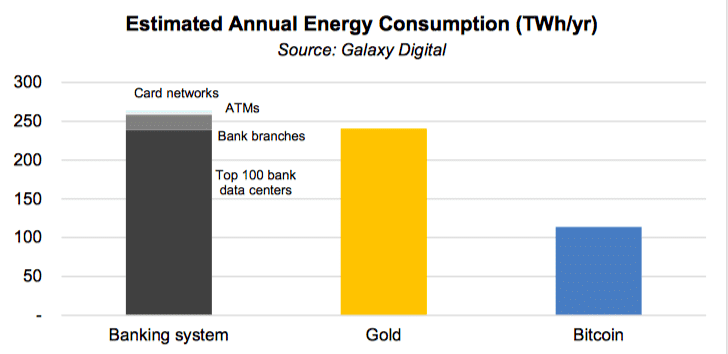

According to research, traditional banking systems consume two times more energy than Bitcoin. The annual energy usage of Bitcoin stands close to 114 TWh. However, the yearly energy usage of the banking industry is over 260 TWh each year.

Galaxy’s estimates

There are ongoing concerns over Bitcoin’s energy consumption. The Galaxy estimates show that the banking system consumes more energy than the Bitcoin network. Michael Novogratz cryptocurrency firm is Galaxy digital.

The firm released a report on Friday which provides open-source access to its methodology and calculations.

Energy consumption

It is effortless to track Bitcoin’s energy consumption in real-time. This can be done with the help of tools like the Cambridge Bitcoin Electricity Consumption Index. However, Galaxy Digital mining stated that the evaluation of energy of the gold industry and the traditional financial systems is not that straightforward.

The banking industry need not directly report its electricity consumption. Moreover, the retail and commercial banking systems need multiple settlement lawyers while Bitcoin offers a final settlement.

Market Crash

The Galaxy digitals analysis on Bitcoin’s energy consumption comes amid a significant Crypto market crash. Moreover, Elon Musk, the CEO of Tesla, also decided to stop accepting BTC as payment for their car purchases due to environmental concerns.

He tweeted, stating that though cryptocurrency is a good idea on many levels and promises a great future, this cannot come at a great cost to the environment. These moves spurred wide-scale criticism from the Crypto community.

In addition, the critics are stating that SpaceX should have to switch its rockets to more sustainable energy to not look like a big clueless hypocrite.