Remember a time before Binance dominated the crypto exchange scene? Mt. Gox was the undisputed king. But its reign ended abruptly with a devastating hack. Let’s dive into the story of its rise and fall, a cautionary tale etched in Bitcoin history.

The Rise of Mt. Gox

Founded by Jed McCaleb (also a co-founder of Ripple and Stellar), Mt. Gox quickly became the go-to platform for Bitcoin trading in the early days of cryptocurrency. Its dominance was undeniable, handling a significant portion of all Bitcoin transactions worldwide.

The Infamous Mt. Gox Hack: A Timeline of Disaster

The cracks began to show in June 2011 when hackers exploited vulnerabilities in the exchange’s system. Here’s a breakdown:

- June 2011: Hackers target Mt. Gox, exploiting security flaws and manipulating Bitcoin prices to a mere $0.01.

- 2011-2014: Over the next three years, approximately 650,000 BTC are siphoned off undetected.

- February 2014: Mt. Gox files for bankruptcy, citing the loss of hundreds of thousands of Bitcoins. The price of Bitcoin plummets.

- Aftermath: Investigations reveal the stolen Bitcoins were allegedly laundered through BTC-e, leading to convictions of individuals involved.

See Also: Black Basta, An Infamous Ransomware Gang, Hacked Major UK Water Company, Southern Water

How Did the Hackers Do It?

The Mt. Gox hack wasn’t a single event but a series of exploits. Hackers used various methods, including:

- Compromised Accounts: Gaining access to employee accounts to manipulate balances.

- Exploiting Vulnerabilities: Taking advantage of weak security protocols to siphon off Bitcoin over an extended period.

- Fake Accounts: Creating fraudulent accounts to buy Bitcoin at artificially low prices during price crashes.

The Aftermath: Fallout and Recovery

The Mt. Gox collapse sent shockwaves through the Bitcoin community. Confidence plummeted, and the price of Bitcoin took a significant hit. However, the cryptocurrency market proved resilient.

- Price Recovery: Bitcoin eventually recovered, reaching new all-time highs.

- Investor Compensation: Former investors are still awaiting compensation, with recent communications suggesting progress.

Bitcoin Today: Lessons Learned

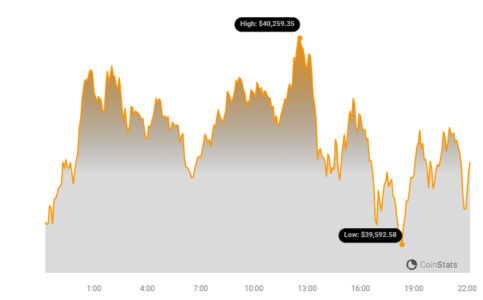

Despite the Mt. Gox debacle, Bitcoin has shown remarkable resilience. As of today, Bitcoin is still far from its peak, trading at $39,800 with a 0.50% decrease. Following the expected halving in April, the price is anticipated to reach new highs.

Many analysts have made price predictions pointing to $100,000 and above.

Key Takeaways from the Mt. Gox Saga

- Security is Paramount: The Mt. Gox hack highlighted the critical importance of robust security measures for cryptocurrency exchanges.

- Decentralization Benefits: Despite the setback, Bitcoin’s decentralized nature allowed it to recover and thrive.

- Resilience of Crypto: The cryptocurrency market has demonstrated remarkable resilience in the face of adversity.

Conclusion: A Cautionary Tale with a Silver Lining

The Mt. Gox story is a stark reminder of the risks associated with early-stage cryptocurrency exchanges. However, it also showcases the resilience of Bitcoin and the importance of learning from past mistakes. While the scars of Mt. Gox remain, the cryptocurrency world has emerged stronger and more secure.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.