Is the specter of mass altcoin delistings returning to haunt the South Korean crypto market? Fears are escalating that exchanges in South Korea might be compelled to initiate a wave of altcoin removals this year, responding to directives from financial authorities. If you’re invested in altcoins on Korean exchanges, or simply keeping a close eye on global crypto regulations, this is critical news you need to understand.

Altcoin Delisting Fears: Echoes of 2021?

According to a detailed report from Business Post, the possibility of altcoins being “delisted one after the other” in the coming weeks is becoming increasingly real. Industry insiders are drawing parallels to 2021, a year etched in the memory of South Korean crypto investors. Back then, major domestic crypto exchanges undertook a significant purge, removing numerous lower-capitalization coins from their trading platforms.

Why are Delistings Back in the Spotlight?

The 2021 delistings were largely seen as a preemptive move by exchanges anticipating stricter regulatory measures. Fast forward to today, and the environment is once again charged with regulatory scrutiny. A surge in public scandals involving what are often termed “scam coins” has placed regulators under renewed pressure to intervene and safeguard investors.

Financial authorities have been vocal about their expectations. They are urging exchanges to implement robust listing audits, emphasizing the need for continuous evaluation of crypto projects. The message is clear: exchanges must diligently assess the credentials and ongoing viability of the coins they list.

What specific criteria are regulators emphasizing? Here’s a breakdown:

- Underperforming Tokens: Coins showing weak market performance are under scrutiny.

- Lack of Transparency: Projects that fail to provide clear and accessible information about their operations and development are at risk.

- Stagnant Development: Tokens associated with projects showing minimal recent development activity are raising red flags.

Officials are advocating for these types of projects to be placed on “cautionary” lists, signaling potential delisting.

Mass Delistings on the Horizon? Experts Weigh In

Business Post highlights expert opinions suggesting that a repeat of the 2021 “altcoin cull” is not out of the question. Experts are quoted as saying they “cannot rule out the possibility that many altcoins will be delisted at once.” This stark warning underscores the seriousness of the current situation.

The regulatory body at the heart of this – the Financial Supervisory Service (FSS) – is actively developing a set of “best practices” to guide exchanges in their delisting decisions. These guidelines are intended to provide a framework for exchanges to follow, ensuring a more standardized and transparent delisting process.

New Guidelines and the Upcoming Act: What’s the Timeline?

The FSS is reportedly aiming to release these new altcoin guidelines as early as next month. This timeline is particularly significant as it’s designed to coincide with the launch of the landmark Act on the Protection of Virtual Asset Users. This act, slated to take effect on July 19, represents a major step in formalizing crypto regulation in South Korea.

An unnamed crypto industry insider shared insights with the media outlet, stating:

“It is my understanding that the financial authorities will announce their new guidelines before the act comes into force. I believe that they are preparing to implement the guidelines as quickly as possible.”

This proactive approach from regulators suggests a determined effort to get ahead of potential market issues and ensure investor protection as the new act comes into play.

S. Korea financial regulators seek to issue guidelines on crypto delistinghttps://t.co/0Yp3F4jY3q

— The Korea Times (@koreatimescokr) June 16, 2024

As anticipated, the news has already sent ripples through the market. Several lower-cap altcoins have experienced price drops on major exchanges, reflecting investor unease and increased selling pressure.

Exchanges Push Back: Is a Mass Delisting Really Expected?

In an attempt to calm market jitters, crypto exchanges are stepping forward to reassure investors. Industry experts are also suggesting that while scrutiny is intensifying, high-profile cryptocurrencies like XRP, Solana, and Cardano, with their established international presence, are likely to be safe from delisting pressures. The focus, they indicate, will primarily be on smaller, less established projects.

Upbit, a leading crypto exchange in South Korea, directly addressed the delisting concerns in a press release on June 19. They stated:

“Upbit already has a maintenance review process for cryptoassets. [We] conduct reviews of the coins we list on a regular basis. The so-called ‘lists of soon-to-be delisted coins’ spreading in some online communities are complete fiction.”

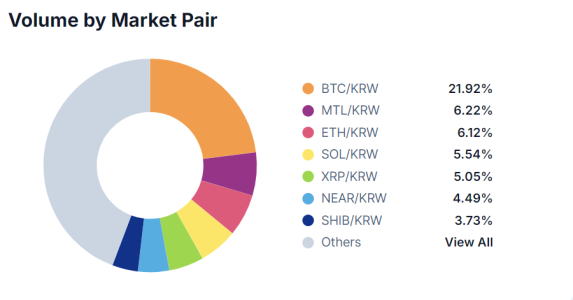

To further illustrate market activity, consider the recent trading volume on Upbit:

Trading volume per market pair on the Upbit crypto exchanges on June 24, 2024 | Source: CoinGecko

Upbit concluded its statement with a strong message of reassurance:

“It is very unlikely that any such large-scale delistings will take place.”

Key Takeaways: Navigating the Uncertainty

While exchanges are attempting to downplay the likelihood of mass delistings, the regulatory pressure is undeniable. Here’s what you should consider:

- Increased Regulatory Scrutiny: South Korean regulators are clearly tightening their grip on the crypto market, prioritizing investor protection.

- Focus on Lower-Cap Altcoins: Smaller, less established altcoins are likely to face the most significant delisting risk.

- Importance of Due Diligence: Investors should exercise caution and conduct thorough research on altcoin projects, especially those with low market capitalization and limited transparency.

- Monitor Exchange Announcements: Keep a close watch on announcements from South Korean crypto exchanges regarding coin listings and potential delistings.

The coming weeks will be crucial in determining the extent of any potential altcoin delistings in South Korea. While a repeat of the 2021 mass cull remains uncertain, the heightened regulatory environment and proactive stance of the FSS signal a significant shift towards greater oversight in the South Korean crypto market. Stay informed and exercise caution as these developments unfold.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.