Buckle up, crypto enthusiasts! Bitcoin has done it again, smashing through the $60,000 barrier and reaching levels unseen since November 2021. The market is buzzing with excitement, but data from Glassnode reveals a fascinating trend: short-term Bitcoin holders are moving their coins to crypto exchanges at an unprecedented rate. What does this mean for the future of BTC? Is this a sign of profit-taking, or simply fuel for the next leg of the bull run? Let’s dive into the on-chain data and explore what’s driving this exchange frenzy.

Short-Term Holders: Bitcoin’s Exchange Inflow Rockets to All-Time Highs

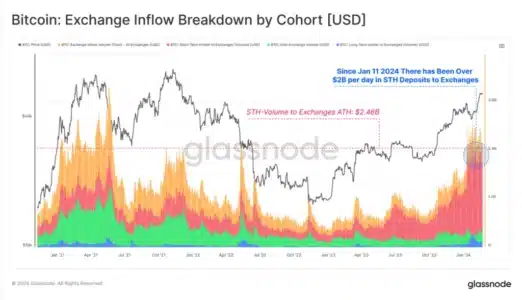

According to a recent Glassnode report, short-term Bitcoin holders are making waves. Since mid-January, these holders have consistently deposited over $2 billion worth of Bitcoin onto crypto exchanges daily. And it doesn’t stop there. They’ve just set a new all-time high, pushing daily deposit volumes to a staggering $2.46 billion. That’s a lot of Bitcoin on the move!

Think about it – over $2 billion flowing into exchanges every single day. This isn’t just a trickle; it’s a flood. This surge indicates significant activity from newer market participants, those who haven’t been holding Bitcoin for the long haul. Are they getting ready to sell, or is something else at play?

Unrealized Profits and Exchange Activity: A Market in Motion

The current market landscape is painted with substantial unrealized profits. Many investors have been holding Bitcoin since the lows of November 2022, and with prices soaring, these gains are now very real. This accumulation of profit is a key factor driving the overall volume of deposits and withdrawals on exchanges.

Consider these key points:

- Total Exchange Volume Surges: Daily volume flowing in and out of exchanges has ballooned to $5.57 billion. This signifies a highly active market with substantial capital movement.

- Speculation is Rife: Glassnode highlights the “extraordinarily high dominance” of exchange-related inflows and outflows compared to all on-chain volume. Over 78% of all economic on-chain activity is now exchange-driven. This points towards a market heavily influenced by trading and speculative behavior.

See Also: Bitcoin (BTC) Price Soared By 9%, Is $60K Target Possible Soon?

Beyond the Rally: The ETF Effect

While the recent price surge is a major catalyst, it’s not the only factor fueling this exchange activity. The introduction of spot Bitcoin ETFs in the US has been a game-changer. These ETFs have opened up Bitcoin investment to a whole new wave of investors, particularly institutional players.

Here’s how ETFs are impacting the market:

- Institutional Access: ETFs provide traditional investors with a regulated and familiar way to gain exposure to Bitcoin. No more navigating crypto exchanges directly – they can now invest through brokerage accounts.

- Massive Inflows: These ETFs have attracted approximately 90,000 BTC in net inflows, translating to nearly $38 billion in Assets Under Management (AUM). This influx of capital is undeniably boosting demand and market activity.

- Increased Speculation: As Glassnode notes, ETFs have “opened a new degree of freedom for demand and speculation.” The ease of access and institutional involvement can amplify both buying and selling pressures in the market.

$60K: A Natural Target? What Analysts Are Saying

Analysts at QCP Capital believe that Bitcoin hitting $60,000 was almost inevitable, suggesting it was a “natural target” for the March expiry. They anticipate Bitcoin’s realized volume to remain robust, hovering around 40%. This sustained realized volume, coupled with ETF demand, paints a picture of continued market momentum.

As of now, Bitcoin is trading around $60,262.43 (according to Coinstats data at the time of writing). This price point marks a significant milestone, taking us back to the bullish days of November 2021.

Is This a Market Top or Just the Beginning?

The million-dollar question remains: is this surge in exchange inflows from short-term holders a sign of an impending market top? It’s a complex situation with arguments on both sides.

Potential Bearish Signals:

- Profit-Taking: Short-term holders are often more sensitive to price fluctuations. The significant inflows could indicate profit-taking as they capitalize on the recent price surge.

- Increased Selling Pressure: A large volume of Bitcoin on exchanges can translate to increased selling pressure, potentially leading to price corrections.

Potential Bullish Signals:

- New Capital Injection: The ETF inflows are a significant source of new capital entering the Bitcoin market. This demand could absorb selling pressure and drive prices even higher.

- Early Bull Market Stages: Historically, bull markets often see increased exchange activity as new participants enter and existing holders re-position. This could be a sign of a healthy, growing bull market.

- Institutional Accumulation: While short-term holders might be moving coins to exchanges, institutional investors through ETFs could be accumulating on the dips, providing a strong underlying bid.

Final Thoughts: Navigating the Bitcoin Frenzy

Bitcoin’s break above $60,000 is undoubtedly a major event, and the surge in exchange inflows from short-term holders adds another layer of intrigue. While it’s crucial to be aware of potential profit-taking and market volatility, the influx of institutional capital via ETFs provides a powerful counterforce. The market is dynamic, and predicting the exact top is always challenging.

Actionable Insights:

- Stay Informed: Keep a close eye on on-chain data, particularly exchange flows and ETF inflows, to gauge market sentiment and potential shifts.

- Manage Risk: Given the increased volatility, ensure your portfolio risk is aligned with your investment goals and risk tolerance. Consider using stop-loss orders and diversification strategies.

- Long-Term Perspective: Remember that Bitcoin is known for its volatility. Focus on the long-term fundamentals and potential rather than getting caught up in short-term price swings.

The Bitcoin story is far from over. The coming weeks and months will be crucial in determining whether this exchange activity marks a temporary peak or simply a pit stop on the road to new all-time highs. Stay tuned, and always remember to do your own research before making any investment decisions in this exciting, yet unpredictable, market.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.