Glassnode Co-Founders Warn of Bitcoin Volatility Risks Amid Recovering Momentum

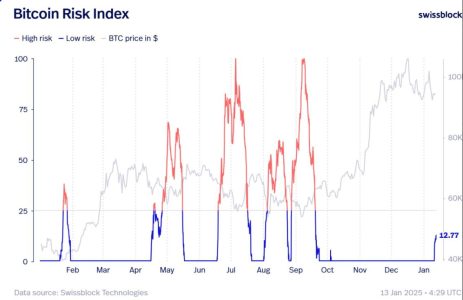

Bitcoin’s price momentum is showing signs of recovery after a significant bearish shift earlier this year, according to Negentropic, the X account managed by Glassnode co-founders Yann Allemann and Jan Happel. However, the co-founders warn of potential volatility risks, citing a rise in the Risk Index from 0 to 12—a notable shift since its stagnation in September 2024. With Bitcoin trading within the $92,000 to $100,000 range, investors are urged to remain cautious as negative indicators emerge.

Recovering Price Momentum

From Bearish Shift to Recovery

- April Pre-Halving Declines: Bitcoin faced its sharpest bearish momentum in April, preceding the 2024 halving.

- Current Price Range: BTC has been fluctuating between $92,000 and $100,000, showing resilience despite recent market pressures.

- Improved Momentum: The gradual uptick suggests growing confidence but does not eliminate the risk of volatility.

Understanding the Risk Index

What Is the Risk Index?

The Risk Index is a proprietary Glassnode metric designed to gauge potential volatility by analyzing market sentiment, liquidity, and on-chain activity.

Key Observations

- Recent Increase: The Risk Index climbed to 12 after remaining at 0 since September 2024, signaling increased uncertainty.

- Implications: Higher Risk Index values often indicate potential for price fluctuations and heightened trading risks.

Emerging Negative Indicators

Market Caution Signals

Despite recovering momentum, the Glassnode co-founders highlighted warning signs:

- Reduced Trading Volumes: Low liquidity can amplify price swings.

- Weakened Investor Sentiment: Persistent macroeconomic pressures are weighing on market confidence.

- Narrow Price Range: Bitcoin’s consolidation between $92,000 and $100,000 could precede a significant breakout—or breakdown.

Volatility Risks

- Short-Term Uncertainty: The rise in the Risk Index points to potential turbulence in the coming weeks.

- Historical Trends: Similar patterns have led to sharp corrections in the past, emphasizing the need for vigilance.

The Role of External Factors

Macroeconomic Pressures

- Strong Dollar: A robust U.S. dollar continues to challenge Bitcoin’s appeal as a store of value.

- Federal Reserve Policies: Uncertainty surrounding interest rate decisions adds to the market’s volatility.

Post-Halving Dynamics

- Supply Adjustments: Bitcoin’s halving has reduced miner rewards, tightening supply but also introducing short-term price pressures.

Investor Strategies Amid Volatility

Risk Management Tips

- Diversify Portfolios: Avoid over-reliance on Bitcoin; consider altcoins or non-crypto assets.

- Set Stop-Loss Orders: Protect against sharp price drops with automated sell triggers.

- Stay Informed: Monitor key metrics like the Risk Index and trading volumes for real-time insights.

Focus on Long-Term Trends

While short-term volatility is concerning, Bitcoin’s long-term growth potential remains intact:

- Institutional Adoption: Increasing interest from major financial players underpins future price stability.

- Decentralized Finance (DeFi): Bitcoin’s integration into DeFi platforms could unlock new use cases.

Conclusion

As Bitcoin navigates its recovery, the Glassnode co-founders’ warning about volatility risks serves as a timely reminder for investors to proceed with caution. The rise in the Risk Index and emerging negative indicators highlight potential short-term challenges, even as long-term prospects remain promising. Maintaining a balanced approach to risk management and staying updated on market trends will be crucial for navigating Bitcoin’s volatile landscape.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.