Navigating the turbulent waters of crypto winters and market crashes, bankruptcies have become unfortunately common. Among the prominent names facing financial storms is crypto lender Genesis. But there’s a glimmer of hope on the horizon! Genesis and its parent company, Digital Currency Group (DCG), have just announced a proposed deal that could resolve a significant legal battle. Let’s dive into the details of this settlement and what it means for the future of Genesis and its creditors.

Genesis and DCG Reach Tentative Agreement: Lawsuit on Hold?

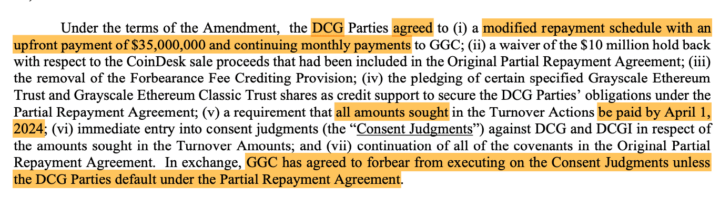

For months, a legal cloud has hung over Genesis and DCG. Genesis initiated a lawsuit seeking to recover a substantial $620 million in loan repayments from DCG. Now, it appears both parties are seeking to put an end to this costly and time-consuming litigation.

In a recent filing on November 28th in a New York Bankruptcy Court, Genesis unveiled a proposed agreement. According to the filing, DCG has committed to repaying outstanding loans amounting to $324.5 million by April of next year. Crucially, the agreement also allows Genesis to pursue any unpaid amounts, ensuring accountability and a pathway for full recovery.

Why Settle? Benefits for Genesis and Creditors

Why opt for a settlement instead of continuing a potentially lengthy and expensive lawsuit? Genesis highlights several key advantages in their filing. The repayment deal offers:

- Immediate Financial Relief: The agreement promises “immediate significant and near-term benefits” by securing a substantial repayment within a defined timeframe. This injection of funds is crucial for Genesis as it navigates bankruptcy proceedings.

- Reduced Risk and Expense: Protracted litigation is inherently risky and resource-intensive. Settling avoids the “risk, expense, and diversion of resources” associated with a drawn-out legal battle. These saved resources can be better channeled towards the bankruptcy process and creditor repayments.

- Focus on Creditor Repayment: By resolving the DCG lawsuit, Genesis can concentrate its efforts on its primary goal: developing and implementing a plan to repay its creditors.

Read Also: Genesis Sues Gemini, Seeking About $690 Million In ‘Preferential Transfers’

What’s the Next Step? Creditor Vote and Court Approval

This proposed deal is not yet finalized. It’s a crucial step, but several stages remain before it becomes a reality. Here’s what needs to happen next:

- Creditor Vote: The repayment deal will be incorporated into Genesis’s broader plan for creditor repayment. Creditors will have the opportunity to review and vote on this plan, including the DCG settlement. Their approval is a critical factor in moving forward.

- Bankruptcy Court Approval: Ultimately, the bankruptcy judge, Sean Lean, will make the final decision. Judge Lean will consider the creditor votes and the details of the proposed plan before granting or denying approval.

Genesis’s Legal Battles: A Web of Complexity

The DCG lawsuit settlement is just one piece of a larger, complex legal puzzle surrounding Genesis. It’s important to remember the broader context of Genesis’s financial woes and legal challenges:

- Gemini Lawsuit: Just days before announcing the DCG deal, Genesis initiated another significant lawsuit against crypto exchange Gemini. This suit aims to recover approximately $670 million in transfers, adding another layer of complexity to Genesis’s financial recovery efforts.

- SEC and New York Lawsuits: Genesis and Gemini are also facing legal action from regulatory bodies. The Securities and Exchange Commission (SEC) has accused them of selling unregistered securities. Furthermore, New York has filed a lawsuit against Genesis, Gemini, and DCG, alleging investor fraud. These regulatory battles add significant pressure and potential liabilities.

- Bankruptcy Filing: Genesis’s current situation stems from its bankruptcy filing in January. This followed the suspension of withdrawals in November 2022, triggered by the broader crypto market downturn and contagion from events like the FTX collapse.

Navigating the Crypto Contagion: A Path Forward for Genesis?

Genesis’s journey through bankruptcy is a stark reminder of the risks and volatility inherent in the cryptocurrency market. The proposed settlement with DCG offers a potential step forward in resolving its financial difficulties and repaying creditors.

Key Takeaways:

| Aspect | Details |

|---|---|

| Deal Overview | Genesis and DCG agree to settle a $620M lawsuit. DCG to repay $324.5M by April. |

| Benefits for Genesis | Immediate funds, reduced litigation costs, focus on creditor repayment. |

| Next Steps | Creditor vote on repayment plan, Bankruptcy Court approval. |

| Broader Context | Genesis bankruptcy, lawsuits against Gemini, SEC & New York lawsuits. |

Conclusion: Cautious Optimism for Genesis and the Crypto Recovery?

The proposed settlement between Genesis and DCG is undoubtedly a positive development in a challenging situation. It represents a tangible step towards financial recovery for Genesis and offers a degree of hope for creditors seeking repayment. However, it’s crucial to remember that this is just one step in a complex process. The creditor vote and court approval are still pending, and Genesis continues to face other significant legal and financial hurdles.

The crypto world will be watching closely to see if this settlement marks a turning point for Genesis and whether it can pave the way for a more stable future for the beleaguered crypto lender. As the dust settles in the crypto winter, the resolution of the Genesis saga will be a significant indicator of the industry’s resilience and its ability to navigate financial storms and emerge stronger.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.