Cryptocurrency markets are known for their rapid fluctuations, and today, Hedera (HBAR) is making headlines with a notable price surge. Over the past 24 hours, the price of Hedera (HBAR) has climbed by 4.0%, reaching $0.08. This upward momentum is catching the attention of investors and traders alike. Let’s dive deeper into what’s driving this price movement and what it could mean for HBAR moving forward.

Hedera’s Price Momentum: A Closer Look

The recent price action is certainly positive for HBAR holders. But is this just a short-term pump, or is there more to it? Let’s break down the key trends:

- Daily Gains: As highlighted, HBAR has experienced a solid 4% increase in price over the last 24 hours. This immediate jump signals strong buying interest in the market.

- Weekly Uptrend: Zooming out to a weekly view, the picture becomes even more encouraging. HBAR has seen an impressive 8.0% increase over the past week, climbing from $0.07 to its current price. This sustained growth suggests a potentially stronger bullish trend forming.

- Distance from All-Time High: While the current price of $0.08 is a positive step, it’s important to remember that HBAR’s all-time high stands at $0.57. This comparison provides context and highlights the potential upside if HBAR were to revisit its previous peak.

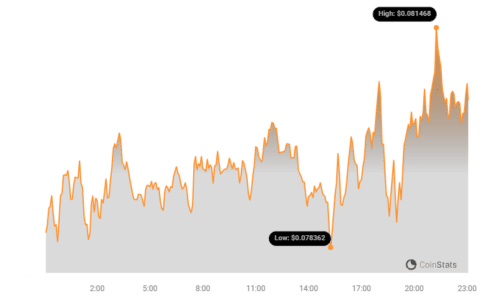

Volatility and Price Movement: What the Charts Tell Us

Understanding volatility is crucial in crypto trading. The following charts offer insights into Hedera’s price fluctuations and volatility over different timeframes.

The chart below compares Hedera’s price movement and volatility over the past 24 hours (left) against its price movement over the past week (right).

Decoding Bollinger Bands: The gray bands you see in the charts are Bollinger Bands. These are a popular technical analysis tool used to measure volatility. Essentially:

- Wider Bands = Higher Volatility: When the Bollinger Bands widen, indicated by a larger gray area, it signifies increased price volatility. This means the price of HBAR is experiencing more significant swings in either direction.

- Narrower Bands = Lower Volatility: Conversely, narrower bands suggest lower volatility and more stable price movement.

By examining the Bollinger Bands in the charts, you can visually assess the periods of higher and lower volatility for HBAR in both the short-term (daily) and medium-term (weekly).

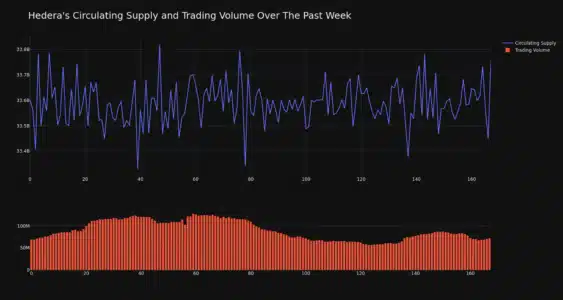

Trading Volume and Circulating Supply: Gauging Market Activity

Price movements are just one piece of the puzzle. To get a more complete picture of Hedera’s market dynamics, it’s essential to consider trading volume and circulating supply.

- Trading Volume Increase: In line with the price uptick, Hedera’s trading volume has also increased by 4.0% over the past week. Rising trading volume often supports price increases, suggesting genuine buying interest rather than just artificial pumps.

- Circulating Supply Expansion: Interestingly, the circulating supply of HBAR has also seen a slight increase of 0.46% in the last week. This means more HBAR tokens are becoming available in the market. While a significant increase in supply could sometimes dilute price, in this case, the price has still risen, indicating strong demand is absorbing the new supply.

Current Supply and Market Cap Metrics:

- Circulating Supply: Currently, there are 33.60 billion HBAR tokens in circulation.

- Percentage of Max Supply: This circulating supply represents approximately 67.19% of Hedera’s total maximum supply of 50.00 billion HBAR.

- Market Cap Ranking: With a market capitalization of $2.69 billion, HBAR currently holds the #32 rank in the overall cryptocurrency market. This ranking places Hedera among the top-tier cryptocurrencies in terms of market size.

What Could Be Driving HBAR’s Price Surge?

While the provided data focuses on price and volume metrics, it’s natural to wonder what factors might be contributing to HBAR’s recent positive performance. Possible drivers could include:

- Broader Market Sentiment: Positive sentiment in the overall cryptocurrency market, often influenced by Bitcoin’s price movements, can lift the prices of altcoins like HBAR.

- Hedera Network Developments: Any significant news or developments within the Hedera ecosystem, such as partnerships, adoption updates, or technological advancements, could boost investor confidence and drive demand for HBAR.

- Increased Utility and Adoption: Growing real-world use cases and adoption of the Hedera network by businesses and projects can translate to increased demand for HBAR tokens, which are used to pay for network services.

- Technical Factors: Technical analysis patterns and breakouts can also trigger buying activity and contribute to price increases.

To gain a deeper understanding of the specific reasons behind this surge, further research into recent Hedera news and broader market trends is recommended.

Final Thoughts: Is HBAR Poised for Further Growth?

Hedera (HBAR) is showing promising signs with its recent price increase and positive market indicators. The 4% daily and 8% weekly gains, coupled with rising trading volume, suggest a healthy level of market interest. However, like all cryptocurrencies, HBAR remains subject to market volatility.

Key Takeaways:

- HBAR has demonstrated strong price growth in the short term.

- Volatility, as indicated by Bollinger Bands, should be monitored.

- Circulating supply and trading volume provide valuable context to price movements.

- Further research into Hedera’s ecosystem and market conditions is crucial for informed investment decisions.

Whether HBAR can sustain this momentum and continue its upward trajectory remains to be seen. Keeping a close eye on market developments, Hedera network updates, and conducting thorough research will be essential for anyone interested in HBAR’s future potential.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.