- Chainlink (LINK) and Maker (MKR) are stirring up investor interest as fresh wallets have started to accumulate LINK and MKR in hopes of a price uptick.

- LINK was up by 12% in the last 24 hours, but a few market indicators were bearish.

- MKR’s market indicators looked bullish, as they suggested a price rise.

As we enter the concluding days of 2023, several tokens, such as Chainlink [LINK] and Maker [MKR], are witnessing newfound interest, as several new wallets started to accumulate those tokens.

Whenever accumulation rises, it increases the possibility of a price uptick. Therefore, considering the latest interest from investors, are LINK and MKR on the brink of a new rally?

See Also: Bitcoin SV (BSV) Price Soars 63% In 24 hours, Hits YTD High

Buying Pressure On Chainlink And Maker Rises

On the 27th of December, Lookonchain recently posted a tweet, which highlighted that fresh wallets have started to accumulate LINK and MKR.

Notably, whale wallet 0xE68E withdrew 3,150 MKR worth more than $4.5 million, while another wallet withdrew 136,146 MKR worth over $2 million.

Fresh whale wallets are accumulating $MKR and $LINK today.

0xE68E withdrew 3,150 $MKR($4.55M) from #Binance in the past 20 minutes.https://t.co/LRuLN0j4Ia

0x8eAD withdrew 136,146 $LINK($2.05M) from #Binance 10 minutes ago and has withdrawn 384,006 $LINK ($5.79M) from #Binance… pic.twitter.com/fjCp1lo0Nx

— Lookonchain (@lookonchain) December 27, 2023

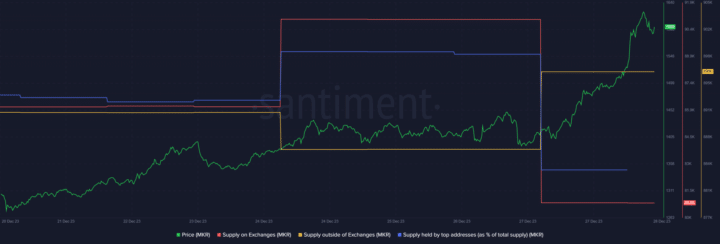

Therefore, to better understand whether investors at large were buying these tokens, let’s take a look at Santiment’s data. As per our analysis, LINK’s Supply on Exchanges registered a drop while its Supply outside of Exchanges increased.

Surprisingly, despite a hike in buying pressure, Chainlink’s supply held by the top addresses remained flat.

A similar trend was visible on Maker’s graph. An analysis revealed that MKR’s Supply on Exchanges registered a massive drop on the 27th of December while its Supply outside of Exchanges surged considerably.

This meant that investors were actively buying MKR at press time.

Additionally, whales’ confidence in the token also increased, which was evident from the rise in its supply held by top addresses. However, the graph registered a decline soon after that.

See Also: How To Prevent Transaction Fees From Eating Into Your Crypto Trading Profits

Will The Coins Have A Positive Impact?

To better understand whether the hike in buying pressure would have any positive impact on both tokens’ price actions, let’s take a look at their daily charts.

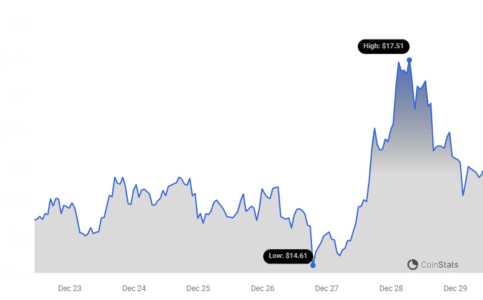

Our analysis found that Chainlink’s MACD displayed a bullish crossover. Additionally, its Bollinger Bands also hinted that LINK’s price was entering a comparatively volatile zone, which looked bullish.

However, its Relative Strength Index (RSI) and Chaikin Money Flow (CMF) registered downticks, implying that a price drop is on the cards. In the last 24 hours, LINK was up over 12% and, at press time, was trading at $15.95.

Like LINK, MKR’s MACD also displayed a clear bullish upper hand in the market, and its Bollinger Bands also looked optimistic. MKR’s CMF and RSI also went northwards, increasing the chances of a price uptick.

According to Coinstats, MKR was up by 2% in the last 24 hours. At the time of writing, it was trading at $1,547 with a market cap of over $1.4 billion.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.