Buckle up, crypto enthusiasts! The volatile world of digital assets is once again throwing curveballs. Just when you thought the FTX saga was a closed chapter, a surprising twist has emerged, sending ripples through the market, especially for the exchange’s native token, FTT. What exactly happened? Let’s dive into the details behind FTT’s dramatic price surge and what it could mean for the future of FTX.

Why is FTT Suddenly Pumping? The Gensler Effect

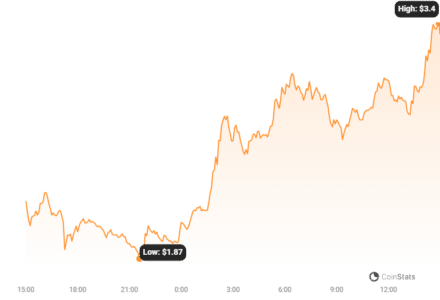

On November 9th, the crypto markets witnessed a significant price jump for FTT, the token associated with the collapsed FTX exchange. Believe it or not, FTT saw an incredible 90% increase in its value during a single trading session. This sudden rally wasn’t due to some random whale activity or meme coin frenzy. The catalyst? Comments from none other than US Securities and Exchange Commission (SEC) Chair, Gary Gensler.

- 90% Price Surge: FTT experienced a massive intraday price increase on November 9th.

- Gensler’s Hint: The surge was triggered by Gary Gensler’s remarks about the potential for restarting the FTX exchange.

In a recent interview with CNBC, Gensler opened up about the possibility of FTX making a comeback. He stated that the SEC is “open” to the idea of reactivating FTX, provided it operates “within the law.” This seemingly simple statement ignited a spark in the market, particularly for FTT holders.

But why such a strong reaction to just words? Well, Gensler’s comments inject a glimmer of hope into a situation many had written off as completely dead. Remember the FTX crash? It sent shockwaves through the crypto industry. Now, the possibility of a resurrected FTX, under regulatory compliance, is a significant development.

Behind the Scenes: Potential Buyers and FTX 2.0?

Gensler’s interview isn’t the only piece of the puzzle. It turns out, there’s been behind-the-scenes activity regarding the bankrupt exchange. During a court hearing in Delaware in late October, investment banker Kevin Cofsky from Perella Weinberg Partners revealed that FTX has received proposals from multiple potential buyers.

Cofsky mentioned that at least three parties are seriously interested in acquiring FTX’s assets. The exchange is currently evaluating these proposals and aims to decide on the next steps by mid-December. This news, combined with Gensler’s comments, paints a picture of a potential FTX revival, albeit in a new, compliant form.

What exactly does the SEC want from a ‘rebooted’ FTX? Gensler clarified the regulator’s expectations for any crypto exchange, emphasizing the crucial elements for investor trust:

“Build the trust of investors in what you’re doing and ensure that you’re doing the proper disclosures — and also that you’re not commingling all these functions, trading against your customers. Or using their crypto assets for your own purposes.” – Gary Gensler, SEC Chair

Essentially, Gensler is highlighting the need for transparency, proper disclosures, and ethical practices – the very areas where the previous FTX regime spectacularly failed.

FTT’s Price Surge: A Look at the Charts

The market reaction to this news is clearly reflected in FTT’s price chart. Let’s take a closer look at the numbers:

FTT Reaches Levels Not Seen Since FTX’s Collapse

As of the latest data, FTT was trading around $2.98. This price point is significant because FTT hasn’t traded at these levels since November 11, 2022 – the day FTX imploded. The price chart visually tells the story of FTT’s resurgence.

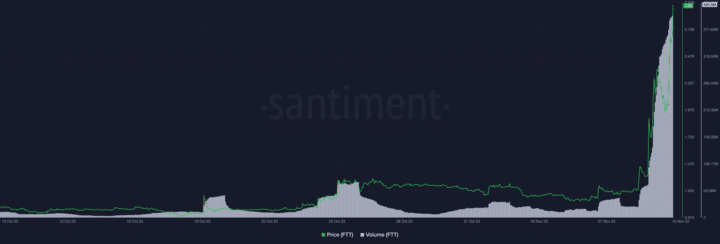

Trading Volume Explodes

Confirming the market’s heightened interest, FTT’s trading volume has also seen a massive spike. Data from Santiment reveals that FTT’s 24-hour trading volume exceeded $400 million, marking the highest daily volume since April 12th. This surge in volume underscores the renewed speculative interest in FTT.

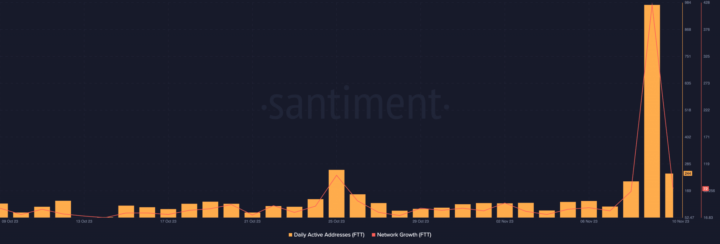

Demand Soars for FTT

Beyond price and volume, on-chain data further supports the narrative of increased demand. Santiment data indicates a remarkable 350%+ increase in the daily count of unique addresses involved in FTT transactions on November 8th and 9th. This suggests a significant influx of new participants or returning investors trading FTT.

Read Also: FXT Token (FTT) Plummets After SBF was Found Guilty

Adding to this surge, the demand for FTT tokens, measured by another Santiment metric, jumped by 532% over the same period. These metrics collectively paint a picture of a token experiencing a sudden and substantial resurgence in market interest.

Is FTT Overbought? A Word of Caution

While the FTT price surge is exciting, it’s crucial to approach with caution. Technical indicators suggest that FTT might be entering overbought territory. Analyzing a 12-hour chart reveals:

- Overbought RSI and MFI: FTT’s Relative Strength Index (RSI) and Money Flow Index (MFI) are currently at very high levels – 89.16 and 96.08 respectively. These readings typically indicate that an asset is overbought and prone to a price correction or pullback.

Historically, such high RSI and MFI values often precede price reversals. Traders should be aware of the increased risk of a potential price drop in the short term.

Profitability vs. Long-Term Value: The MVRV Ratio

Santiment data also highlights an interesting point about FTT’s profitability. The daily ratio of FTT transaction volume in profit to loss is currently at 5.198. This means for every transaction incurring a loss, there are over 5 profitable transactions. This reflects the immediate gains being realized by many traders during this rally.

However, the bigger picture is revealed by the Market Value to Realized Value (MVRV) ratio. For FTT, the MVRV ratio remains deeply negative at -29.35%. This signifies that, despite the recent surge, most FTT investors are still underwater, holding tokens purchased at significantly higher prices before the FTX collapse. Selling at the current price would likely result in losses for the majority of holders.

Final Thoughts: Hope or Hype for FTT?

The FTT price surge driven by Gensler’s comments and potential FTX reboot news is undoubtedly a significant event. It demonstrates the crypto market’s sensitivity to regulatory signals and the enduring, albeit speculative, interest in the FTX saga. While the short-term gains are enticing, the overbought indicators and negative MVRV ratio serve as reminders of the inherent risks and the long road to recovery for FTT and potentially, FTX itself.

Will FTX 2.0 become a reality? Will FTT sustain its upward momentum? Only time will tell. For now, traders should proceed with caution, acknowledging both the potential upside and the significant risks associated with this highly volatile token.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.