The world of meme stocks is never short of surprises, and GameStop (GME) is no exception. After a surge fueled by the return of Roaring Kitty, GameStop’s price has taken a nosedive, plummeting 18% recently. What’s behind this sudden drop, and can GME recover? Let’s dive into the details.

GameStop’s Price Plunge: The Lawsuit Effect

- The Initial Surge: Roaring Kitty’s return ignited a frenzy, boosting GME’s price significantly.

- The Lawsuit: Allegations of pump and dump schemes led to legal action against Keith Gill, creating uncertainty.

- Price Decline: The lawsuit news triggered an 18% drop in GME’s price, reflecting investor concerns.

Roaring Kitty’s Impact: A Double-Edged Sword

Keith Gill, known as Roaring Kitty, played a pivotal role in the 2021 meme stock saga. His recent return briefly revived GameStop’s fortunes, but the subsequent lawsuit has cast a shadow over GME’s future.

Analyzing GameStop’s Price History

Before the lawsuit, GME’s price was already volatile. The recent drop only exacerbates the situation. Here’s a quick recap:

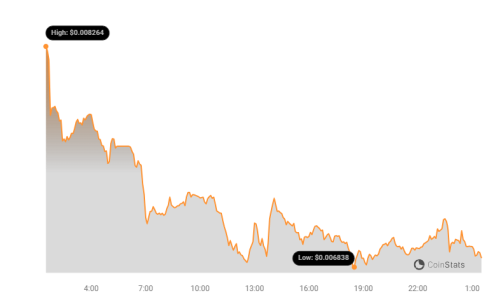

- Current Price: Around $0.00705 (as of writing).

- Recent Peak: $0.00994 on June 28.

- All-Time High (ATH): $0.03207 (25 days ago).

- Distance from ATH: Down 78%.

Despite the hype, GME has only delivered a 27% profit since its launch, raising questions about its long-term viability.

Will GameStop Price Recover? Factors to Consider

Predicting GME’s future is challenging, but here are some key factors:

- Lawsuit Uncertainty: Although withdrawn, the lawsuit could be refiled, creating ongoing risk.

- Investor Sentiment: Roaring Kitty’s involvement raises concerns about manipulation.

- Market Trends: GME is currently in a selling zone, with no major peaks since its ATH.

- RSI Neutral: The Relative Strength Index suggests the sideways trend will continue.

The Bottom Line

GameStop’s price faces significant headwinds due to the lawsuit, investor concerns, and market trends. While a recovery is possible, it’s far from guaranteed. Investors should proceed with caution and carefully consider the risks involved.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.