereum facing significant downward pressure. Bitcoin dipped below crucial support levels, nearing $59,000, fueled by Mt. Gox repayment announcements sparking fears of a massive sell-off. Ethereum (ETH) mirrored this trend, plummeting from its $3,500 high. But what’s causing this ETH dip, and can it recover soon?

Ethereum’s Whale Transaction Decline: A Deep Dive

This week began with a sharp downturn, impacting ETH significantly. Data from Coinglass reveals over $350 million in total market liquidations in the past 24 hours. Ethereum liquidations alone approached $80 million, with long positions bearing the brunt at over $67 million.

A major factor contributing to Ethereum’s woes is the behavior of whales – large holders whose actions can significantly sway market prices. These whales are exhibiting negative sentiment towards ETH. Addresses holding between 100,000 and 1 million ETH have offloaded approximately 700,000 ETH in the last two weeks, a sale valued at roughly $2.32 billion. This reduces their collective holdings to 20.26 million ETH. This is especially concerning considering whales tend to hold steady even during bear markets.

Furthermore, IntoTheBlock data reveals a decline in large transaction volume for Ethereum, dropping from a peak of $6.7 billion to $3.4 billion this week. This weakening buying volatility adds further pressure to ETH’s price.

Adding to the mix, retail investor sales are also on the rise. Currently, around 25% of ETH users are in profit, incentivizing them to secure gains. Historically, selling pressure remains low when profitability dips below 25%, but the current situation suggests investors are keen to lock in profits amidst potential further price declines.

What’s Next for ETH Price? Key Levels to Watch

Ethereum’s price action has broken below the 50-day SMA at $3,420, resolving its previous uncertainty with a downward move. While buyers showed some resilience around the $3,200 mark, bears couldn’t push the price further down immediately, creating a potential rebound opportunity. As of writing, ETH trades at $3,300, reflecting a 4.7% decline in the last 24 hours.

The declining 20-day EMA at $3,372 and an RSI near 28 indicate strong bearish control. Sellers are likely targeting the psychological level of $3,000 and potentially $2,850. Buyers are anticipated to step in strongly within the $3,000 – $2,850 range. A break and close above the 20-day EMA would signal weakening bearish pressure, potentially triggering an upward movement towards $3,545.

Key Takeaways

- Whale Activity: Keep a close eye on whale transactions. Significant selling pressure from large holders can heavily influence ETH’s price.

- Retail Investor Sentiment: Monitor the percentage of ETH users in profit. A high percentage can lead to increased selling as investors look to secure gains.

- Support and Resistance Levels: Watch for key support levels around $3,000 and $2,850. A break below these levels could indicate further downside. Resistance lies around the 20-day EMA ($3,372) and $3,545.

In conclusion, Ethereum faces significant headwinds due to whale selling, declining transaction volumes, and broader market anxieties. While potential rebound opportunities exist, closely monitoring key support and resistance levels, along with whale activity, is crucial for navigating this volatile period.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.