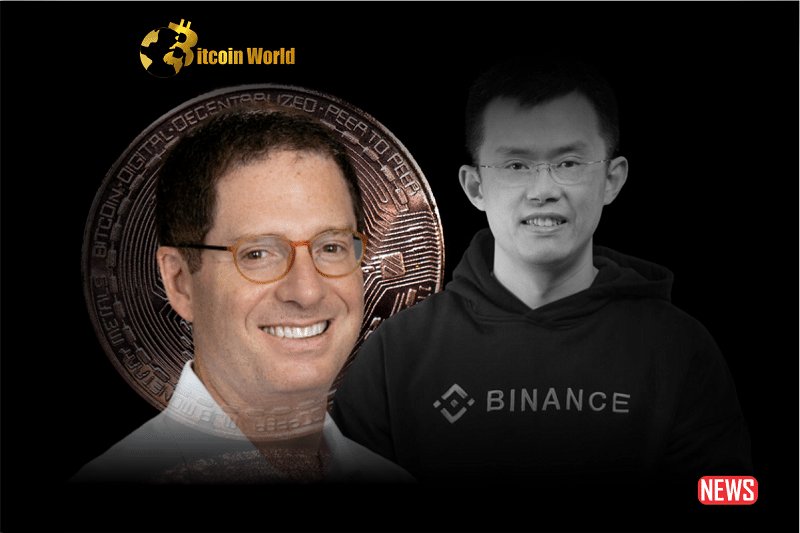

Ever wondered what really goes on behind the scenes at major crypto exchanges? Well, recent court documents have dropped a bombshell, offering a fascinating glimpse into the departure of Brian Brooks from his role as CEO of Binance.US. If you’re following the twists and turns in the world of cryptocurrency and regulation, this is a story you won’t want to miss.

Why Did Brian Brooks Really Leave Binance.US? The Court Documents Spill the Tea

For months, speculation swirled around Brian Brooks’ abrupt resignation from Binance.US after just four short months. Now, thanks to interview transcripts with the US Securities and Exchange Commission (SEC), we’re getting a clearer picture. Brooks himself revealed some pretty significant insights into the dynamics at play, particularly concerning the influence of Binance’s global CEO, Changpeng Zhao (CZ).

Here’s the gist:

- CZ Was the Real Boss: Brooks stated unequivocally that he came to realize Changpeng Zhao was the ultimate authority at BAM Trading, the company operating Binance.US. This wasn’t just a feeling; it was a conclusion drawn from his experience within the organization.

- Clash of Visions: Brooks cited fundamental differences in vision and, crucially, decision-making power as key factors in his departure. It seems his attempts to steer the ship in a certain direction were often met with resistance or outright overruling.

- Governance vs. Management: Drawing on his experience as the former Acting Comptroller of the Currency, Brooks emphasized the critical distinction between governance (setting broad policies) and management (day-to-day operations). He felt his role as CEO, focused on management, was being undermined.

CZ’s Shadow Over Binance.US: What the SEC Alleges

The revelations from Brooks’ interview come at a critical time, as Binance and CZ are facing a significant legal challenge from the SEC. The regulatory body has filed 13 charges against them, accusing them of a “blatant disregard of the federal securities laws.”

So, what’s the connection between Brooks’ departure and the SEC’s allegations?

- Evading US Laws? The SEC argues that Binance strategically created BAM Management and BAM Trading to operate Binance.US while circumventing US regulations.

- Control Remains Central: Despite Binance’s claims that Binance.US operated independently, the SEC maintains that CZ and the broader Binance organization retained significant control over the US entity. Brooks’ testimony seems to support this assertion.

- Mounting Legal Pressure: This situation adds another layer of complexity to the legal battles facing Binance and its CEO, raising serious questions about their compliance with established regulatory frameworks.

Brian Brooks: A Regulatory Mind in a Crypto World

It’s worth noting Brooks’ background. Before taking the helm at Binance.US, he held a prominent regulatory position as the Acting Comptroller of the Currency. This role involved overseeing national banks and federal savings associations within the US Treasury. His understanding of regulatory landscapes is undoubtedly deep. This makes his observations about the operational structure of Binance.US all the more significant.

Consider this:

| Area | Brian Brooks’ Perspective | Potential Implications |

|---|---|---|

| Decision-Making | Felt “overruled” on key issues, lacking true authority. | Raises questions about the autonomy of Binance.US and CZ’s influence. |

| Company Mission | Believed the company’s direction differed from his initial understanding. | Suggests potential misalignments between leadership and operational practices. |

| Regulatory Compliance | His regulatory background highlights the importance of adhering to legal frameworks. | The SEC’s charges underscore the potential consequences of non-compliance. |

What Does This Mean for Binance and the Crypto Industry?

The unfolding situation surrounding Binance and the revelations from Brian Brooks’ testimony have significant implications, not just for the exchange itself, but for the broader cryptocurrency landscape.

- Increased Scrutiny: Expect continued and potentially intensified regulatory scrutiny of cryptocurrency exchanges, particularly those with global operations.

- Compliance Challenges: The case highlights the ongoing challenges for crypto businesses in navigating complex and evolving regulatory environments.

- Impact on Trust: These developments could impact public trust and confidence in centralized cryptocurrency exchanges.

- Future of Binance.US: The legal proceedings and the questions surrounding its operational independence could significantly affect the future of Binance.US.

Key Takeaways and Actionable Insights

So, what can we learn from this situation?

- Transparency Matters: The need for clear and transparent governance structures within cryptocurrency organizations is paramount.

- Regulatory Engagement is Crucial: Proactive engagement with regulatory bodies is essential for the long-term sustainability of the crypto industry.

- Due Diligence is Key: For individuals and institutions interacting with crypto exchanges, thorough due diligence is crucial.

The Road Ahead: Uncertainty and Potential Change

Brian Brooks’ departure, as illuminated by these court documents, paints a picture of internal tensions and alleged regulatory maneuvering at Binance.US. As the SEC’s investigation progresses, the cryptocurrency world will be watching closely to see how these revelations impact Binance, its operations, and the future of crypto regulation. One thing is certain: this story is far from over, and its outcome could have a lasting impact on the entire industry.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.