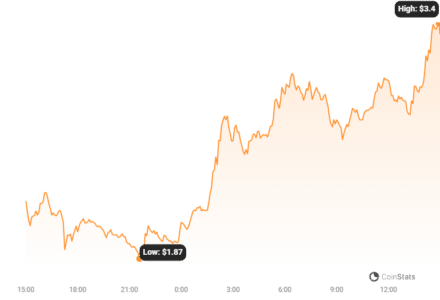

- FTT saw a 90% price uptick during the trading session on 9th November.

- The rally came after Gary Gensler commented on the possibility of restarting FTX.

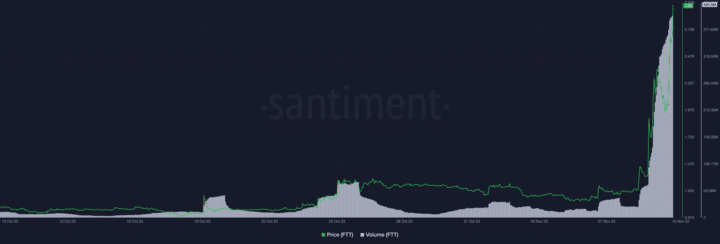

FTT, the native token of the now-defunct FTX cryptocurrency exchange, increased over 90% during the intraday trading session on November 9th. This came after US Securities and Exchange Commission (SEC) Chair Gary Gensler signaled that the exchange would be restarted.

In an interview with CNBC, Gensler noted that the regulator is open to the concept of reactivating the FTX as long as it is done “within the law.”

During a court hearing in Wilmington, Delaware on October 24th, Perella Weinberg Partners investment banker Kevin Cofsky stated that the bankrupt crypto exchange had received various proposals from possible buyers.

According to Cofsky, at least three buyers are in the running to purchase the exchange’s assets. He went on to say that the business is examining the proposals and will determine how to continue by mid-December.

In terms of what the regulator wants from ecosystem stakeholders, Gensler added:

“Build the trust of investors in what you’re doing and ensure that you’re doing the proper disclosures — and also that you’re not commingling all these functions, trading against your customers. Or using their crypto assets for your own purposes.”

FTT Reaches A Multi-Month High

FTT was trading at $2.98 at the time of publication. The altcoin was last traded at this price level on November 11, 2022, the day FTX crashed.

According to Santiment data, FTT’s trading volume in the previous 24 hours has surpassed $400 million, the biggest daily volume since April 12th.

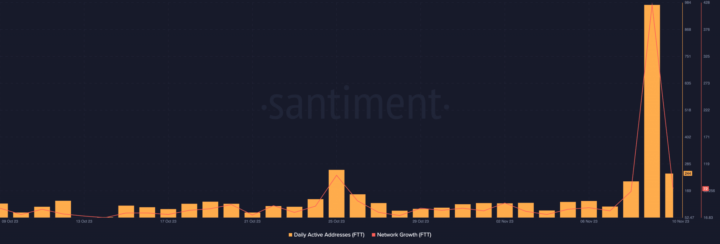

In addition, following Gensler’s interview, there has been a huge increase in demand for the token. According to Santiment data, the daily count of unique addresses involved in FTT transactions grew by more than 350% on November 8th and 9th.

Read Also: FXT Token (FTT) Plummets After SBF was Found Guilty

Similarly, fresh demand for the token surged by 532% over the same time period.

Key indicators examined on a 12-hour chart revealed, as expected, that FTT’s spot market has since been defined by considerable accumulation.

The token’s Relative Strength Index (RSI) and Money Flow Index (MFI) were at overbought highs of 89.16 and 96.08 as of this writing. At these levels, the token has a strong danger of a price reversal or drop.

According to Santiment, the daily ratio of FTT transaction volume in profit to loss was 5.198 at press time, indicating how profitable FTT transactions have been since the rally began. That is, for every transaction that resulted in a loss, 5.198 transactions resulted in a profit.

However, because of the difficulties faced by the cryptocurrency since FTX’s collapse a year ago, the FTT’s Market Value to Realized Value (MVRV) ratio remains severely negative, -29.35% at press time. Most investors are guaranteed to lose money if they sell at the current price.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.