Have you noticed your Ethereum transaction costs feeling lighter on your wallet lately? If you’re an active user of the Ethereum network, you’re in for some good news! Over the past couple of months, sending ETH, swapping tokens on decentralized exchanges (DEXs), and even trading NFTs has become significantly more affordable. Let’s dive into the details of this welcome price drop and what it means for the Ethereum ecosystem.

Ethereum Fees Slashed: A Whopping 94% Drop!

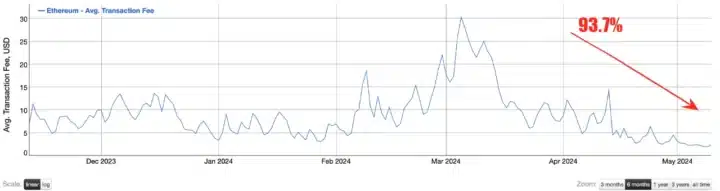

Imagine this: back in early March 2024, you were paying around $30 to make a simple transaction on Ethereum. Fast forward just over two months, and that same transaction costs you a mere fraction of that. Incredible, right?

Specifically, since March 5, 2024, Ethereum’s average transaction fees have plummeted by a staggering 93.7%! Yes, you read that correctly – ninety-four percent! This means the average cost per transfer has fallen from a hefty $30.33 to a much more palatable $1.91. That’s a massive slide in fees over just 68 days!

- Dramatic Decrease: Ethereum transaction fees have fallen by 93.7% in just 68 days.

- Significant Cost Reduction: Average transaction cost dropped from $30.33 to $1.91.

- Bitcoin Parallels: This trend mirrors recent declines seen in Bitcoin’s on-chain transaction fees.

Breaking Down the Current Cost of Ethereum Transactions

So, what does this fee reduction look like in practice? According to bitinfocharts.com, the average transaction cost on the Ethereum blockchain is now around 0.00065 ETH, which translates to approximately $1.91. This is a stark contrast to the fees we were seeing just a short time ago.

But that’s just the average. For basic ETH transfers, you might be paying even less! Data from etherscan.io’s gas tracker indicates that a simple ETH transfer currently costs between 4 and 7 gwei. Now, what’s ‘gwei,’ you might ask? Gwei is a tiny fraction of ETH (specifically, 1 gwei = 0.000000001 ETH). In dollar terms, this translates to a mere $0.18 to $0.37 per transfer. That’s pocket change in the crypto world!

For more complex operations like interacting with decentralized exchanges or trading NFTs, the fees are naturally a bit higher, but still significantly reduced:

This weekend, here’s what you can expect to pay for common Ethereum actions:

- DEX Swap: Estimated between $4.16 and $7.28

- NFT Sale: Estimated between $7.03 and $12.31

Here’s a visual representation of the average Ethereum transaction fee trend:

Ethereum Network Activity: Steady as She Goes

Despite the fee fluctuations, the Ethereum network remains consistently busy. Over the past 50 days, Ethereum has processed an average of just over one million transactions daily. Let’s take a quick look at the network’s activity:

- Busiest Day (Past 50 Days): March 22, 2024, with 1.324 million transactions.

- Slowest Day (Past 50 Days): April 4, 2024, with 1.091 million transactions.

- Average Daily Transactions (Past 50 Days): Approximately 1.212 million.

This consistent transaction volume suggests that the lower fees are making Ethereum more accessible and usable for a wider range of activities without deterring users.

Inflationary Ether and the $12.5 Billion Burn: A Balancing Act

Now, let’s talk about Ethereum’s economics. Did you know that Ethereum is currently experiencing a slight inflation rate? According to ultrasound.money, the current annual inflation rate for ETH is around 0.895%. While this might sound concerning, it’s crucial to understand the context.

Before Ethereum transitioned to Proof-of-Stake (PoS), under the old Proof-of-Work (PoW) system, the annual issuance rate would have been significantly higher, at 3.923%. The move to PoS dramatically reduced ETH issuance.

Furthermore, Ethereum has a mechanism to counteract inflation – the burning of transaction fees. Remember the London upgrade on August 5, 2021, and the introduction of EIP-1559? This upgrade was a game-changer. It replaced the old gas fee auction model with a more predictable base fee that gets burned, effectively removing ETH from circulation permanently.

Since EIP-1559 went live, a massive 4.29 million ETH has been burned! At current prices, this burned ETH is valued at a staggering $12.51 billion. That’s a significant amount of ETH permanently removed from supply, helping to offset the inflationary pressure.

The Validator’s Perspective: Lower Fees, Lower Rewards?

While lower transaction fees are fantastic news for users, they do present a potential challenge for Ethereum validators. Validators are the backbone of the Ethereum network, responsible for securing the blockchain and processing transactions. They are rewarded with transaction fees for their work.

When transaction fees are significantly reduced, the economic incentives for validators can be impacted. It’s a delicate balance – making Ethereum affordable for users to encourage adoption while ensuring validators are adequately compensated to maintain network security.

We’re seeing a similar dynamic in the Bitcoin world. Following the recent Bitcoin halving, as block rewards decreased, and with fluctuating transaction fees, Bitcoin has witnessed a drop in hashpower as some miners become less profitable. This highlights the ongoing challenge of balancing user affordability and validator economics in evolving cryptocurrency networks.

Ethereum’s current situation with lower transaction fees and a modest inflationary rate underscores this intricate balance. The network is navigating the path of making blockchain technology more accessible and user-friendly while ensuring the long-term health and security of the network. It’s a fascinating evolution to watch unfold!

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.