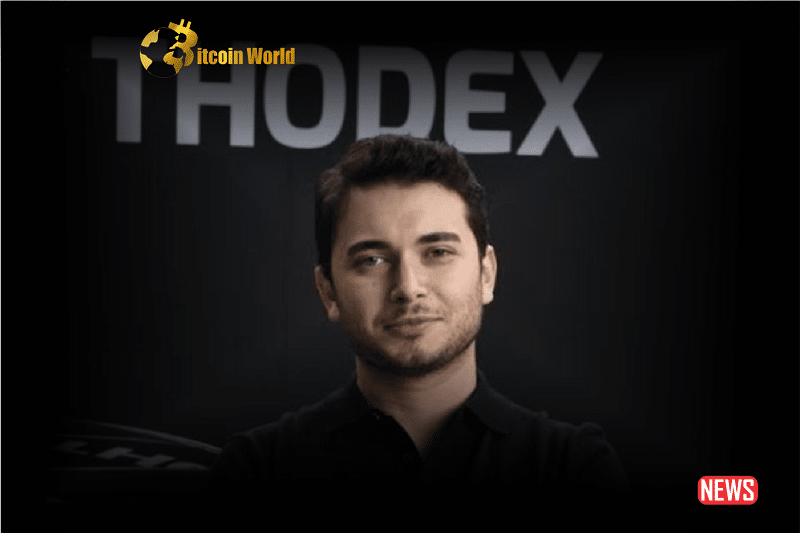

Hold onto your hats, crypto enthusiasts! The world of digital currency just witnessed a legal earthquake. In a jaw-dropping verdict that’s sending shockwaves through the crypto sphere, Faruk Fatih Özer, the mastermind behind the now-infamous Thodex cryptocurrency exchange, has been slapped with a staggering 11,196-year prison sentence in Turkey. Yes, you read that right – over eleven thousand years! This isn’t just a slap on the wrist; it’s a legal hammer blow signaling a new era of accountability in the often Wild West world of crypto.

What Exactly Happened with Thodex? The Crypto Exchange Collapse Heard Around the World

Let’s rewind a bit. Thodex was once a rising star in the Turkish cryptocurrency exchange market, promising users a platform to trade digital assets. But like a shooting star that burns out too quickly, Thodex abruptly imploded in April 2021. One minute, users were trading Bitcoin and Ethereum; the next, the exchange was dark, and the CEO, Faruk Fatih Özer, had vanished into thin air. Sounds like a movie plot, right? Unfortunately, this was very real for thousands of Thodex users who suddenly found themselves locked out of their accounts, their crypto assets seemingly gone with the wind.

The charges against Özer were as serious as they come, painting a picture of calculated deception and financial malfeasance. He faced accusations of:

- Establishing and Managing a Criminal Organization: This wasn’t just a business failure; the court deemed it an organized criminal enterprise.

- Qualified Fraud: Deceiving investors on a massive scale for personal gain.

- Money Laundering: Attempting to hide the ill-gotten gains from the fraudulent scheme.

And if the millennia-long sentence wasn’t enough, the court also added a $5 million penalty on top. Ouch.

Family Ties and Shared Fate: Siblings Sentenced in Thodex Saga

This wasn’t a solo act. In a dramatic twist, Özer’s siblings were also implicated in the scandal and received the exact same eye-watering 11,196-year sentences. This highlights the extent of the alleged conspiracy and the court’s determination to hold all involved parties accountable. It sends a clear message: crypto fraud isn’t a game, and those involved, regardless of their role, will face severe consequences.

The Missing Billions: How Much Crypto Vanished?

Here’s where the numbers get a bit murky, but the scale of the potential losses is undeniably huge. Initial reports suggested a staggering $2.6 billion in user funds disappeared when Thodex went offline. Imagine your life savings vanishing overnight – that’s the reality many Thodex users faced. While some sources quoted a slightly lower figure of $2 billion, Turkish prosecutors, in their indictment, conservatively estimated the losses at 356 million Turkish liras, which translates to roughly $13 million. Regardless of the exact figure, the financial impact on Thodex users was devastating, leaving many in financial ruin.

From Istanbul to Albania and Back: The International Manhunt for Özer

Once Thodex collapsed, Özer became a ghost, fleeing Turkey and sparking an international manhunt. His escape added another layer of intrigue to the already sensational case. After over a year on the run, Özer was finally apprehended in Albania in August 2022. His capture marked a crucial turning point, paving the way for his extradition back to Turkey in April 2023 to face justice. This international cooperation underscores the global reach of law enforcement in追查ing financial criminals, even in the decentralized world of crypto.

“I’m Too Smart to be Amateurish”: Özer’s Bold Defense

Throughout the trial, Özer remained defiant, proclaiming his innocence and painting himself as a victim of circumstance. He argued that Thodex was a legitimate business that simply failed, not a deliberate scam. In a particularly audacious statement, Özer asserted, “I am smart enough to manage all institutions in the world. This is evident from the company I founded at the age of 22. If I were to establish a criminal organization, I would not act so amateurishly.” His defense hinged on portraying the collapse as a business misfortune rather than a calculated fraud. However, the court clearly didn’t buy it.

The Verdict Breakdown: Who Else Was Involved?

The Thodex legal saga was a complex affair involving 21 defendants in total. Here’s a snapshot of how the legal chips fell:

| Defendant Status | Number of People | Outcome |

|---|---|---|

| Appeared in Court Personally | 5 | Faced varying sentences, including Özer and his siblings with 11,196 years each. |

| Cleared of “Qualified Fraud” | 16 | Released due to insufficient evidence on fraud charges, but some may have faced other charges. |

| Immediate Release Orders | 4 (out of the 5 who appeared) | Released from custody, likely related to the cleared fraud charges or lesser involvement. |

This breakdown shows that while the spotlight was on Özer and his inner circle, the legal process involved a broader group of individuals, with varying degrees of culpability and legal outcomes.

A Wake-Up Call for Crypto? Lessons from the Thodex Trial

The Thodex case is more than just a sensational news story; it’s a critical inflection point for the cryptocurrency industry. It throws into sharp relief the urgent need for stronger regulation and investor protection in the rapidly evolving world of digital assets. Here are some key takeaways:

- Regulatory Scrutiny is Intensifying: Governments worldwide are paying closer attention to crypto exchanges and related activities. The Thodex verdict signals a willingness to take decisive action against fraudulent operators.

- “Not Your Keys, Not Your Coins” – A Harsh Reminder: The case reinforces the fundamental crypto principle. Relying on centralized exchanges always carries risks. Users must understand the importance of secure self-custody solutions.

- Due Diligence is Non-Negotiable: Investors need to conduct thorough research before entrusting their funds to any crypto platform. Promises of high returns and flashy marketing should be treated with skepticism.

- Global Cooperation is Essential: The international effort to apprehend Özer highlights the necessity of cross-border collaboration to combat crypto crime effectively.

The Final Verdict: Accountability in the Crypto Age

The unprecedented 11,196-year sentence handed down in the Thodex case is a landmark moment. While the sheer length of the sentence is symbolic and may be subject to legal adjustments in the future, the message is crystal clear: crypto fraud will not be tolerated. This verdict serves as a powerful deterrent and a stark warning to anyone contemplating similar schemes. As the crypto industry matures, expect to see increased regulatory pressure and a greater emphasis on accountability. The Thodex saga is a painful but necessary lesson, pushing the crypto world towards greater transparency, security, and ultimately, investor trust.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.