Cryptocurrency markets are no stranger to volatility, but recent events have sent shockwaves through the industry. If you’ve been following the crypto space, you’ve likely heard about FTX, once a giant in the world of crypto exchanges, and its founder, Sam Bankman-Fried (SBF). Well, the latest news isn’t good for FTX Token (FTT) holders. Buckle up as we dive into the dramatic price crash of FTT following SBF’s fraud conviction and explore what this means for the future of FTX.

FTT Token in Freefall: The Immediate Impact of SBF’s Verdict

The price of FTX Token (FTT) has taken a nosedive, hitting a new yearly low of $1.1579. This significant 8% drop is a direct reaction to a major development in the crypto world: the conviction of Sam Bankman-Fried. SBF, the founder of FTX, who once stood at the helm of a top-tier bitcoin exchange, has been found guilty of fraud. Let’s break down the key events that triggered this market reaction:

- FTT Price Plummets: Immediately following the verdict, the FTX token (FTT) experienced a sharp decline, reaching $1.1579.

- Guilty Verdict for SBF: Sam Bankman-Fried was convicted on all seven counts of fraud and conspiracy after a high-profile 15-day trial.

- Sentencing Date Set: SBF’s sentencing is scheduled for March 28, 2024, marking the next crucial phase in this legal saga.

This price drop reflects a significant loss of confidence in the FTT token and the FTX ecosystem following the legal outcome for its founder.

The Verdict Heard Around the Crypto World: Sam Bankman-Fried Found Guilty

So, what exactly led to this dramatic verdict? SBF’s trial, lasting 15 days, culminated in a guilty verdict on all seven charges. These weren’t minor charges either. They included serious accusations such as conspiracy to commit wire fraud, conspiracy to commit securities fraud, and conspiracy to commit money laundering, among others. The prosecution painted a picture of fraudulent activities that shook investor trust and led to substantial financial losses.

A key element of the trial was the testimony from former close associates of Sam Bankman-Fried. These individuals provided firsthand accounts, alleging SBF’s direct involvement in fraudulent schemes that ultimately harmed FTX clients. While SBF’s defense team argued that he acted without malicious intent to defraud, the jury ultimately sided with the prosecution. SBF himself took the stand starting October 26th, attempting to defend his actions, but the jury remained unconvinced.

FTT Token’s Rollercoaster: From Peak to Plunge

To truly understand the magnitude of the current situation, let’s look at the historical value of the FTT token. The numbers tell a stark story:

- Peak Value: FTT once soared to an all-time high of $85.02.

- Current Value: As of recent reports, FTT has plummeted by over 98% from that peak.

This dramatic decline highlights the volatile nature of cryptocurrency markets and the significant impact that events like the FTX collapse and SBF’s conviction can have on token values. The price chart visually represents this tumultuous journey:

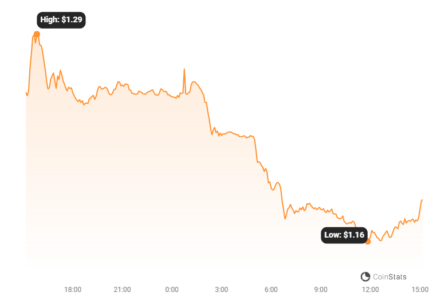

In the past 24 hours alone, FTT’s price has seen significant fluctuations, trading between a low of $1.16 and a high of $1.32. Looking at a broader 52-week window, the token’s price ranged from a low of $0.77 to a high of $25.86. However, the overarching trend since its all-time high has been a struggle for recovery.

The FTX Domino Effect: Bankruptcy and Loss of Confidence

The seeds of FTT’s decline were sown earlier when FTX filed for bankruptcy in November. This event marked a turning point, eroding market confidence in FTT. Prior to the bankruptcy filing, FTT was still trading at its high of $85.02. The bankruptcy announcement triggered a wave of panic selling and a reassessment of the risks associated with the token and the exchange.

Is There a Future for FTT and FTX? A Glimmer of Hope

Despite the current challenges, it’s not all doom and gloom for FTT and FTX. Under new leadership, there are efforts underway to revive the exchange. A significant undertaking is the attempt to recover over $7 billion in assets that were lost. Furthermore, there’s talk of rebranding FTX, signaling a fresh start and a move away from the shadow of its past controversies.

This recovery project, though ambitious, holds the potential to reshape the future of both the exchange and the FTT token. It represents a chance for a new chapter after a period of immense turmoil. Whether these efforts will be successful remains to be seen, but the possibility of a revitalized FTX offers a ray of hope in an otherwise turbulent situation.

Read Also: Bitcoin Mining Stocks Skyrocket as BTC Price Hovers Around $35K

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.