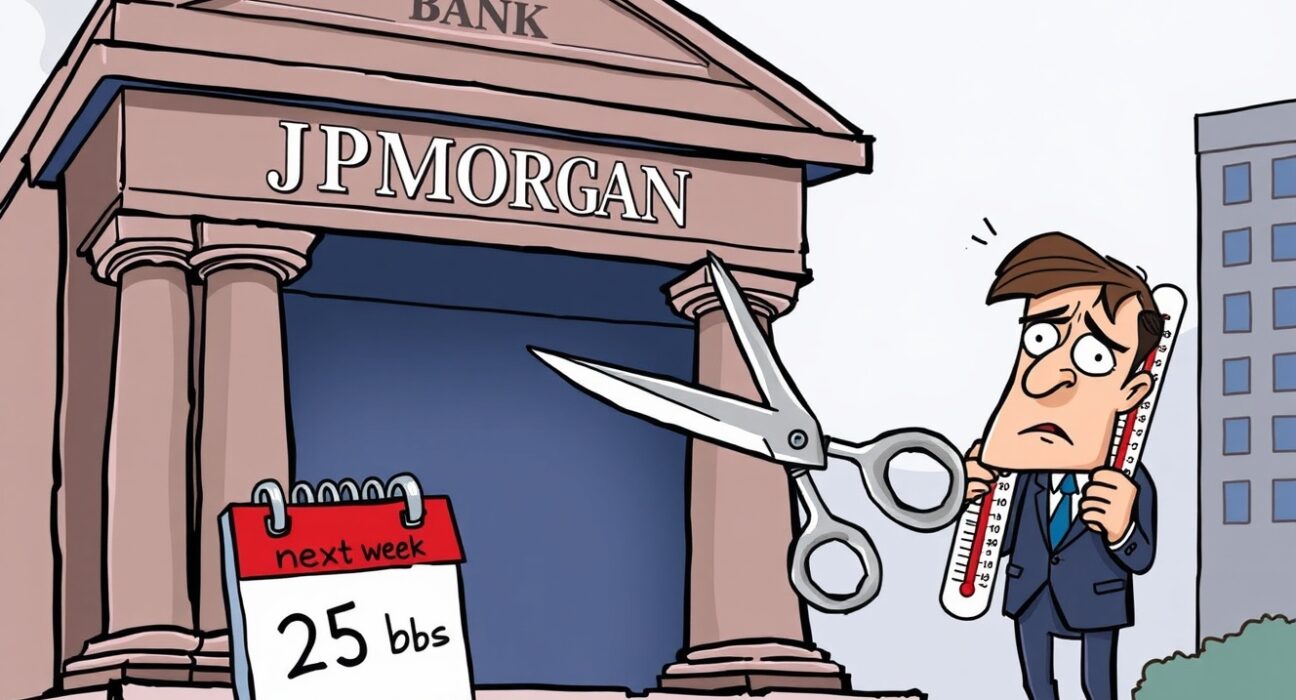

The financial world is abuzz with JPMorgan’s latest forecast: a potential 25 basis point Fed rate cut next week. For cryptocurrency enthusiasts and traditional investors alike, understanding these macroeconomic shifts is paramount. Central bank decisions often ripple through digital asset markets, influencing everything from investor sentiment to liquidity, making this projected Fed rate cut a pivotal event.

JPMorgan’s Bold Forecast: Why a Fed Rate Cut is Expected

JPMorgan, a leading global financial institution, has issued a significant economic outlook. The bank anticipates that the Federal Reserve will implement a 25 basis point (bps) Fed rate cut during its upcoming meeting. This prediction suggests that despite ongoing economic fluctuations, JPMorgan sees a compelling case for easing monetary policy.

- This expectation likely stems from a comprehensive analysis of various economic indicators.

- Factors such as slowing economic growth, moderating inflation trends, or a desire to support specific sectors could be at play.

- The market is now closely watching for confirmation of this anticipated Fed rate cut, preparing for its potential effects.

Navigating CPI Uncertainty: The Challenge to a Timely Fed Rate Cut

However, the path to a straightforward Fed rate cut is not entirely clear. A significant element of uncertainty revolves around the Consumer Price Index (CPI), which measures inflation. The CPI report is a critical piece of data that heavily influences the Federal Reserve’s decisions regarding interest rates.

JPMorgan specifically highlighted that if inflation data comes in hotter than expected, indicating persistent price pressures, the planned Fed rate cut could be delayed. This scenario introduces a layer of caution, with potential postponements pushing the decision to October or even December. Such delays would undoubtedly alter market expectations and investment strategies.

What a Fed Rate Cut Means for Your Finances

A Fed rate cut can have wide-ranging implications, impacting everything from borrowing costs to investment returns. Understanding these effects is crucial for both individuals and businesses.

Potential Benefits:

- Lower Borrowing Costs: Mortgages, car loans, and business credit could become more affordable.

- Economic Stimulation: Reduced interest rates can encourage spending and investment, potentially boosting economic growth.

- Stock Market Support: Lower rates often make equities more attractive compared to bonds, potentially leading to higher stock valuations.

Potential Challenges:

- Inflation Concerns: If the cut is seen as premature, it could reignite inflationary pressures.

- Savings Returns: Interest earned on savings accounts and Certificates of Deposit (CDs) may decrease.

- Market Volatility: The announcement and its aftermath can lead to short-term market fluctuations.

Strategic Moves: Preparing for the Fed Rate Cut

Given JPMorgan’s forecast and the surrounding uncertainties, what steps can you take to prepare for a potential Fed rate cut? Proactive planning is key to navigating these dynamic economic conditions.

Actionable Insights:

- Stay Informed: Keep a close watch on the upcoming CPI report and the Federal Reserve’s official announcement. Reliable news sources are essential.

- Review Your Portfolio: Assess how your current investments, including any cryptocurrency holdings, might react to lower interest rates. Consider rebalancing if necessary.

- Evaluate Debt: If you have variable-rate loans, a rate cut could reduce your monthly payments. Conversely, consider locking in fixed rates if you anticipate future increases.

- Consult an Expert: Speaking with a financial advisor can provide personalized guidance tailored to your specific financial situation and goals.

JPMorgan’s forecast of an urgent 25 bps Fed rate cut next week signals a pivotal moment for the global economy. While the potential for lower borrowing costs and economic stimulation is clear, the specter of CPI uncertainty looms large. Staying informed, strategically reviewing your financial position, and considering expert advice are paramount for successfully navigating these evolving market conditions. The coming weeks will undoubtedly bring clarity to this crucial economic decision.

Frequently Asked Questions (FAQs)

What is a basis point (bp)?

A basis point (bp) is a common unit of measure in finance, equal to one one-hundredth of one percentage point (0.01%). So, a 25 bps Fed rate cut means a reduction of 0.25%.

What is the Consumer Price Index (CPI)?

The Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. It is a key indicator of inflation.

Why does JPMorgan’s forecast matter?

JPMorgan is a major financial institution with significant influence and analytical capabilities. Their forecasts often reflect deep market insights and can sway investor sentiment and expectations regarding future central bank actions like a Fed rate cut.

How might a Fed rate cut impact my savings?

Generally, a Fed rate cut tends to lead to lower interest rates on savings accounts, money market accounts, and Certificates of Deposit (CDs), potentially reducing the returns on your cash holdings.

Could the Fed decide not to cut rates?

Yes, absolutely. The Federal Reserve’s decisions are data-dependent. If economic data, particularly inflation figures like CPI, come in stronger than anticipated, the Fed could choose to delay or even forgo a Fed rate cut, maintaining current rates.

We hope this comprehensive overview helps you understand the implications of JPMorgan’s forecast. If you found this article insightful, please consider sharing it with your network on social media. Your shares help us continue to provide timely and relevant financial news.

To learn more about the latest crypto market trends, explore our article on key developments shaping the crypto market’s future outlook.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.