On Saturday, ANC token holders decisively voted against a proposal to cut yield rates on the Terra-based Anchor Protocol (ANC). Polychain Capital and Arca Prop recommended the decrease, which aimed to reduce rates by up to 50% in order to make the protocol more sustainable.

On USDTerra (UST) deposits, ANC is now offering a yield of approximately 20% per year. The Polychain proposal aims to gradually reduce interest rates on larger accounts, with yields as low as 10% on deposits of over 500,000 UST.

The proposal will be voted on till March 16th. However, roughly 72% of ANC token holders have voted thus far, with 55% voting against the proposal.

On Twitter, many expressed their displeasure with the plan, claiming that it would overcomplicate the programming and possibly ruin the platform.

ANC, which was created by the same people who created Terra, presently has the highest stablecoin yield on the market, at around 20%. In comparison, major stablecoins like Tether, USD Coin, and Binance USD have yields of up to 12%.

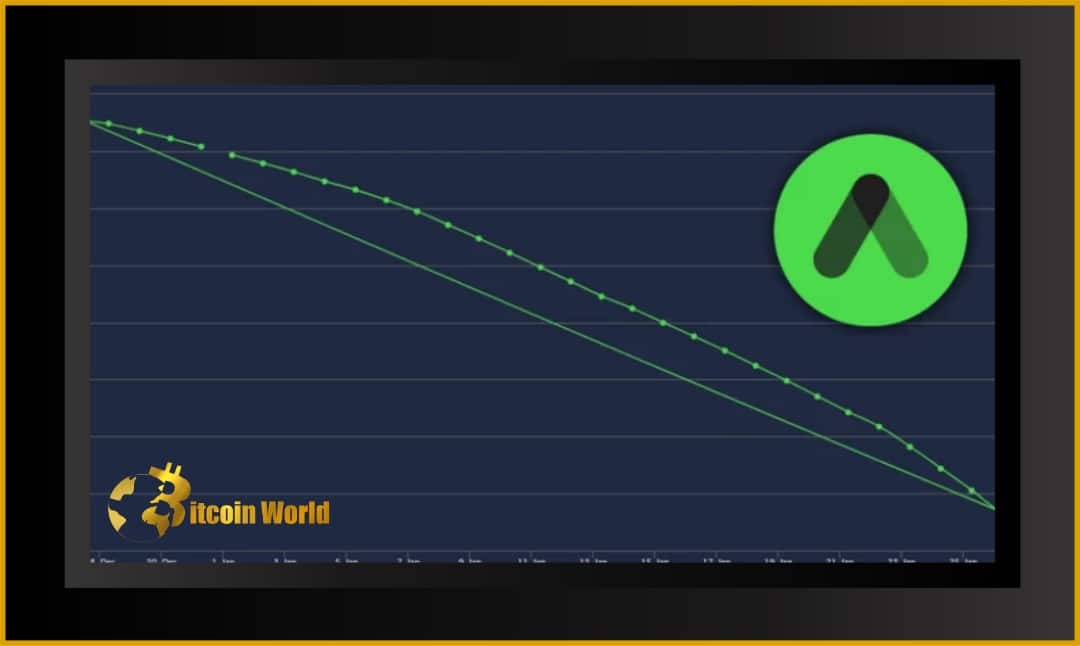

While the relatively high rate has resulted in a rise in deposits through February, it has also raised concerns about the long-term viability of the system, considering that total deposits on ANC are over four times those of total borrowers.

ANC generates this high yield by collecting interest from UST borrowers and setting aside a yield reserve.

However, this reserve has been depleting in recent weeks, prompting the community to increase its fundraising efforts.

Despite the fact that ANC token holders voted against the proposed rate drop, ANC and Terra’s native token LUNA values exhibited some uncertainty. LUNA, which may be used to wager on the protocol, has dropped 4.4 percent in the last 24 hours, pulling away from the key $100 mark, while ANC has dropped 11 percent to $3.42.

Related Posts – Ferrari joins the NFT universe through a collaboration with a Swiss…